“The homeownership rates among all age groups increased in the first quarter 2020.”

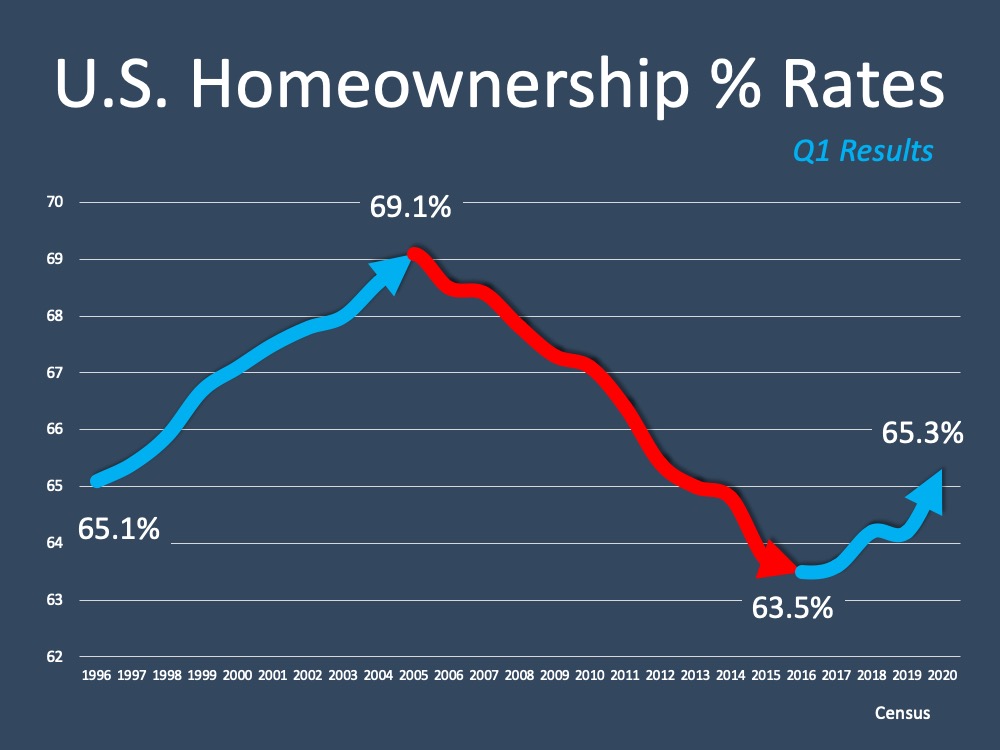

The latest results of the Housing Vacancy Survey (HVS) provided by the U.S. Census Bureau shows how Americans place immense value in homeownership, and it is continuing to grow in the United States. The results indicate that the homeownership rate increased to 65.3% for the first quarter of 2020, a number that has been rising since 2016 and is the highest we’ve seen in eight years (see graph below): Why is the rate increasing? The National Association of Home Builders (NAHB) explained:

Why is the rate increasing? The National Association of Home Builders (NAHB) explained:

“Strong owner household formation with around 2.7 million homeowners added in the first quarter has driven up the homeownership rate, especially under the decreasing mortgage interest rates and strong new home sales and existing home sales in the first two months before the COVID-19 pandemic hit the economy.”

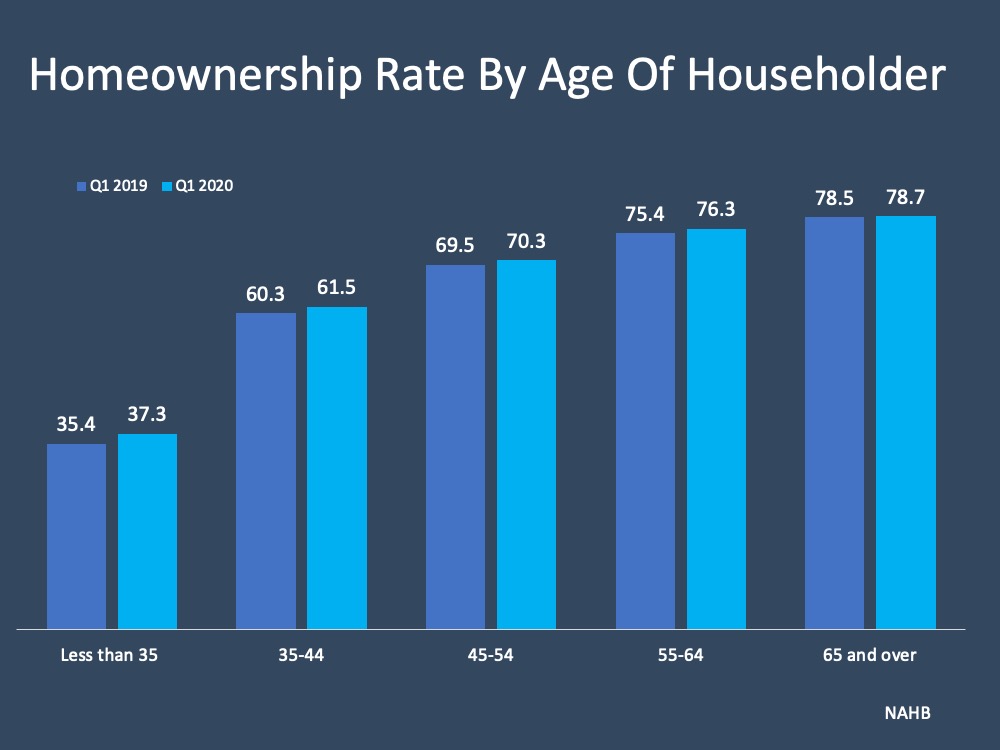

The NAHB also emphasizes the year-over-year increase in each generational group:

“The homeownership rates among all age groups increased in the first quarter 2020. Households under 35, mostly first-time homebuyers, registered the largest gains, with the homeownership rate up 1.9 percentage points from a year ago. Households ages 35-44 experienced a 1.2 percentage points gain, followed by the 55-64 age group (a 0.9 percentage point increase), the 45-54 age group (a 0.8 percentage point gain), and the 65+ group age (up by 0.2 percentage point).” (See chart below):

Homeownership is an important part of the American dream, especially in moments like this when many are feeling incredibly grateful for the home they have to shelter in place with their families. COVID-19 may be slowing our lives down, but it is showing us the emotional value of homeownership too.

Homeownership is an important part of the American dream, especially in moments like this when many are feeling incredibly grateful for the home they have to shelter in place with their families. COVID-19 may be slowing our lives down, but it is showing us the emotional value of homeownership too.

Bottom Line

If you’re considering buying a home this year, let’s connect to set a plan that will help you get one step closer to achieving your dream.

To view original article, visit Keeping Current Matters.

Are There More Homes Coming to the Market?

Recent data shows more sellers are listing their houses this season, which may give you more options for your home search.

Will Home Prices Fall This Year? Here’s What Experts Say.

Experts say the housing market isn’t set up for a price decline due to that ongoing imbalance between supply and demand.

How Today’s Mortgage Rates Impact Your Home Purchase

If you’re planning to buy a home, it’s critical to understand the relationship between mortgage rates and your purchasing power.

Three Tips for First-Time Homebuyers

No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional.

Things That Could Help You Win a Bidding War on a Home

Bidding wars are common today with so many buyers looking to make a purchase before mortgage rates rise further.

Today’s Home Price Appreciation Is Great News for Existing Homeowners

Because it will take some time for housing supply to increase, experts believe prices will continue rising.