Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

The Benefits of a 20% Down Payment

Why do so many people believe that they need a 20% down payment to buy a home? Today, we want to talk about four reasons why putting 20% down is a good plan, if you can afford it.

Home Buyers are Optimistic About Home Ownership!

Let’s get together to help you understand our local market and determine if buying a home is the right choice for you now.

Why Access Is One of the Most Important Factors in Getting Your House Sold!

Access to your home can make or break your ability to get the price you are looking for, or even sell your house at all!

Open House! $379,000

Sunday, May 5, 2019

12PM – 2PM

9 Newport Beach Blvd., East Moriches, NY 11940

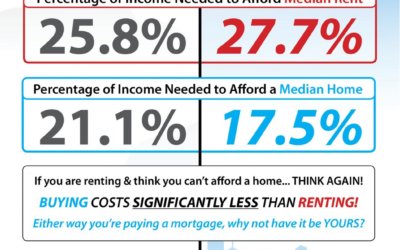

The Cost of Renting vs. Buying This Spring

If you are renting and think you can’t afford a home…THINK AGAIN! Buying costs significantly less than renting!

Your Fabulous New Dream Home is Now Available

Are you thinking of selling your old house to buy a new home that better fits your current lifestyle? Now may be the perfect time!

2 Trends Helping Keep Housing Affordable

Low mortgage interest rates have kept housing affordable throughout the country. If you plan on purchasing a home this year, act now!

What Would Make You Sell Your House?

Have you outgrown your current house? Not sure? Get together with one of our expert agents to set you on the path to finding a home that fits your current needs!

How Quickly Can You Save Your Down Payment?

Saving for a down payment? You may be closer to your dream home than you think!

Renters Paying Substantially More While Owning Costs Less

With rent prices skyrocketing and mortgage payments decreasing, we’re in for a great spring home-buying season!