Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

Real Estate Tops Best Investment Poll for 7th Year Running

For the seventh year in a row, real estate has come out on top as the best long-term investment.

New Listing! 32 Sagebrush Lane, Islandia

Check out the latest listing by BrookHampton Realty! You won’t want to miss this spacious 3-4 bedroom farmhouse! Call Donna today to schedule your private showing!

Are You Ready for the Summer Housing Market?

Summer is gearing up to be the 2020 buying season, so including your house in the mix may be your best opportunity to sell yet.

Is a Recession Here? Yes. Does that Mean a Housing Crash? No.

While we may be in a recession, the housing industry is much different than it was in 2008.

New York State COVID-19 Phase 2 Reopening

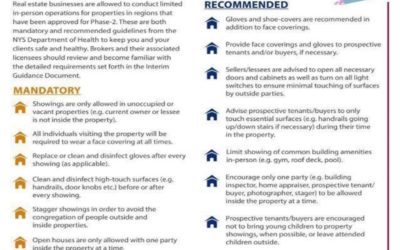

Beginning Wed., June 10, 2020, as NY enters Phase 2 of reopening, we will resume in-person showings following mandatory guidelines.

Real Estate Will Lead the Economic Recovery

Experts say the economy will begin to recover later this year. With real estate as a driver, that recovery may start sooner than we think.

Three Things to Understand About Unemployment Statistics

Tomorrow’s unemployment report will be difficult to digest, but as the nation reopens, many will return to work.

Home Prices: It’s All About Supply and Demand

Wondering what impact the pandemic will have on home prices? Supply and demand will give us the best idea of what’s to come.

The Benefits of Homeownership May Reach Further Than You Think

Homeownership is truly a way to build financial freedom and find greater satisfaction and happiness.

Why This Summer Is the 2020 Real Estate Season

Trusted real estate professionals can help you list safely and effectively, keeping your family’s needs top of mind.