“The current situation makes it extremely difficult to project the future of the economy. “

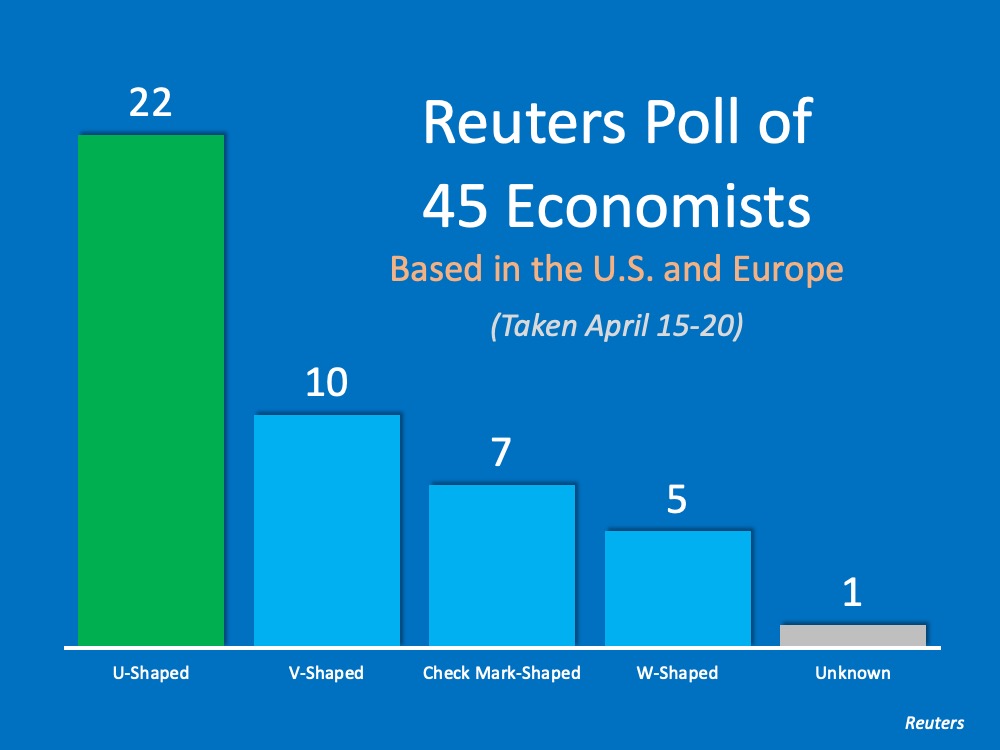

In addition, we noted how there are some in the business community who believe we may instead be headed for a U-shaped recovery, where the return to previous levels of economic success won’t occur until the middle of next year. Yesterday, Reuters released a poll of U.S. and European economists which revealed that most surveyed are now leaning more toward a U-shaped recovery.

Here are the results of that poll:

Why the disparity in thinking among different groups of economic experts?

The current situation makes it extremely difficult to project the future of the economy. Analysts normally look at economic data and compare it to previous slowdowns to create their projections. This situation, however, is anything but normal.

Today, analysts must incorporate data from three different sciences into their recovery equation:

1. Business Science – How has the economy rebounded from similar slowdowns in the past?

2. Health Science – When will COVID-19 be under control? Will there be another flareup of the virus this fall?

3. Social Science – After businesses are fully operational, how long will it take American consumers to return to normal consumption patterns? (Ex: going to the movies, attending a sporting event, or flying).

The challenge of accurately combining the three sciences into a single projection has created uncertainty, and it has led to a wide range of opinions on the timing of the recovery.

Bottom Line

Right now, the vast majority of economists and analysts believe a full recovery will take anywhere from 6-18 months. No one truly knows the exact timetable, but it will be coming.

To view original article, visit Keeping Current Matters.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.

The Best Week To List Your House Is Almost Here

The third week of April brings the best combination of housing market factors for sellers.