” Let’s alleviate the fears about the current mortgage market.”

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. One of the factors they’re pointing at is the availability of mortgage money. Recent articles about the availability of low-down payment loans and down payment assistance programs are causing concern that we’re returning to the bad habits of a decade ago. Let’s alleviate the fears about the current mortgage market.

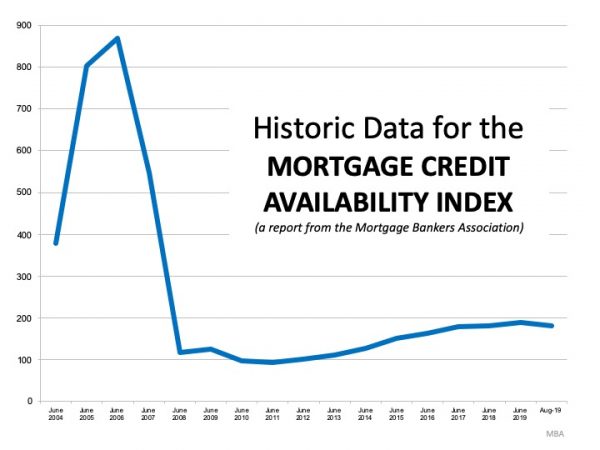

The Mortgage Bankers’ Association releases an index several times a year titled: The Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is…a summary measure which indicates the availability of mortgage credit at a point in time.”

Basically, the index determines how easy it is to get a mortgage. The higher the index, the more available the mortgage credit.

Here is a graph of the MCAI dating back to 2004, when the data first became available: As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

Thankfully, lending standards have eased since. The index, however, is still below 200, which is half of what it was before things got out of control.

Bottom Line

It is easier to get a mortgage today than it was immediately after the market crash, but it is still difficult. The difference in 2006? At that time, it was difficult not to get a mortgage.

To view original article, visit Keeping Current Matters.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

Why You May Want To Seriously Consider a Newly Built Home

Newly built homes are becoming an increasingly significant part of today’s housing inventory.

Homeownership Is Still at the Heart of the American Dream

Buying a home is a powerful decision, and it remains at the heart of the American Dream.

Why Pre-Approval Is Your Homebuying Game Changer

If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip.