“Since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news.”

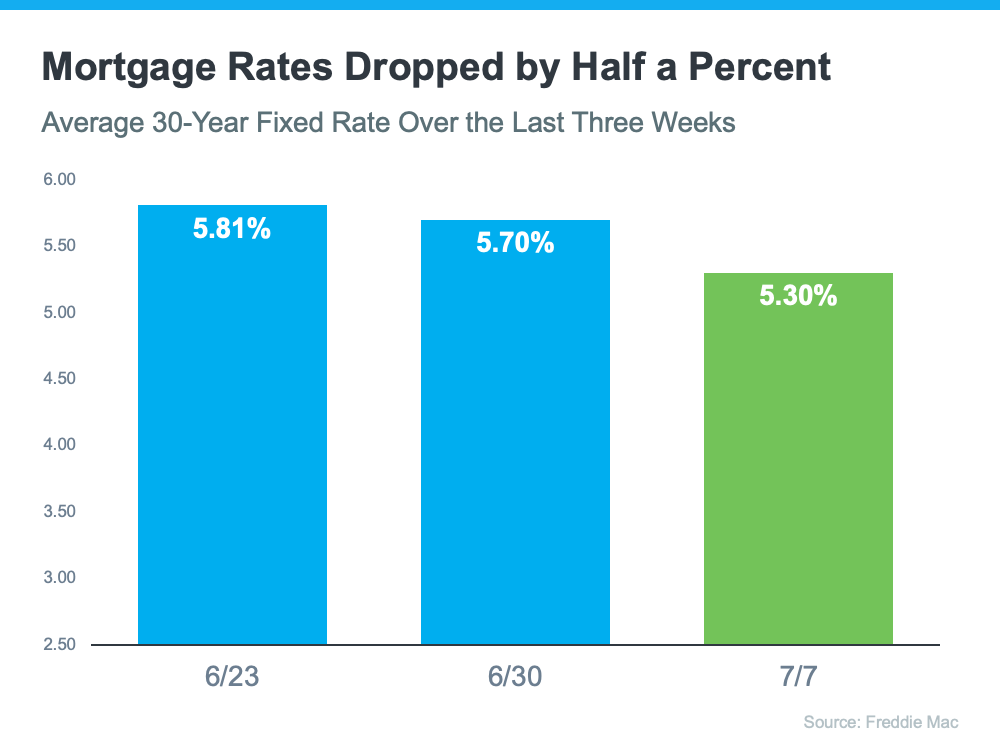

Over the past few weeks, the average 30-year fixed mortgage rate from Freddie Mac fell by half a percent. The drop happened over concerns about a potential recession. And since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news.

Freddie Mac reports that the average 30-year rate was down to 5.30% from 5.81% two weeks prior (see graph below):

But why is this recent dip such good news for homebuyers? As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains:

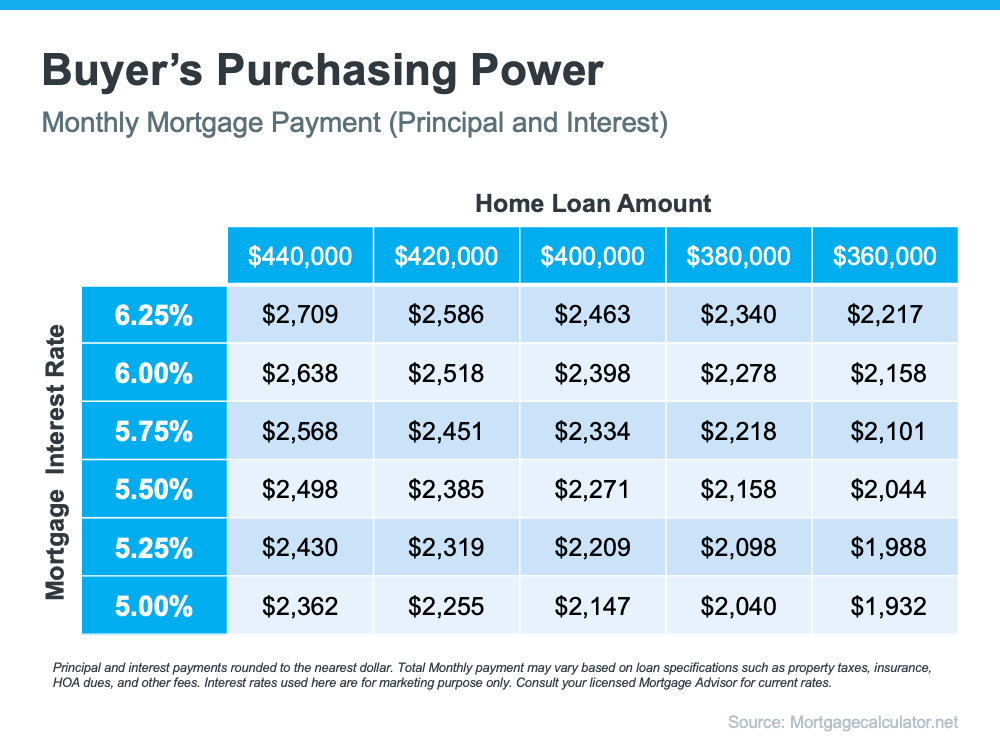

“According to Freddie Mac, the 30-year fixed mortgage rate dropped sharply by 40 basis points to 5.3 percent. . . . As a result, home buying is about 5 percent more affordable than a week ago. This translates to about $100 less every month on a mortgage payment.”

That’s because when rates go up (as they have for the majority of this year), they impact how much you’ll pay in your monthly mortgage payment, which directly affects how much you can comfortably afford. The inverse is also true. A decrease in mortgage rates means an increase in your purchasing power.

The chart below shows how a half-point, or even a quarter-point, change in mortgage rates can impact your monthly payment:

Bottom Line

If your home doesn’t meet your needs, this may be the opportunity you’ve been waiting for. Let’s connect to see how you can benefit from the current drop in mortgage rates.

To view original article, visit Keeping Current Matters.

Homeowner Equity Increases an Astonishing $1 Trillion

Over the past year, strong home price growth has created a record level of home equity for homeowners.

The Holidays Aren’t Stopping Homebuyers This Year

There are first-time, move-up, and move-down buyers actively looking for the home of their dreams this winter.

5 Steps to Follow When Applying for Forbearance

Help is out there for homeowners in need, but it’s important to apply now while this benefit is still available.

Winning as a Buyer in a Sellers’ Market

Buying a home in today’s sellers’ market doesn’t have to feel like an uphill battle. Make your life easier by working with one of our trusted agents!

Why It Makes Sense to Sell Your House This Holiday Season

The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house.

Are Home Prices Headed Toward Bubble Territory?

High demand coupled with restricted supply has caused home prices to appreciate above historic levels.