“Mortgage rates rose across all loan types this week as the 10-year U.S. Treasury yield reached its highest point since June.”

Every Thursday, Freddie Mac releases the results of their Primary Mortgage Market Survey which reveals the most recent movement in the 30-year fixed mortgage rate. Last week, the rate was announced as 3.01%. It was the first time in three months that the mortgage rate surpassed 3%. In a press release accompanying the survey, Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates rose across all loan types this week as the 10-year U.S. Treasury yield reached its highest point since June.”

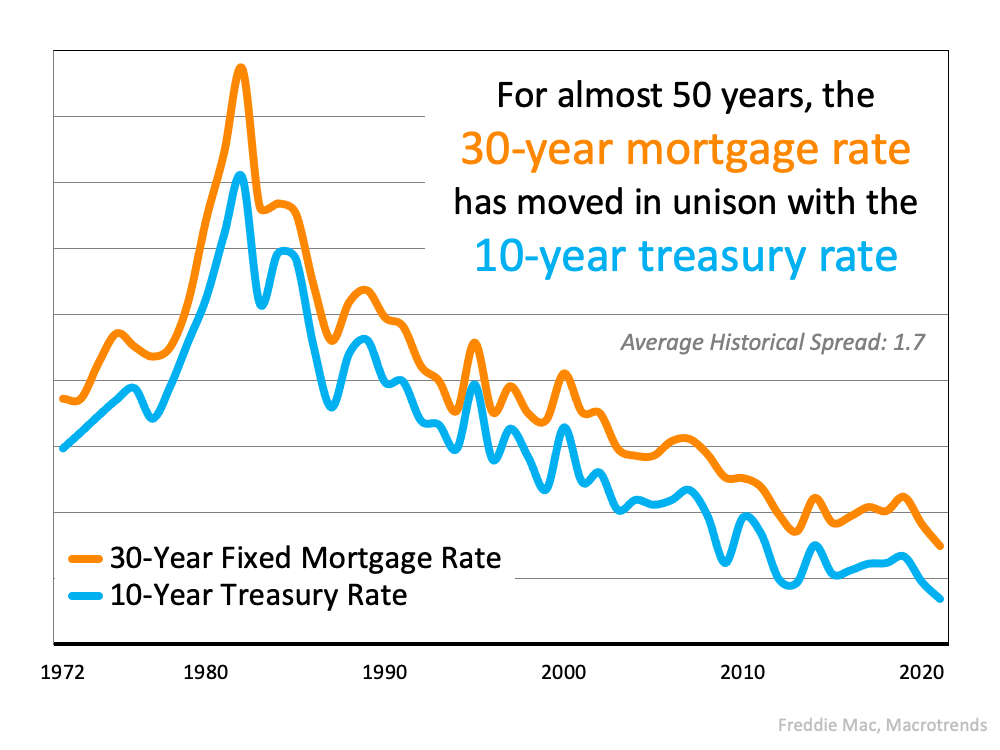

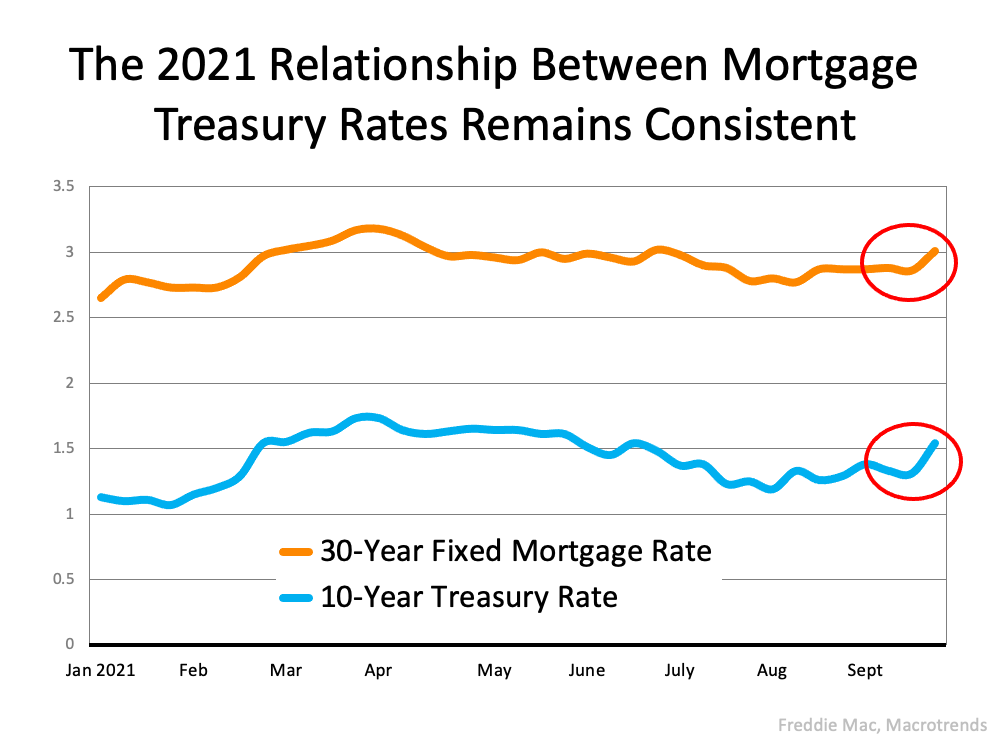

The reason Khater mentions the 10-year U.S. Treasury yield is because there has been a very strong relationship between the yield and the 30-year mortgage rate over the last five decades. Here’s a graph showing that relationship: The relationship has also been consistent throughout 2021 as evidenced by this graph:

The relationship has also been consistent throughout 2021 as evidenced by this graph: The graph also reveals the most recent jump in mortgage rates was preceded by a jump in the 10-year Treasury rate (called out by the red circles).

The graph also reveals the most recent jump in mortgage rates was preceded by a jump in the 10-year Treasury rate (called out by the red circles).

So, What Impacts the Yield Rate?

According to Investopedia:

“There are a number of economic factors that impact Treasury yields, such as interest rates, inflation, and economic growth.”

Since there are currently concerns about inflation and economic growth due to the pandemic, the Treasury yield spiked last week. That spike impacted mortgage rates.

What Does This Mean for You?

Khater, in the Freddie Mac release mentioned above, says:

“We expect mortgage rates to continue to rise modestly which will likely have an impact on home prices, causing them to moderate slightly after increasing over the last year.”

Nadia Evangelou, Senior Economist and Director of Forecasting for the National Association of Realtors (NAR), also addresses the issue:

“Consumers shouldn’t panic. Keep in mind that even though rates will increase in the following months, these rates will still be historically low. The National Association of REALTORS forecasts the 30-year fixed mortgage rate to reach 3.5% by mid-2022.”

Bottom Line

Forecasting mortgage rates is very difficult. As Mark Fleming, Chief Economist at First American, once quipped:

“You know, the fallacy of economic forecasting is don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.”

That being said, if you’re either a first-time homebuyer or a current homeowner thinking of moving into a home that better fits your current needs, keep abreast of what’s happening with mortgage rates. It may very well impact your decision.

To view original article, visit Keeping Current Matters.

4 Ways to Make an Offer That Stands Out This Spring

If you’re serious about landing a home you’ll love, you need a smart strategy that includes a working with a great agent.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.