“Since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news.”

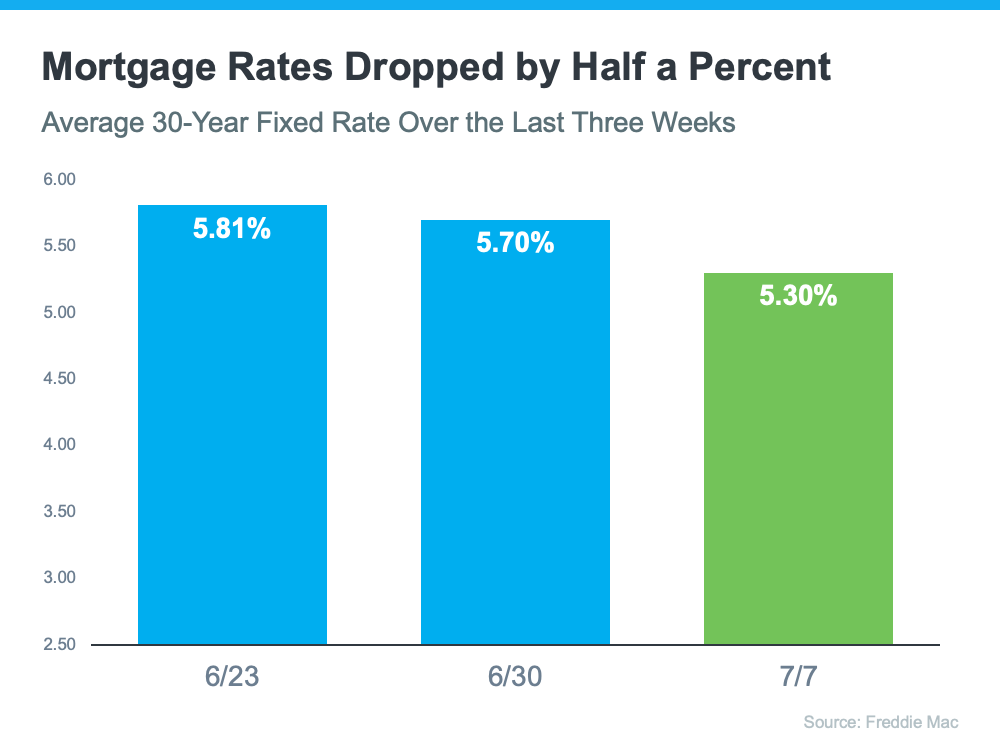

Over the past few weeks, the average 30-year fixed mortgage rate from Freddie Mac fell by half a percent. The drop happened over concerns about a potential recession. And since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news.

Freddie Mac reports that the average 30-year rate was down to 5.30% from 5.81% two weeks prior (see graph below):

But why is this recent dip such good news for homebuyers? As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains:

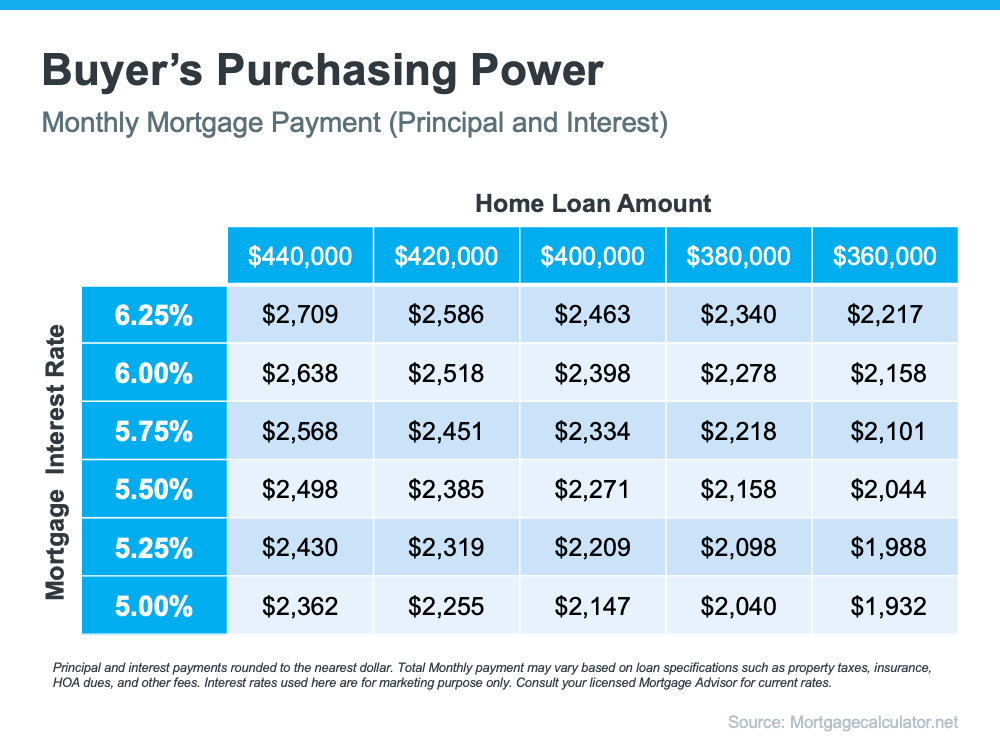

“According to Freddie Mac, the 30-year fixed mortgage rate dropped sharply by 40 basis points to 5.3 percent. . . . As a result, home buying is about 5 percent more affordable than a week ago. This translates to about $100 less every month on a mortgage payment.”

That’s because when rates go up (as they have for the majority of this year), they impact how much you’ll pay in your monthly mortgage payment, which directly affects how much you can comfortably afford. The inverse is also true. A decrease in mortgage rates means an increase in your purchasing power.

The chart below shows how a half-point, or even a quarter-point, change in mortgage rates can impact your monthly payment:

Bottom Line

If your home doesn’t meet your needs, this may be the opportunity you’ve been waiting for. Let’s connect to see how you can benefit from the current drop in mortgage rates.

To view original article, visit Keeping Current Matters.

What To Expect from Mortgage Rates and Home Prices in 2025

With home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

Why Did More People Decide To Sell Their Homes Recently?

As rates came down at the end of the summer, more people jumped into the market and decided to make their move.

Why an Agent Is Essential When Buying a Newly Built Home

By working with a knowledgeable real estate agent, you can feel confident when buying a newly built home today.

Why Now’s Not the Time To Take Your House Off the Market

By keeping your home on the market, you increase the chances of attracting people who are truly ready to make a purchase.

Now’s the Time to Upgrade to Your Dream Home

A recent survey reveals the top motivator for today’s homebuyers is the desire for more space or an upgraded home.

This Is the Sweet Spot Homebuyers Have Been Waiting For

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible.