Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

Interest Rates Over Time

With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time.

The #1 Misconception in the Homebuying Process

If you’re thinking about purchasing a home, realize that homes are still affordable even though prices are increasing.

The Many Benefits of Aging in a Community

“Aging-in-place” definitely has its advantages, but it could mean getting “stuck-in-place” too. We can help you figure it all out!

How Trusted Professionals Make Homebuying Easier to Understand

There are many possible steps in a real estate transaction, but they don’t have to be confusing.

The Overlooked Financial Advantages of Homeownership

With a mortgage, you can keep your monthly housing costs steady and predictable.

How the Housing Market Benefits with Uncertainty in the World

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

The #1 Reason to List Your House Right Now

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand.

Homeownership Rate on the Rise to a 6-Year High

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high.

How Pricing Your Home Right Makes a Big Difference

Pricing your home correctly will increase the visibility of your listing and drive more buyers your way.

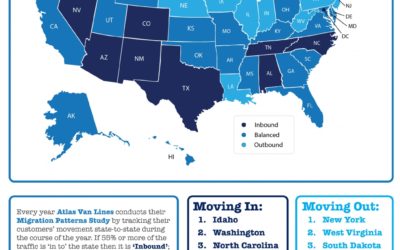

The Top States Americans Moved To Last Year

Idaho held on to the top spot of ‘high inbound’ states for the second time since 2017, followed by Washington State.