Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

3 Reasons This is NOT the 2008 Real Estate Market

Today’s real estate market is nothing like the 2008 market. Therefore, when a recession occurs, it won’t resemble the last one.

3 Reasons to Use a Real Estate Pro in a Complex Digital World

3 top reasons why using a real estate professional in addition to a digital search is key…

Be on the Lookout for Gen Z: The Next Generation of Homebuyers

It is never too early to start saving for your own home, whether you are part of Gen Z or a different generation.

Existing-Home Sales Report Indicates Now Is a Great Time to Sell

Now may be the time to take advantage of the ready, willing, and able buyers who are searching for their dream home.

What You Need to Know About the Mortgage Process

Your local professionals are here to help you determine how much you can afford, so take advantage of the opportunity to learn more.

You Need More Than a Guide. You Need a Sherpa.

Hiring an agent who has a finger on the pulse of the market will make your buying or selling experience an educated one.

Homeownership is the Top Contributor to Your Net Worth

There are financial and non-financial benefits to owning a home. Let’s talk about how we can help you become a homeowner.

What FICO® Score Do You Need to Qualify for a Mortgage?

If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

62% of Buyers Are Wrong About Down Payment Needs

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.

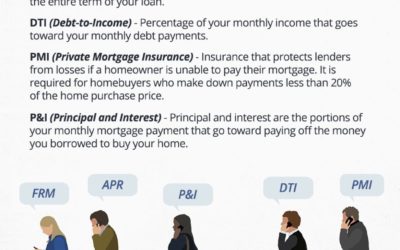

5 Homebuying Acronyms You Need to Know

“Learning the lingo of homebuying is an important part of feeling successful when buying a home.”