” Let’s alleviate the fears about the current mortgage market.”

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. One of the factors they’re pointing at is the availability of mortgage money. Recent articles about the availability of low-down payment loans and down payment assistance programs are causing concern that we’re returning to the bad habits of a decade ago. Let’s alleviate the fears about the current mortgage market.

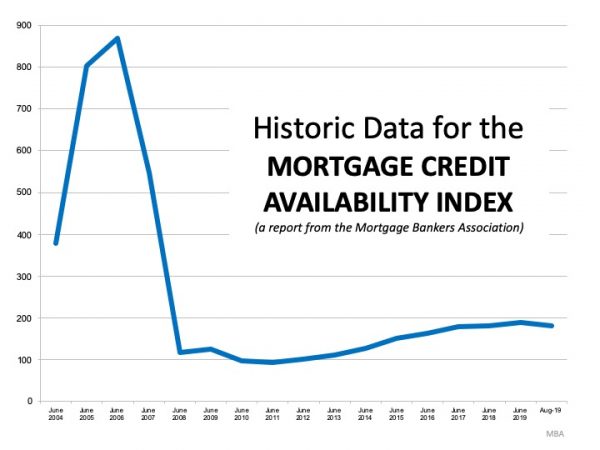

The Mortgage Bankers’ Association releases an index several times a year titled: The Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is…a summary measure which indicates the availability of mortgage credit at a point in time.”

Basically, the index determines how easy it is to get a mortgage. The higher the index, the more available the mortgage credit.

Here is a graph of the MCAI dating back to 2004, when the data first became available: As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

Thankfully, lending standards have eased since. The index, however, is still below 200, which is half of what it was before things got out of control.

Bottom Line

It is easier to get a mortgage today than it was immediately after the market crash, but it is still difficult. The difference in 2006? At that time, it was difficult not to get a mortgage.

To view original article, visit Keeping Current Matters.

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Here’s what’s really happening with home prices.

Your Equity Could Make a Move Possible

Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Equity can help you make your move.

More Than a House: The Emotional Benefits of Homeownership

Here’s a look at just a few of those more emotional or lifestyle perks, to help anchor you to why homeownership is one of your goals.

The Biggest Mistakes Buyers Are Making Today

There’s one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice.

How Do Climate Risks Affect Your Next Home?

How can you be sure your investment is safe from the elements? Work with a local real estate agent!

Questions You May Have About Selling Your House

If you’ve been considering selling your house, and have some questions, call us today for some clarity.