“Mortgage rates rose across all loan types this week as the 10-year U.S. Treasury yield reached its highest point since June.”

Every Thursday, Freddie Mac releases the results of their Primary Mortgage Market Survey which reveals the most recent movement in the 30-year fixed mortgage rate. Last week, the rate was announced as 3.01%. It was the first time in three months that the mortgage rate surpassed 3%. In a press release accompanying the survey, Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates rose across all loan types this week as the 10-year U.S. Treasury yield reached its highest point since June.”

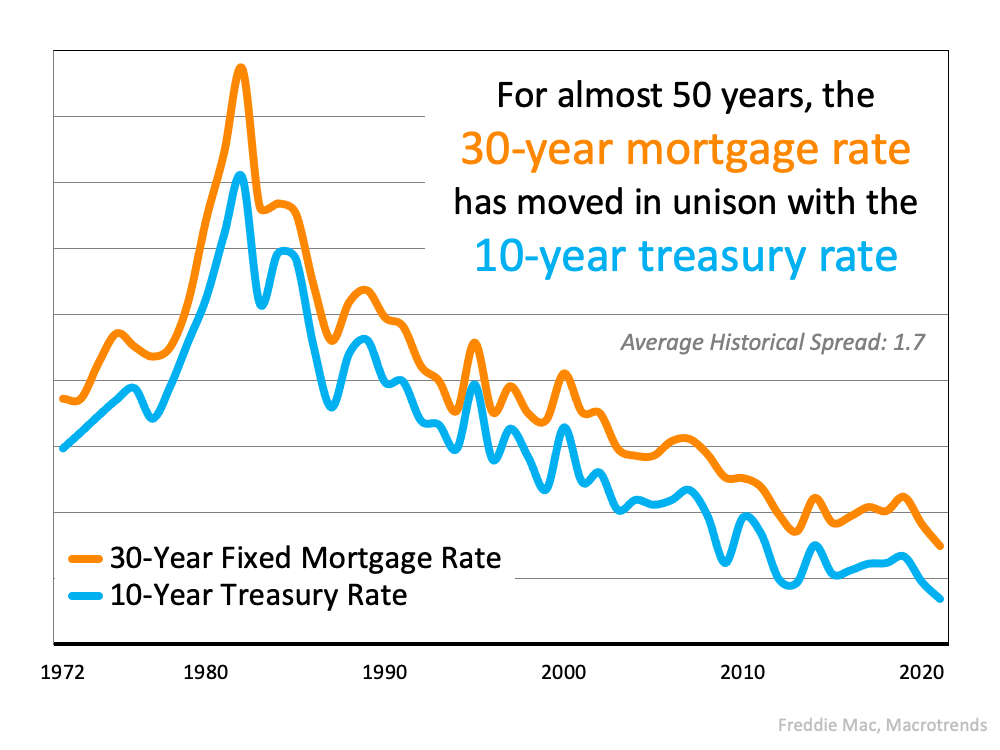

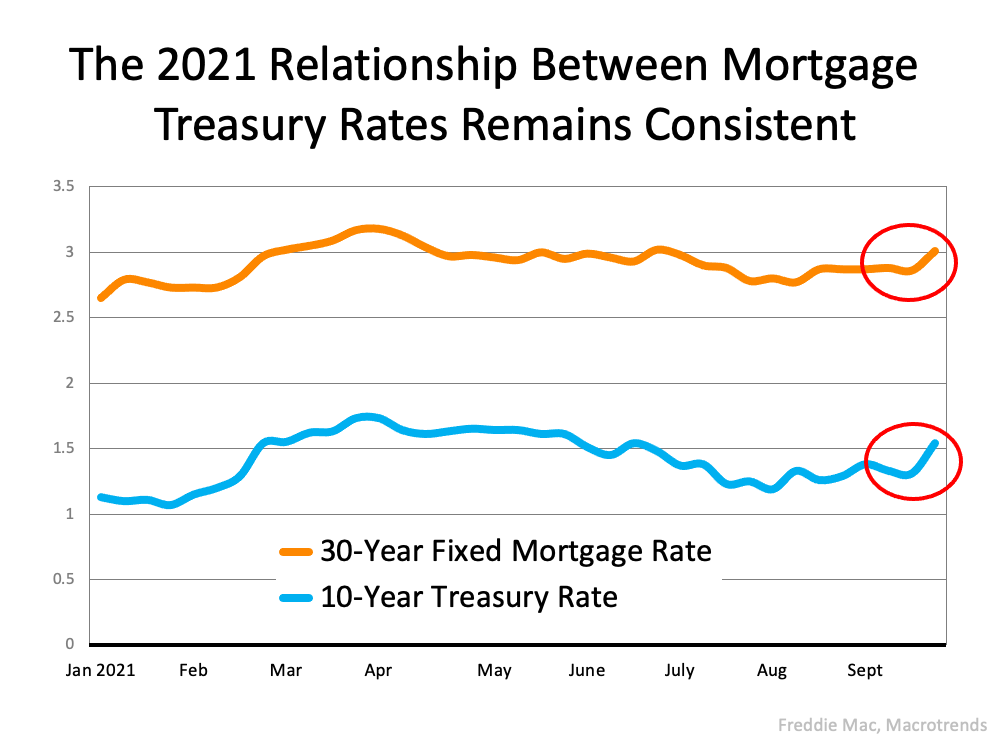

The reason Khater mentions the 10-year U.S. Treasury yield is because there has been a very strong relationship between the yield and the 30-year mortgage rate over the last five decades. Here’s a graph showing that relationship: The relationship has also been consistent throughout 2021 as evidenced by this graph:

The relationship has also been consistent throughout 2021 as evidenced by this graph: The graph also reveals the most recent jump in mortgage rates was preceded by a jump in the 10-year Treasury rate (called out by the red circles).

The graph also reveals the most recent jump in mortgage rates was preceded by a jump in the 10-year Treasury rate (called out by the red circles).

So, What Impacts the Yield Rate?

According to Investopedia:

“There are a number of economic factors that impact Treasury yields, such as interest rates, inflation, and economic growth.”

Since there are currently concerns about inflation and economic growth due to the pandemic, the Treasury yield spiked last week. That spike impacted mortgage rates.

What Does This Mean for You?

Khater, in the Freddie Mac release mentioned above, says:

“We expect mortgage rates to continue to rise modestly which will likely have an impact on home prices, causing them to moderate slightly after increasing over the last year.”

Nadia Evangelou, Senior Economist and Director of Forecasting for the National Association of Realtors (NAR), also addresses the issue:

“Consumers shouldn’t panic. Keep in mind that even though rates will increase in the following months, these rates will still be historically low. The National Association of REALTORS forecasts the 30-year fixed mortgage rate to reach 3.5% by mid-2022.”

Bottom Line

Forecasting mortgage rates is very difficult. As Mark Fleming, Chief Economist at First American, once quipped:

“You know, the fallacy of economic forecasting is don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.”

That being said, if you’re either a first-time homebuyer or a current homeowner thinking of moving into a home that better fits your current needs, keep abreast of what’s happening with mortgage rates. It may very well impact your decision.

To view original article, visit Keeping Current Matters.

Don’t Fall for the Next Shocking Headlines About Home Prices

In the coming months, you’re going to see even more headlines that either get what’s happening with home prices wrong or are misleading.

Foreclosure Numbers Today Aren’t Like 2008

Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

Explaining Today’s Mortgage Rates

Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve are all influencing mortgage rates today.

Homebuyers Are Getting Used to the New Normal

One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal.

Home Prices Are Rebounding

Experts believe one of the reasons prices didn’t crash like some expected is because there aren’t enough available homes for the number of people who want to buy them.

Momentum Is Building for New Home Construction

If you’re looking to move right now, reach out to a local real estate professional to explore the homes that were recently completed.