Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

The Role Access Plays in Getting Your House Sold

Here are five levels of access you and your agent can provide to buyers looking to see your home.

Home Sales Expected to Continue Increasing In 2020

Freddie Mac, Fannie Mae, and the Mortgage Bankers Association are all projecting home sales will increase nicely in 2020.

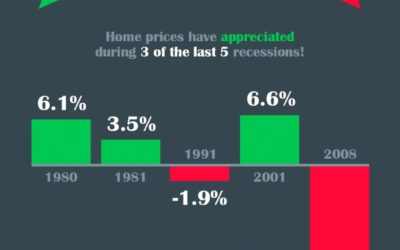

Everybody Calm Down! This Is NOT 2008

It is important to realize that the impact of a recession on the housing market will in no way resemble 2008.

How Property Taxes Can Impact Your Mortgage Payment

When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment.

5 Reasons to Sell This Fall

Perhaps the time has come for you and your family to move on and start living the life you desire. NOW may be exactly that time! Let’s get together and talk about it!

A Recession Does Not Equal a Housing Crisis

Experts predict a potential recession on the horizon. But, housing will not be the trigger; home values will still continue to appreciate.

Top Priorities When Moving With Kids

If you’re a seller with children and looking to relocate, let’s get together to navigate the process in the most reasonable time frame for you and your family.

What’s the Latest on Interest Rates?

As a potential buyer, the best thing you can do is work with a trusted advisor who can help you keep a close eye on how the market is changing.

Experts Predict a Strong Housing Market for the Rest of 2019

The housing market will be strong for the rest of 2019. Let’s get together to discuss what’s happening in our area.

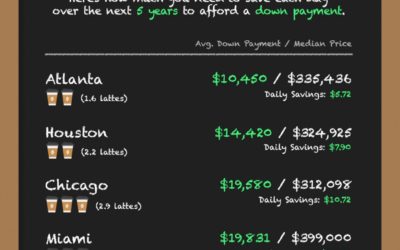

A Latte a Day Keeps Homeownership Away

Saving just a small amount each day will get you to the average down payment you may need for homeownership faster than you think.