Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

Watch The Video: 1 Newpoint Lane, East Moriches

Spacious Colonial in Newport Beach, with deeded beach and boating rights!

Watch The Video: 3 Wright Road, Manorville

Spacious 3 bedroom, 2 bath ranch with many upgrades on over an acre of beautifully landscaped property!

Watch the Video: 62 Cobbleridge Lane, Manorville

Condo living at its best! 2 bedroom, 1.5 bath condo with sophistication and style!

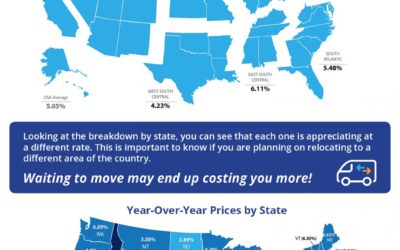

Home Prices Up 5.05% Across the Country

Looking at the breakdown by state, you can see that each one is appreciating at a different rate.

3 Powerful Reasons to Buy a Home Now

With affordability increasing, mortgage rates decreasing, and home values about to re-accelerate, it may be time to make a move. Let’s get together to determine if buying now makes sense for your family.

Mid-Year Housing Market Update: Three Things to Know Today

If you’re thinking of buying or selling, or if you just want to know what experts are saying, here are the top three things to put on your radar.

What Experts are Saying About the Current Housing Market

Experts agree the housing market will be strong for the rest of 2019. If you’d like to know more, let’s chat about what’s happening in our area.

Is Renting Right for Me?

With rent costs rising annually and many helpful down payment assistance programs available, homeownership may be closer than you realize.

The Cost of Waiting: Interest Rates Edition

Rates are still low right now – don’t wait until they hit 5% to start searching for your dream home!

What a Difference a Year Makes for Sellers

What a difference we’ve seen over the course of this year! If you’re thinking of selling, now is the time as inventory is on the rise.