Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

3 Signs the Housing Market Is on the Rebound

Existing home sales, buyer traffic and pending home sales are all good signs that the real estate market is rebounding!

4 Tips to Improve Your Home and Save on Your Energy Bill

By making a few key upgrades to your home, you’ll save on your utility bills and improve the energy efficiency of your home.

What to Expect from Your Home Inspection

To ensure you make an educated decision before you buy, work with a professional you can trust to give you the most information possible.

How Does the Supply of Homes for Sale Impact Buyer Demand?

The price of any item is determined by supply, as well as the market’s demand for the item.

What is the Cost of Waiting Until Next Year to Buy?

If you’re ready and willing to buy your dream home, now is a great time to buy.

Homeowners Are Happy! Renters? Not So Much.

As good as the “financial equity” is, it doesn’t compare to the “emotional equity” gained through owning your own home.

Are You Ready for the ‘Black Friday’ of Real Estate?

New realtor.com study reports the week of September 22 is the best time of year to buy a home, making it ‘Black Friday’ for homebuyers.

Should You Fix Your House Up or Sell Now?

If you’re considering selling your house, let’s get together to help you confidently determine what the best choice for you and your family is.

Is Your House “Priced to Sell Immediately”?

In today’s real estate market, more houses are coming to market every day. Pricing your home right from the start can make a big difference!

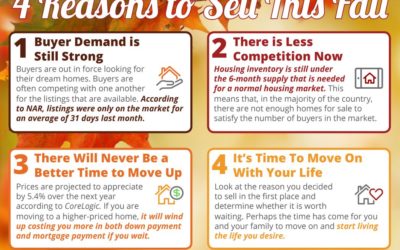

4 Reasons to Sell This Fall

Fall is a great time to sell your house! Take a look at 4 great reasons why you should consider selling this Fall and then let us help you with the rest!