Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

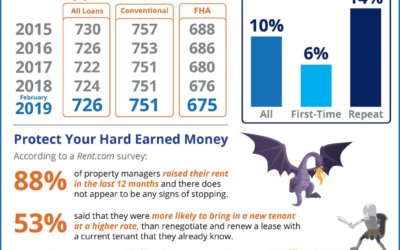

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

New Study Reveals One Surprising Reason for the Inventory Shortage

If millennials are unable to find a home to buy at a young age like their predecessors, then who is living in those homes?

Buyer Demand Surging as Spring Market Begins

Whether you are selling or buying, this is important news! The spring buyers’ market is going to be much stronger than many had projected.

3 Questions You Need To Ask Before Buying A Home

Only you will know if now is the right time to purchase a home. Need help deciding? Call our office for help from one of our agents.

Slaying the Hardest Homebuying Myths Today

Arming yourself with info about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

Home Value Appreciation Stops Falling, Begins to Stabilize

Home price appreciation has ended its decline and looks to be stabilizing… and may even accelerate.

Why Pet-Friendly Homes Are in High Demand

It is important to understand the unique needs and wants of animal owners when it comes to homeownership. Pets are our family too!

What to Consider When Choosing Your Home To Retire In

In today’s housing market climate, it makes sense to evaluate your home’s ability to adapt to your retirement needs.

Data Says April is the Best Month to List Your Home for Sale

The spring housing market is off to the races with increased inventory and low interest rates!

3 Graphs That Show What You Need to Know About Today’s Real Estate Market

The best way to show what’s really going on in today’s real estate market is to go straight to the data! Here’s good news!

Looking to Upgrade Your Current Home? Now’s the Time to Move-Up!

Knowing what characteristics you are looking for in a premium home will help your agent find your dream home.