“Historically, the choice between renting and buying a home has been a tough decision.”

Some Highlights:

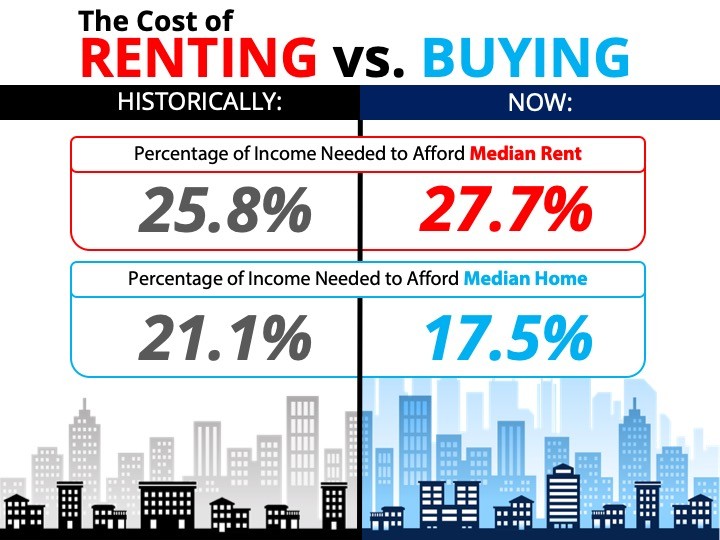

- Historically, the choice between renting and buying a home has been a tough decision.

- Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a median-priced home (17.5%), the choice is clear.

- Every market is different. Before you renew your lease, find out if you can put your housing costs to work by buying a home this year.

To view original article, visit Keeping Current Matters.

Consumers Agree: It’s a Good Time To Sell

From record-high equity gains to record-low housing supply and high buyer demand, homeowners have more motivation than ever to sell.

Millions of Americans Have Discovered the Benefits of Multigenerational Households

Is multigenerational living right for you?

The Top Indicator if You Want to Know Where Mortgage Rates Are Heading

Mortgage rates have increased significantly since the beginning of the year.

Owning Is More Affordable than Renting in the Majority of the Country

If you’re weighing your options between renting and buying, it’s important to look at the full picture.

Why Right Now Is a Once-in-a-Lifetime Opportunity for Sellers

In the case of homeowners who are thinking about selling, there may never be a better time than right now.

Why Pre-Approval Is Key for Homebuyers in 2022

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing.