Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

5 Easy Steps to Avoid Overwhelm from Media Overload

Don’t let the plethora of seemingly conflicting information on the housing market stop you from moving forward with your life.

Housing Supply Not Keeping Up with Population Increase

The dip in home building coupled with the increasing U.S. population means there is a SELLING opportunity for homeowners!

A Great Way to Increase Your Family’s Net Worth

If you want to find out how you can use your monthly housing cost to increase your family’s wealth, we can help you through the process.

Watch The Video: 30 Lewis Road, East Quogue

Recently renovated 3 bedroom, 3 bath Cape located in the Town of Southampton!

5 Real Estate Reality TV Myths Explained

Having an experienced professional on your side while navigating the real estate market is the best way to guarantee you can make the home of your dreams a true reality.

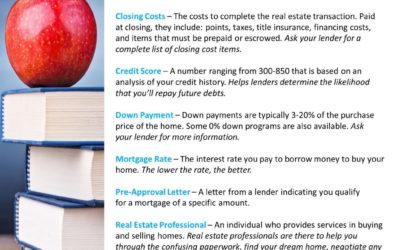

Buying a Home: Know the Lingo?

The best way to ensure your home-buying process is a positive one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher.’

Busting the Myth About a Housing Affordability Crisis

If you’ve put off buying your first home because of affordability concerns, you should take another look at your ability to buy.

The Benefits of Growing Equity in Your Home

If you’re a current homeowner, you may have more equity than you realize. Your equity can open the door to future opportunities.

American Confidence in Housing at an All-Time High

Most Americans believe it’s a good time to buy since they are not worried about jobs and interest rates are low!

How Much Do You Know About Down Payments?

There is a long-standing misconception about down payment requirements.