“Here are two fundamentals that prove this point is the strongest market we have seen.”

When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime. Here are two fundamentals that prove this point.

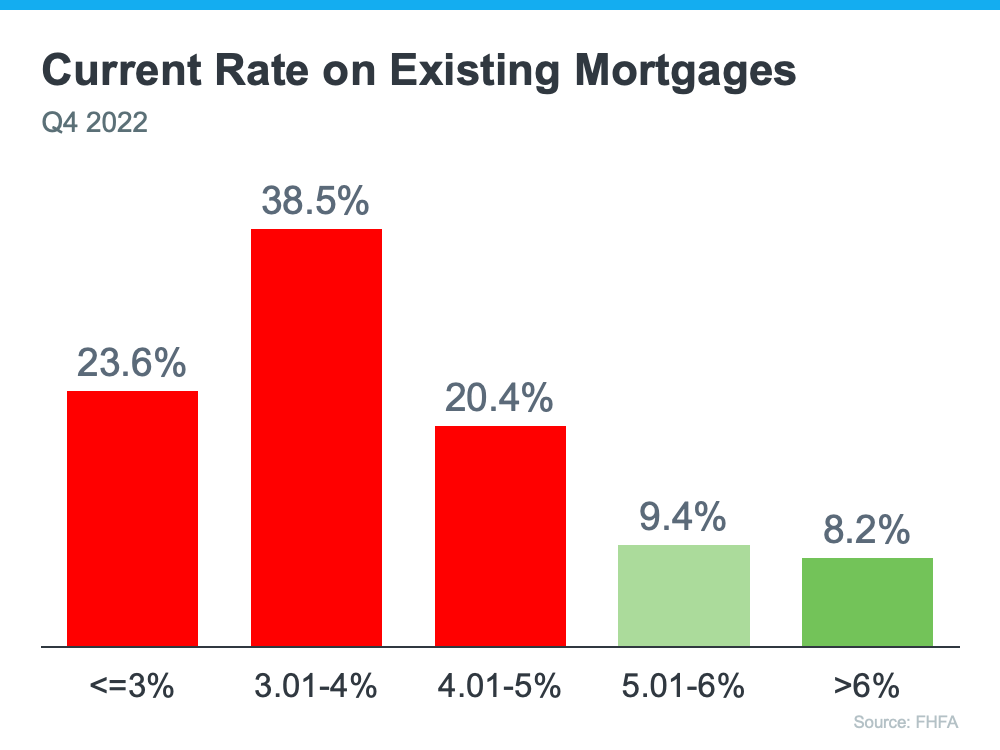

1. The Current Mortgage Rate on Existing Mortgages

First, let’s look at the current rate on existing mortgages. According to the Federal Housing Finance Agency (FHFA), as of the fourth quarter of last year, over 80% of existing mortgages have a rate below 5%. That’s significant. And, to take that one step further, over 50% of mortgages have a rate below 4% (see graph below):

Now, there’s a lot of talk in the media about a potential foreclosure crisis or a rise of homeowners defaulting on their loans, but consider this. Homeowners with such good mortgage rates are going to work as hard as they can to keep that mortgage and stay in their homes. That’s because they can’t go out and buy another house, or even rent an apartment, and pay what they do today. Their current mortgage payment is more affordable. Even if they downsize, with today’s higher mortgage rates, it could cost more.

Here’s why this gives the housing market such a solid foundation today. Having so many homeowners with such low mortgage rates helps us avoid a crisis with a flood of foreclosures coming to market like there was back in 2008.

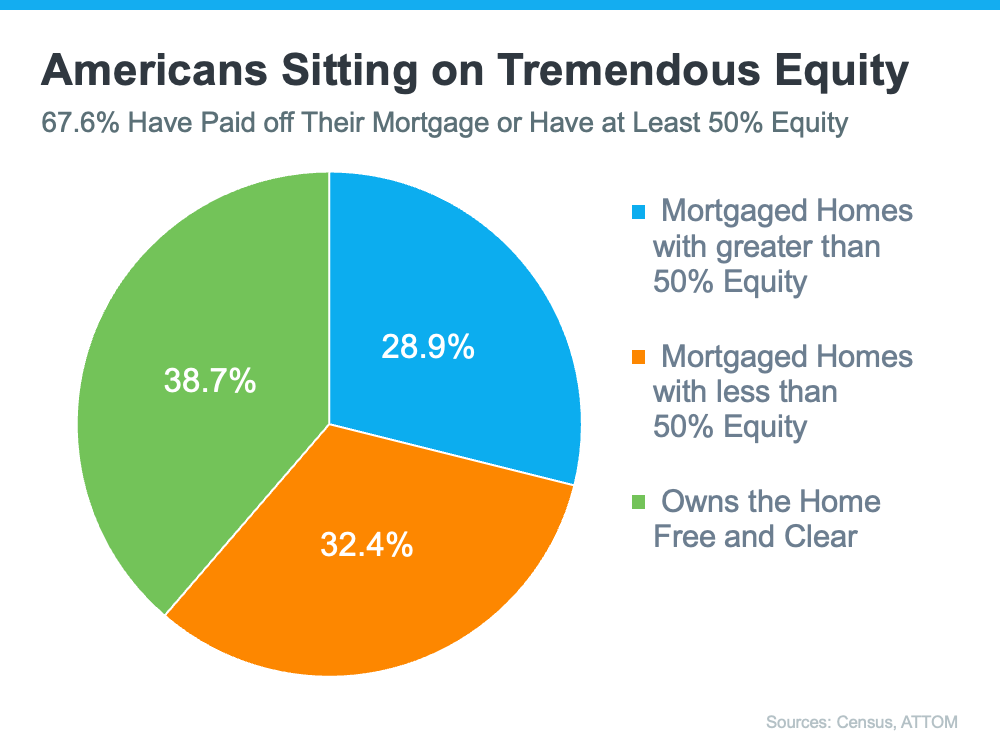

2. The Amount of Homeowner Equity

Second, Americans are sitting on tremendous equity right now. According to the Census and ATTOM, roughly two-thirds (around 68%) of homeowners have either paid off their mortgage or have at least 50% equity (see chart below):

In the industry, the term for this is equity rich. This is significant because if you think back to 2008, some people had to make the difficult decision to walk away from their homes because they owed more on the home than it was worth.

But this time, things are different because homeowners have built up so much equity over the past few years alone. And, when homeowners have that much equity, it helps us avoid another wave of distressed properties coming onto the market like we saw during the crash. It also creates an extremely strong foundation for today’s housing market.

Bottom Line

We are in one of the most foundationally strong housing markets of our lifetime because homeowners are going to fight to keep their current mortgage rate and they have a tremendous amount of equity. This is yet another reason things are fundamentally different than in 2008.

To view original article, visit Keeping Current Matters.

Will Home Prices Fall This Year? Here’s What Experts Say.

Experts say the housing market isn’t set up for a price decline due to that ongoing imbalance between supply and demand.

How Today’s Mortgage Rates Impact Your Home Purchase

If you’re planning to buy a home, it’s critical to understand the relationship between mortgage rates and your purchasing power.

Three Tips for First-Time Homebuyers

No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional.

Things That Could Help You Win a Bidding War on a Home

Bidding wars are common today with so many buyers looking to make a purchase before mortgage rates rise further.

Today’s Home Price Appreciation Is Great News for Existing Homeowners

Because it will take some time for housing supply to increase, experts believe prices will continue rising.

What You Need To Know About Selling in a Sellers’ Market

Listing your house this season means you’ll be in front of serious buyers who are ready to buy.