“3% mortgage rates shouldn’t deter you from your homebuying goals.”

With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since experts project rates will rise further in the coming months, that conversation isn’t going away any time soon.

But as a homebuyer, what do rates above 3% really mean?

Today’s Average Mortgage Rate Still Presents Buyers with a Great Opportunity

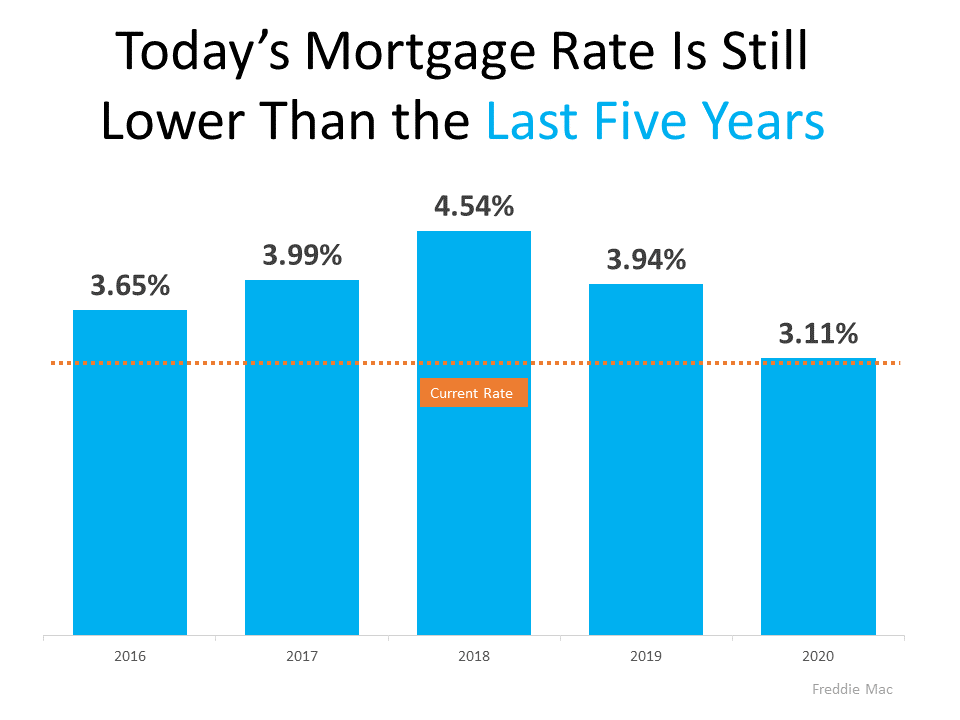

Buyers don’t want mortgage rates to rise, as any upward movement increases your monthly mortgage payment. But it’s important to put today’s average mortgage rate into perspective. The graph below shows today’s rate in comparison to average rates over the last five years: As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

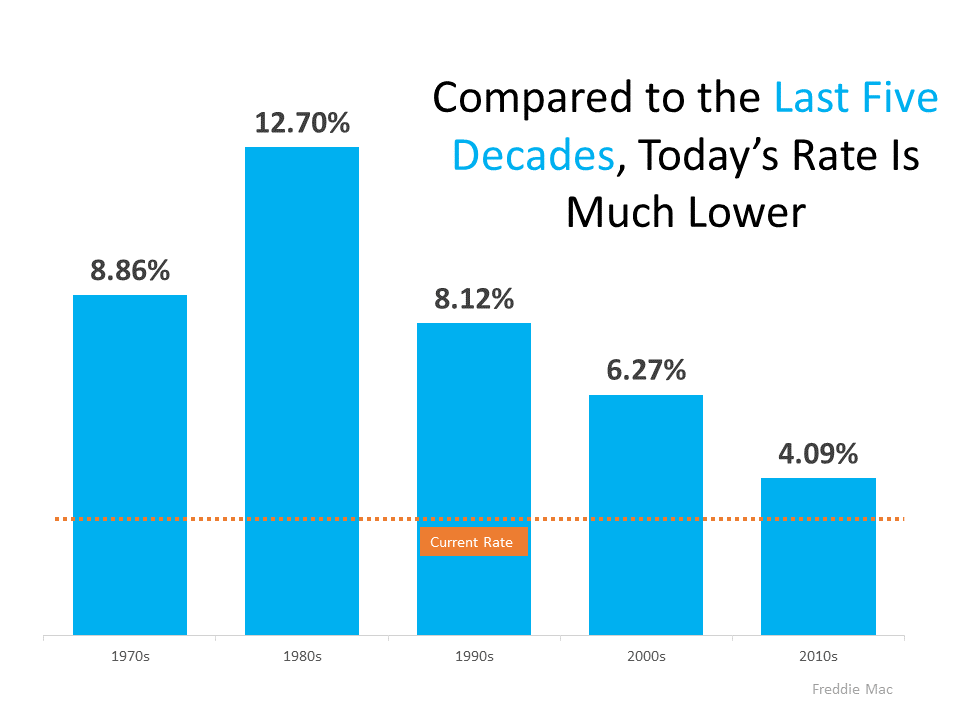

But today’s rate isn’t just low when compared to the most recent years. To truly put today into perspective, let’s look at the last 50 years (see graph below): When we look back even further, we can see that today’s rate is truly outstanding by comparison.

When we look back even further, we can see that today’s rate is truly outstanding by comparison.

What Does That Mean for You?

Being upset that you missed out on sub-3% mortgage rates is understandable. But it’s important to realize, buying now still makes sense as experts project rates will continue to rise. And as rates rise, it will cost more to purchase a home.

As Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates, all else equal, will diminish house-buying power, meaning it will cost more per month for a borrower to buy ‘their same home.’”

In other words, the longer you wait, the more it will cost you.

Bottom Line

While it’s true today’s average mortgage rate is higher than just a few months ago, 3% mortgage rates shouldn’t deter you from your homebuying goals. Historically, today’s rate is still low. And since rates are expected to continue rising, buying now could save you money in the long run. Let’s connect so you can lock in a great rate now.

To view original article, visit Keeping Current Matters.

Why It Makes Sense to Move Before Spring

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

The 3 Factors That Affect Home Affordability

When you think about affordability, the full picture includes more than just mortgage rates and prices. Wages need to be factored in too.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.

Think Twice Before Waiting for 3% Mortgage Rates

It’s important to have a realistic vision for what you can expect this year; advice of expert real estate advisors is critical.

Today’s Housing Market Is Nothing Like 15 Years Ago

In the 2nd half of 2022, there was a dramatic shift in real estate causing many people to make comparisons to the 2008 housing crisis.