The Ultimate Truth about Housing Affordability

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

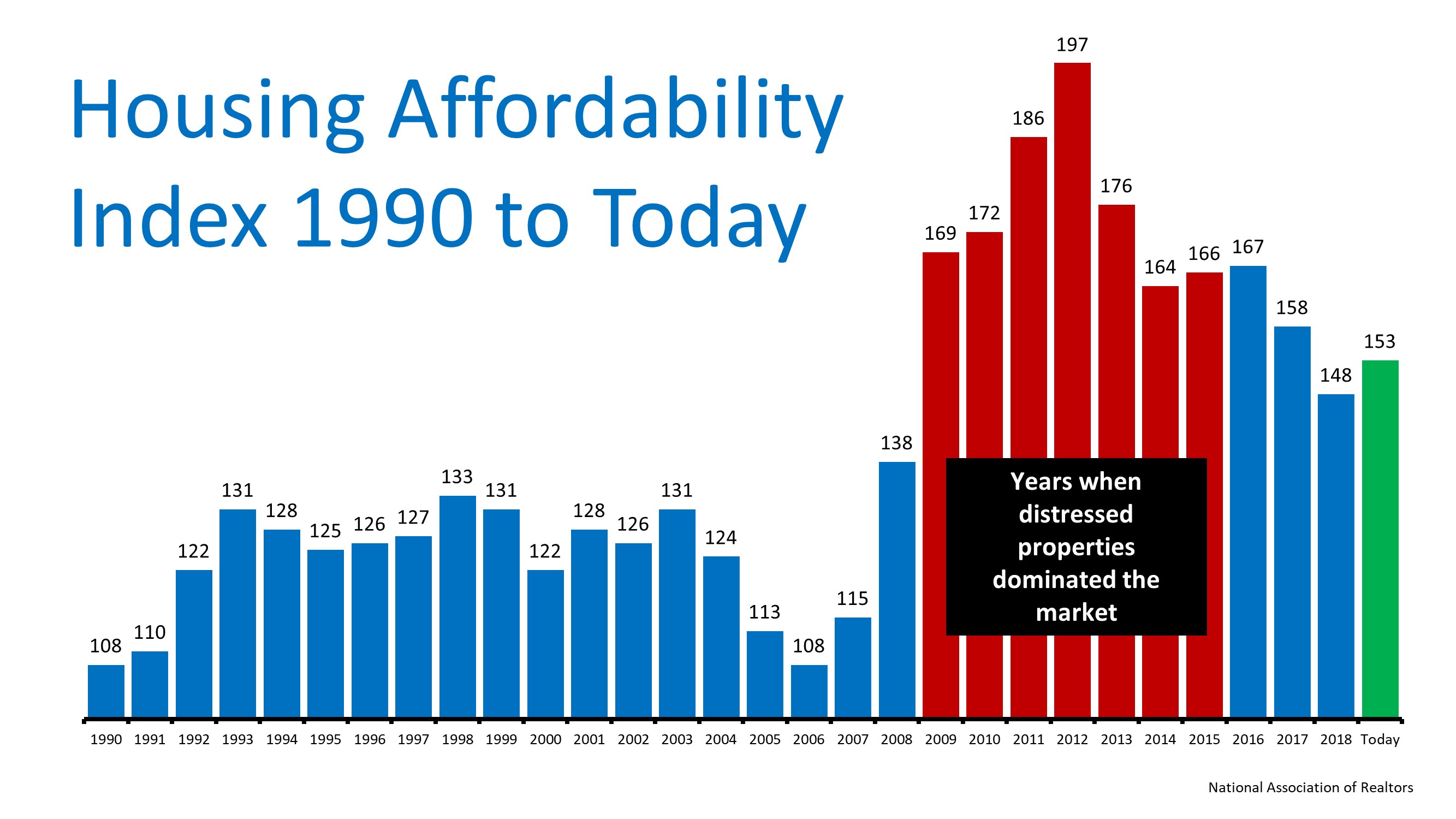

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

To view original article, visit Keeping Current Matters.

How Homeownership is Life Changing for Many Women

The financial security and independence homeownership provides can be life changing.

Get Ready: The Best Time To List Your House Is Almost Here

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching.

Why Buying a Home Is a Sound Decision

Experts aren’t forecasting a drastic fall in home prices nationally, even though some markets will see home price appreciation while others may depreciate.

The Role of Access in Selling Your House

As today’s housing market changes, be sure to work with your local agent to give buyers as much access as you can to your house when you sell.

What’s Ahead for Home Prices in 2023

The decision to purchase a home is best made when you do it knowing all the facts and have an expert on your side. Call today to speak to one of our expert real estate agents.

What Buyer Activity Tells Us About the Housing Market

January’s home showings are a positive sign that buyers are getting back out there.