“With the continued imbalance between supply and demand, home prices are likely to have another year of strong gains.”

If you’re planning to sell your home this season, rising prices are great news for you. But it’s important to understand why prices are rising to begin with. One major factor is supply and demand.

In any industry, when there are more buyers for an item than there are of that item available, prices naturally rise. In those situations, buyers are willing to pay more to get the product or service they’re looking for when options are scarce. And that’s exactly what’s happening in the current real estate market.

Selma Hepp, Executive, Research & Insights and Deputy Chief Economist at CoreLogic, puts it like this:

“With so few homes, buyers are once again left with fierce competition that’s driving the share of homes that sold over the listing price up to 66% . . . With the continued imbalance between supply and demand, home prices are likely to have another year of strong gains and are expected to average about 10% growth for the year.”

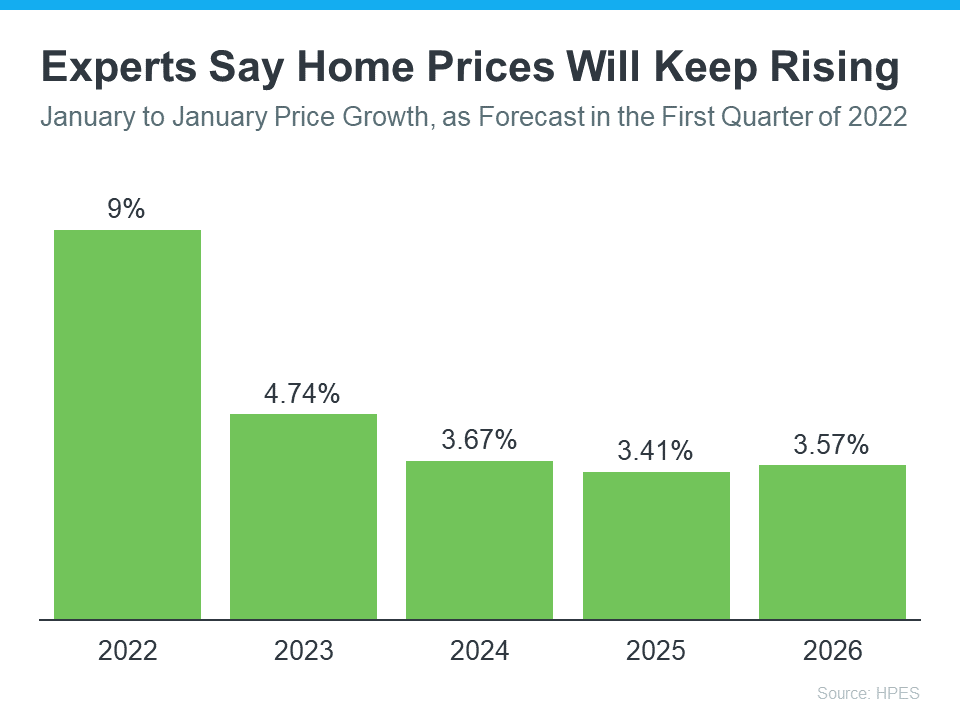

Because it will take some time for housing supply to increase, experts believe prices will continue rising. The latest Home Price Expectations Survey forecasts what will happen with home prices over the next 5 years. As the graph below shows, while the rate of appreciation will moderate over the next few years, prices will continue rising through 2026:

What This Means When You Sell Your House

If you’re a homeowner, the projection for continued price appreciation this year opens up an opportunity to move. That’s because it may give your equity a major boost. Equity is the difference between what you owe on your house and its market value. The amount of equity you have increases as you make your monthly payments and as rising home prices drive up the market value for your home.

Growing equity is a powerful tool for homeowners. When you sell your house, the equity you’ve built comes back to you in the sale. That money could be enough to cover some (if not all) of your down payment on your next home.

Of course, if you want to know how much equity you have in your current house, it’s crucial to work with a real estate professional. They follow current market trends and can help you understand your home’s value when you’re ready to sell.

What This Means for Your Next Purchase

But today’s rising home values aren’t just good news if you’re ready to sell. Because price appreciation is forecast to continue in the years ahead, you can rest assured your next home will be an investment that should grow in value with time. That’s one of several reasons why real estate has been rated the best investment in a recent Gallup poll.

Bottom Line

If you’re weighing whether or not you should sell your house this season, know rising home values may be opening up an opportunity to use equity to fuel your move. Let’s connect so you can find out how much your home is worth and to learn more about all the benefits you have in today’s market.

To view original article, visit Keeping Current Matters.

Evaluating Your Wants and Needs as a Homebuyer Matters More Today

So, if you’re looking to buy a home, take some time to consider what’s truly essential for you in your next house.

Where Will You Go If You Sell? Newly Built Homes Might Be the Answer.

New home construction is up and is becoming an increasingly significant part of the housing inventory.

Why Homeownership Wins in the Long Run

It’s important to think about the long-term benefits of homeownership when deciding whether or not to buy a home.

The True Cost of Selling Your House on Your Own

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide.

What Homebuyers Need To Know About Credit Scores

Your credit score is one of the most important factors lenders consider when you apply for a mortgage.

Why the Median Home Price Is Meaningless in Today’s Market

Using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now.