Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

In Center Moriches, 19th century farmhouse asks $699,900

88 Lake Avenue, Center Moriches featured in the Real Estate section of Newsday! Interested in this home? Give Steve and Marc a call today.

Today’s Buyers Are Serious about Purchasing a Home

As demand for homes to buy grows and millennials enter the market with buying power, the opportunity to sell your house grows too.

Experts Weigh-In on the Remarkable Strength of the Housing Market

Here’s a look at what the experts have said about the housing market over the past few weeks.

Where Is the Housing Market Headed for the Rest of 2020?

Historically low mortgage rates are creating great potential for homebuyers, and home sales are on the rise.

Will We See a Surge of Homebuyers Moving to the Suburbs?

With the ongoing health crisis, it’s no surprise that many people are starting to consider moving out of bigger cities.

Homeownership Rate Continues to Rise in 2020

There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates.

Guidance and Support Are Key When Buying Your First Home

If you’re not sure where to begin or you simply want help in figuring out how to save for a home, we are here to help you! Call us today 🙂

Three of the Latest Reports Show Housing Market Is Strong

The residential real estate market is remaining resilient as the country still struggles to beat the COVID-19 pandemic.

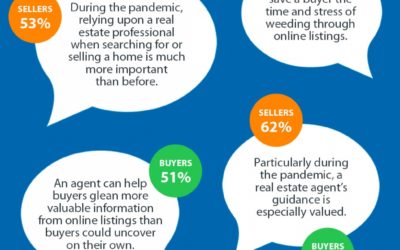

A Real Estate Pro Is More Helpful NOW than Ever

A recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.

Home Sales Hit a Record-Setting Rebound

Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.