“3% mortgage rates shouldn’t deter you from your homebuying goals.”

With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since experts project rates will rise further in the coming months, that conversation isn’t going away any time soon.

But as a homebuyer, what do rates above 3% really mean?

Today’s Average Mortgage Rate Still Presents Buyers with a Great Opportunity

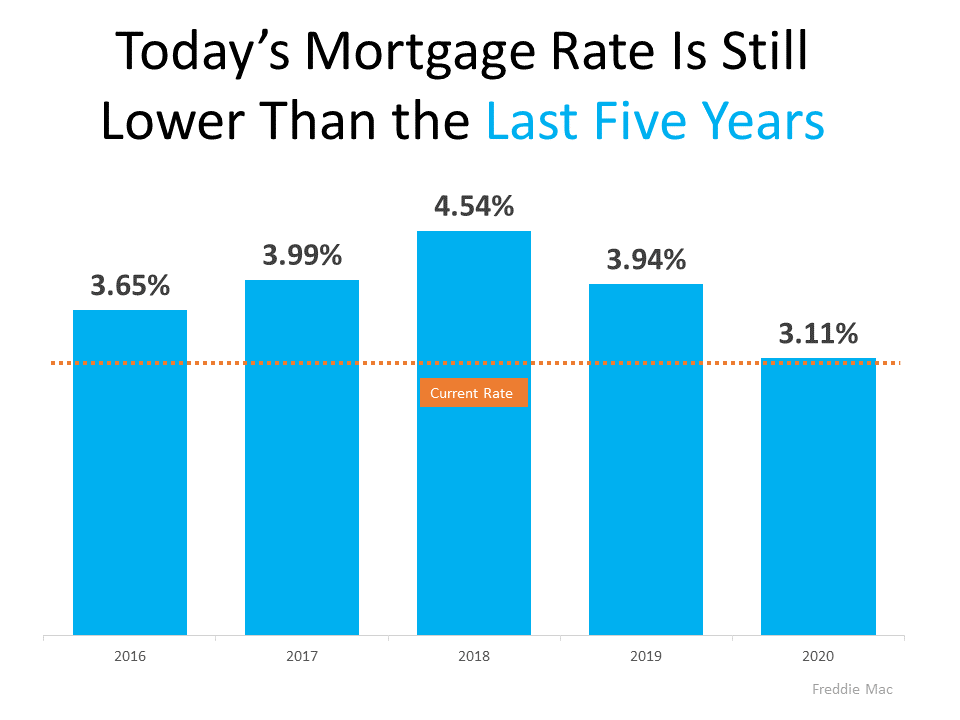

Buyers don’t want mortgage rates to rise, as any upward movement increases your monthly mortgage payment. But it’s important to put today’s average mortgage rate into perspective. The graph below shows today’s rate in comparison to average rates over the last five years: As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

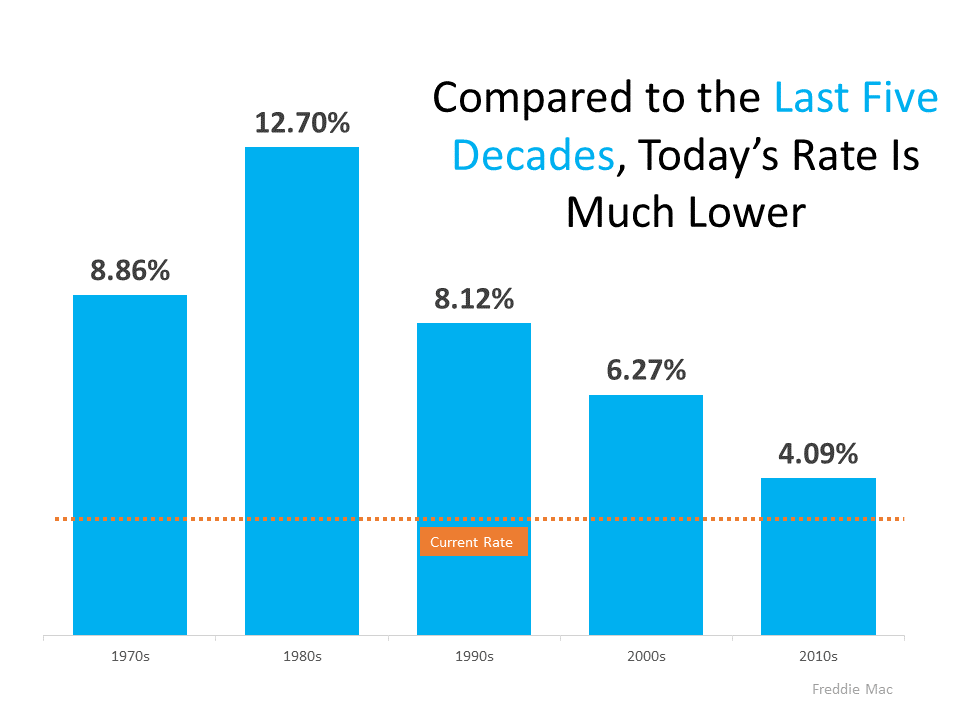

But today’s rate isn’t just low when compared to the most recent years. To truly put today into perspective, let’s look at the last 50 years (see graph below): When we look back even further, we can see that today’s rate is truly outstanding by comparison.

When we look back even further, we can see that today’s rate is truly outstanding by comparison.

What Does That Mean for You?

Being upset that you missed out on sub-3% mortgage rates is understandable. But it’s important to realize, buying now still makes sense as experts project rates will continue to rise. And as rates rise, it will cost more to purchase a home.

As Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates, all else equal, will diminish house-buying power, meaning it will cost more per month for a borrower to buy ‘their same home.’”

In other words, the longer you wait, the more it will cost you.

Bottom Line

While it’s true today’s average mortgage rate is higher than just a few months ago, 3% mortgage rates shouldn’t deter you from your homebuying goals. Historically, today’s rate is still low. And since rates are expected to continue rising, buying now could save you money in the long run. Let’s connect so you can lock in a great rate now.

To view original article, visit Keeping Current Matters.

Reasons Your Home May Not Be Selling

If you’re thinking of selling, lean on your real estate agent for expert advice based on your unique situation and feedback you get from buyers throughout the process.

Today’s Housing Inventory Is a Sweet Spot for Sellers

Buyers have fewer choices now than they did in more normal years, and that’s continuing to impact statistics in the housing market.

Evaluating Your Wants and Needs as a Homebuyer Matters More Today

So, if you’re looking to buy a home, take some time to consider what’s truly essential for you in your next house.

Where Will You Go If You Sell? Newly Built Homes Might Be the Answer.

New home construction is up and is becoming an increasingly significant part of the housing inventory.

Why Homeownership Wins in the Long Run

It’s important to think about the long-term benefits of homeownership when deciding whether or not to buy a home.

The True Cost of Selling Your House on Your Own

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide.