“Here are two fundamentals that prove this point is the strongest market we have seen.”

When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime. Here are two fundamentals that prove this point.

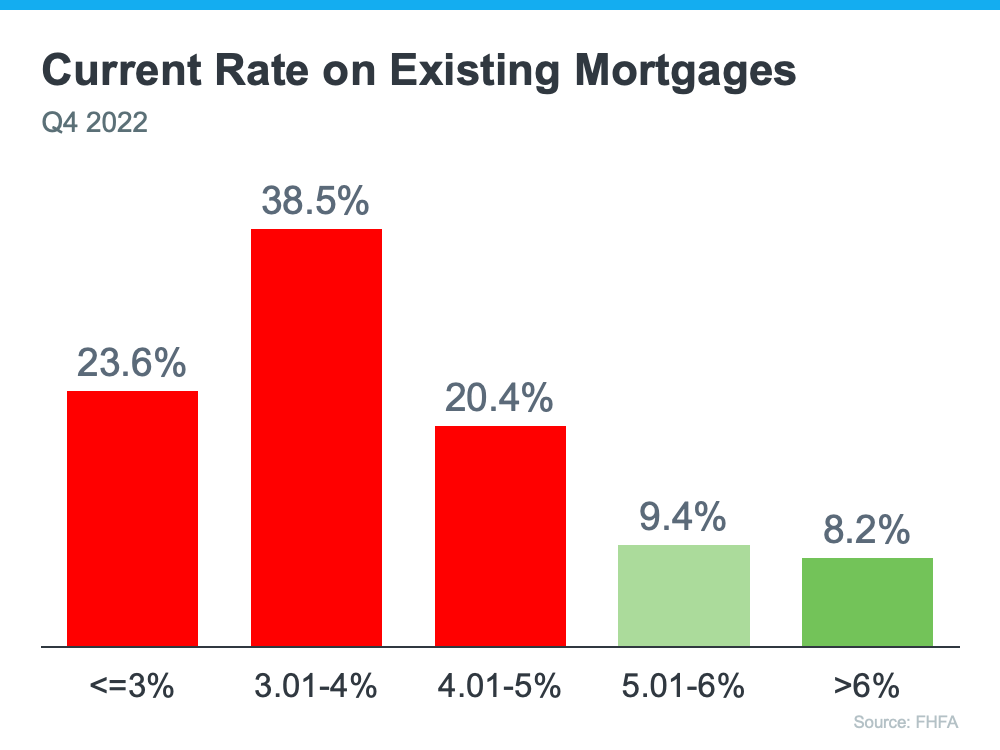

1. The Current Mortgage Rate on Existing Mortgages

First, let’s look at the current rate on existing mortgages. According to the Federal Housing Finance Agency (FHFA), as of the fourth quarter of last year, over 80% of existing mortgages have a rate below 5%. That’s significant. And, to take that one step further, over 50% of mortgages have a rate below 4% (see graph below):

Now, there’s a lot of talk in the media about a potential foreclosure crisis or a rise of homeowners defaulting on their loans, but consider this. Homeowners with such good mortgage rates are going to work as hard as they can to keep that mortgage and stay in their homes. That’s because they can’t go out and buy another house, or even rent an apartment, and pay what they do today. Their current mortgage payment is more affordable. Even if they downsize, with today’s higher mortgage rates, it could cost more.

Here’s why this gives the housing market such a solid foundation today. Having so many homeowners with such low mortgage rates helps us avoid a crisis with a flood of foreclosures coming to market like there was back in 2008.

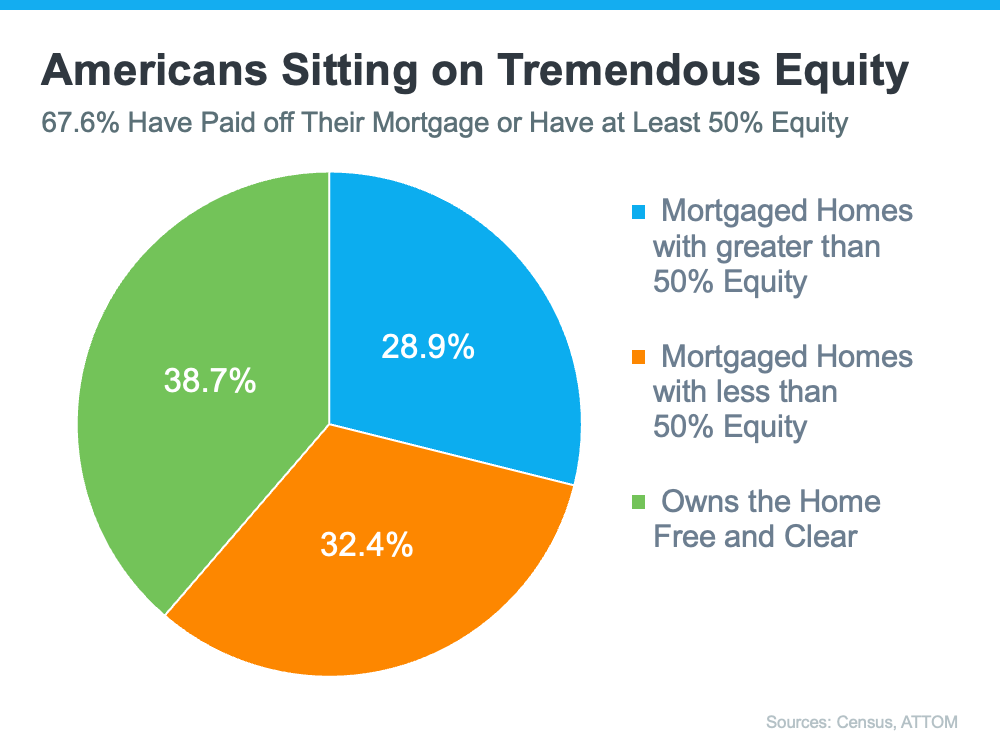

2. The Amount of Homeowner Equity

Second, Americans are sitting on tremendous equity right now. According to the Census and ATTOM, roughly two-thirds (around 68%) of homeowners have either paid off their mortgage or have at least 50% equity (see chart below):

In the industry, the term for this is equity rich. This is significant because if you think back to 2008, some people had to make the difficult decision to walk away from their homes because they owed more on the home than it was worth.

But this time, things are different because homeowners have built up so much equity over the past few years alone. And, when homeowners have that much equity, it helps us avoid another wave of distressed properties coming onto the market like we saw during the crash. It also creates an extremely strong foundation for today’s housing market.

Bottom Line

We are in one of the most foundationally strong housing markets of our lifetime because homeowners are going to fight to keep their current mortgage rate and they have a tremendous amount of equity. This is yet another reason things are fundamentally different than in 2008.

To view original article, visit Keeping Current Matters.

Surprising Shift Favors Homeowners: Buyers Now Prefer Existing Homes

Existing homes are now the top preference among today’s buyers. Are you ready to sell?

Sellers: Make Today’s Home Price Appreciation Work for You

While prices aren’t expected to depreciate, the rise in prices is forecast to moderate over the next few years.

Key Questions To Ask Yourself Before Buying a Home

Homeownership is life-changing, and buying a home can positively impact you in so many ways.

3 Hot Topics in the Housing Market Right Now

If you’re a prospective buyer or seller, it’s important to understand the current real estate market conditions and how they affect you.

A Look at Housing Supply and What It Means for Sellers

It’s not too late to take advantage of today’s sellers’ market and use rising equity and low interest rates to make your next move.

3 Charts That Show This Isn’t a Housing Bubble

With home prices continuing to deliver double-digit increases, some are concerned we’re in a housing bubble like the one in 2006.