Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

A Housing Bubble? Industry Experts Say NO!

With residential home prices continuing to appreciate at levels above historic norms, some are questioning if we are heading toward another housing bubble. Recently, five housing experts weighed in on the question.

How to Save on a Mortgage Payment Whether Buying or Selling

In Trulia’s recent report, Rent vs. Buy: Roommate Edition, they examined the impact that renting with a roommate has in determining whether it is more expensive to rent or buy. The study explains: “Since we started keeping track in 2012, it’s been a better deal to buy...

Don’t Let Fear Stop You from Applying for a Mortgage

For many, the mortgage process can be scary, but it doesn’t have to be!

Why Sell Now Instead of Later? The Buyers are Out Now

The concept of ‘supply & demand’ reveals that the best price for an item will be realized when the supply of that item is low and the demand for that item is high. Recently released data suggests that a seller’s best deal may be available right now.

Vacation Home Property Sales Surge

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment. The BH&J Index is a...

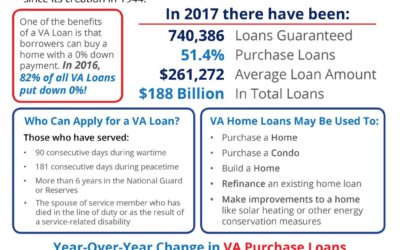

Veterans Affairs Loans by the Numbers

The Veterans Affairs Home Loan is a benefit that has helped more than 22 million veterans achieve the dream of homeownership since its creation in 1944.

Singles Are Falling For Their Dream Home First!

“The primary reason for buying a home amongst singles was the desire to own a home of their own.”

84% of Americans Believe Buying a Home is a Good Financial Decision

Majority of Americans strongly agree that homeownership helps create safe, secure, and stable environments.

Thinking of Selling? You Should Act NOW!

“The best time to sell something is when supply of that item is low and demand for that item is high. That defines today’s real estate market.”

3 Questions to Ask Before You Buy Your Dream Home?

“The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.”