” Let’s alleviate the fears about the current mortgage market.”

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. One of the factors they’re pointing at is the availability of mortgage money. Recent articles about the availability of low-down payment loans and down payment assistance programs are causing concern that we’re returning to the bad habits of a decade ago. Let’s alleviate the fears about the current mortgage market.

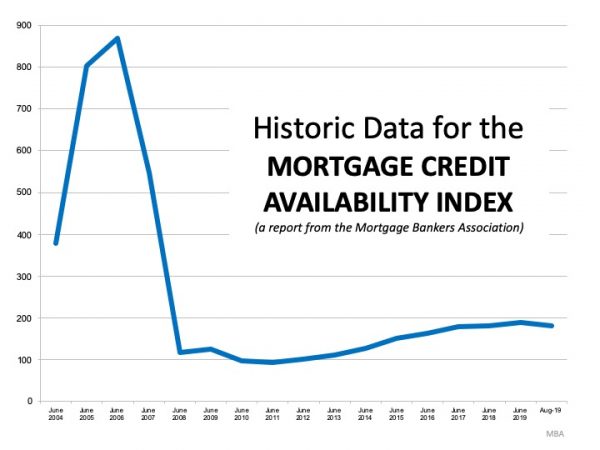

The Mortgage Bankers’ Association releases an index several times a year titled: The Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is…a summary measure which indicates the availability of mortgage credit at a point in time.”

Basically, the index determines how easy it is to get a mortgage. The higher the index, the more available the mortgage credit.

Here is a graph of the MCAI dating back to 2004, when the data first became available: As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

Thankfully, lending standards have eased since. The index, however, is still below 200, which is half of what it was before things got out of control.

Bottom Line

It is easier to get a mortgage today than it was immediately after the market crash, but it is still difficult. The difference in 2006? At that time, it was difficult not to get a mortgage.

To view original article, visit Keeping Current Matters.

Don’t Let These Two Concerns Hold You Back from Selling Your House

Working with a local real estate agent is the best way to see what inventory trends look like in your area.

More Homes, Slower Price Growth – What It Means for You as a Buyer

Having a real estate agent who knows the local area can be a big advantage when you start the buying process.

What’s Motivating Homeowners To Move Right Now

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.

Renting vs. Buying: The Net Worth Gap You Need To See

If you’re on the fence, it may be helpful to speak with a local real estate agent. They can help you weigh your options.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Understanding what’s happening will help you make the right decisions, whether that’s buying or selling.