Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

Home Builder Confidence Hits All-Time Record

The housing market continued to exceed expectations in August, as housing demand for new homes stayed strong.

The Cost of a Home Is Far More Important than the Price

Thanks to today’s lower interest rates, even with the price increase, you would still save $61 in your monthly mortgage payments.

Is the Economic Recovery Beating All Projections?

Is the U.S. economy and labor market are recovering from the coronavirus-related downturn more quickly than previously expected?

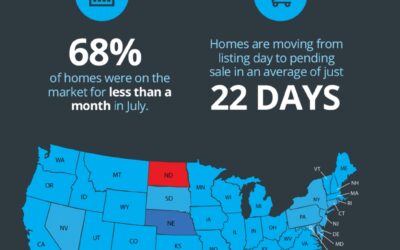

Homes Across the Country Are Selling Fast

Buyers are actively searching for and purchasing homes at a record-breaking pace.

How Low Inventory May Impact the Housing Market This Fall

Considering selling your house? Let’s talk about how you can benefit from the market trends in our area.

The Surging Real Estate Market Continues to Climb

Though there is some evidence that the overall economic recovery may be slowing, the housing market is still gaining momentum.

Two New Surveys Indicate Urban to Suburban Lean

Americans are feeling less enamored with living in a large city and may be longing for the open spaces in suburban and rural areas.

Virtual School Is Changing Homebuyer Needs

With remote learning sweeping the nation this year, organized spaces with room for kids to learn effectively are high on buyer wish lists.

Homebuyer Traffic Is On the Rise

Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), is now forecasting that more homes will sell this year than last year. Are you ready to make a move?

Have You Ever Seen a Housing Market Like This?

2020 will certainly be one to remember, with new realities and norms that changed the way we live and real estate is no exception.