The ‘REAL’ News about Housing Affordability

![20170406-Share-STM[1] Keeping Current Matters](https://brookhampton.com/wp-content/uploads/blog-post-images/20170406-Share-STM1.jpg)

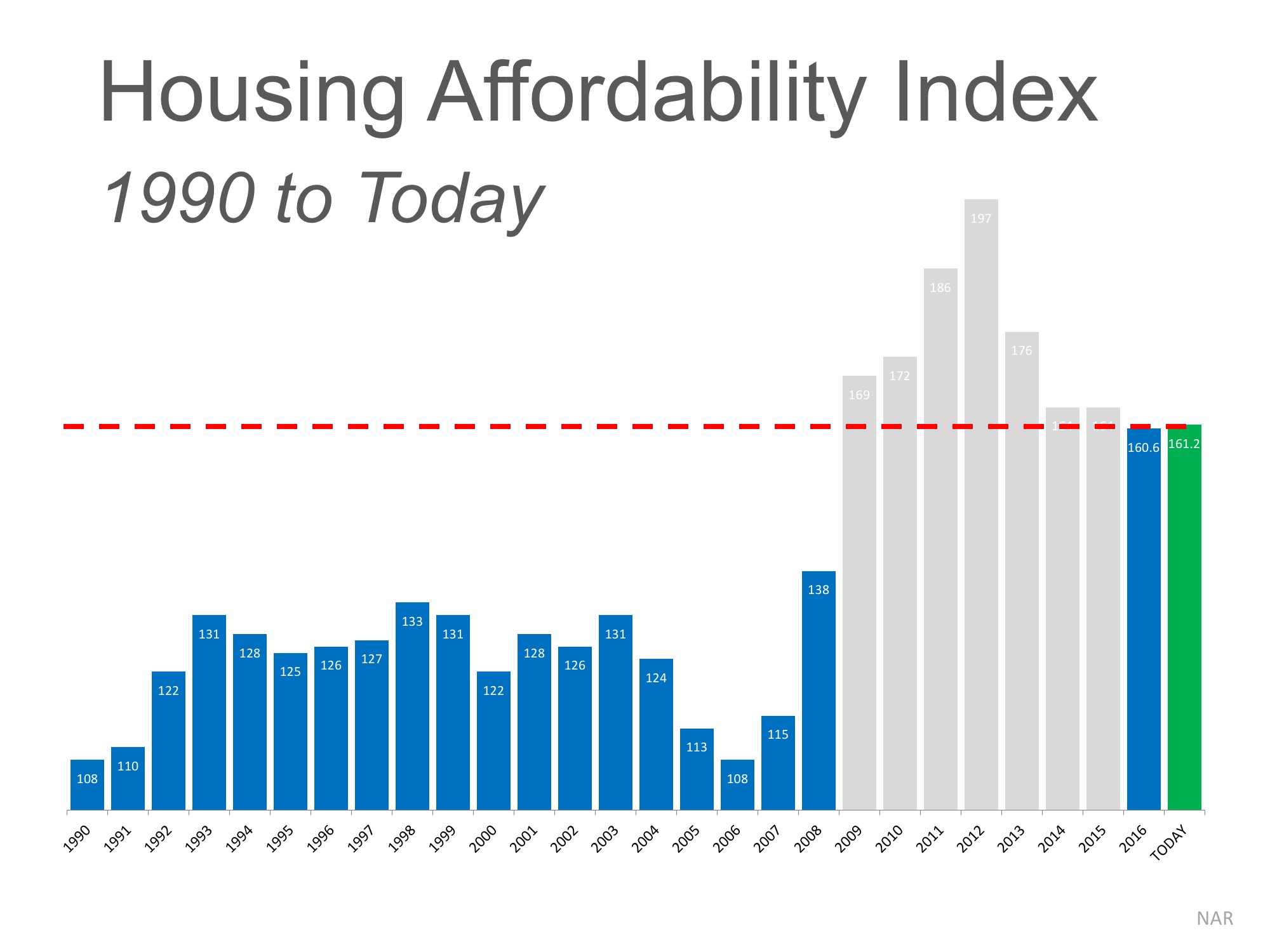

Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).

Here is how NAR defines the index:

“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”

Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median-priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify.

The higher the index, the easier it is to afford a home.

Why the concern?

The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market.

But, wait a minute…

Though the index skyrocketed from 2009 through 2013, we must realize that during that time, the housing crisis left the market with an overabundance of distressed properties (foreclosures and short sales). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock.

The market is recovering, and values are coming back nicely. That has caused the index to fall.

However, let’s remove the crisis years (shaded in gray) and look at the current index as compared to the index from 1990 – 2008:

Though prices and rates appear to be increasing, we must realize that affordability is composed of three ingredients: home prices, interest rates, and income. And, incomes are finally rising.

ATTOM Data Solutions recently released their Q1 2017 U.S. Home Affordability Index. The report explained:

“Stronger wage growth is the silver lining in this report, outpacing home price growth in more than half of the markets for the first time since Q1 2012, when median home prices were still falling nationwide. If that pattern continues, it will help turn the tide in the eroding home affordability trend.”

Bottom Line

Compared to historic norms, it is still a great time to buy from an affordability standpoint.

4 Ways to Make an Offer That Stands Out This Spring

If you’re serious about landing a home you’ll love, you need a smart strategy that includes a working with a great agent.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must to protect your home and your investment.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Best Week To List Your House Is Almost Here – Are You Ready?

A seller listing a well-priced, move-in ready home is likely to find success.

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

4 Things To Expect from the Spring Housing Market

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market.