“The typical gain in the sale of the home (equity) has increased significantly over the last five years.”

Every year, households across the country make the decision to rent for another year or take the leap into homeownership. They look at their earnings and savings and then decide what makes the most financial sense. That equation will most likely take into consideration monthly housing costs, tax advantages, and other incremental expenses. Using these measurements, recent studies show that it’s still more affordable to own than rent in most of the country.

There is, however, another financial advantage to owning a home that’s often forgotten in the analysis – the wealth built through equity when you own a home.

Odeta Kushi, Deputy Chief Economist for First American, discusses this point in a recent blog post. She explains:

“Once you include the equity benefit of price appreciation, owning made more financial sense than renting in 48 out of the 50 top markets, with the only exceptions being San Francisco and San Jose, Calif.”

What has this equity piece meant to homeowners in the past?

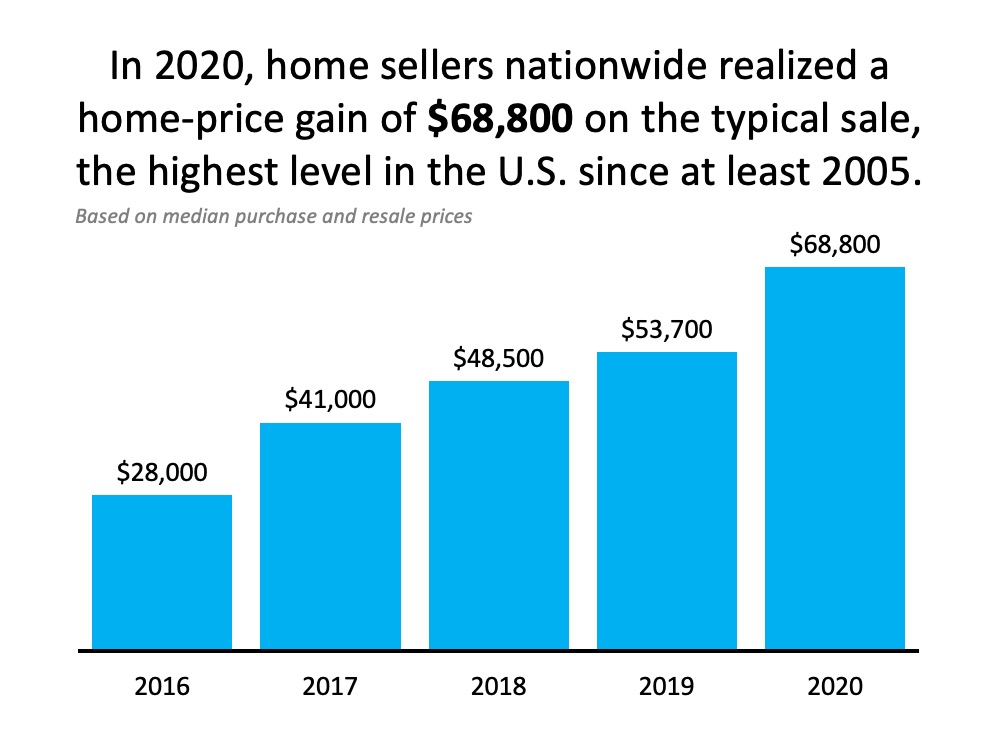

ATTOM Data Solutions, the curator of one of the nation’s premier property databases, just analyzed the typical home-price gain owners nationwide enjoyed when they sold their homes. Here’s a breakdown of their findings: The typical gain in the sale of the home (equity) has increased significantly over the last five years.

The typical gain in the sale of the home (equity) has increased significantly over the last five years.

CoreLogic, another property data curator, also weighed in on the subject. According to their latest Homeowner Equity Insights Report, the average homeowner gained $17,000 in equity in just the last year alone.

What does the future look like for homeowners when it comes to equity?

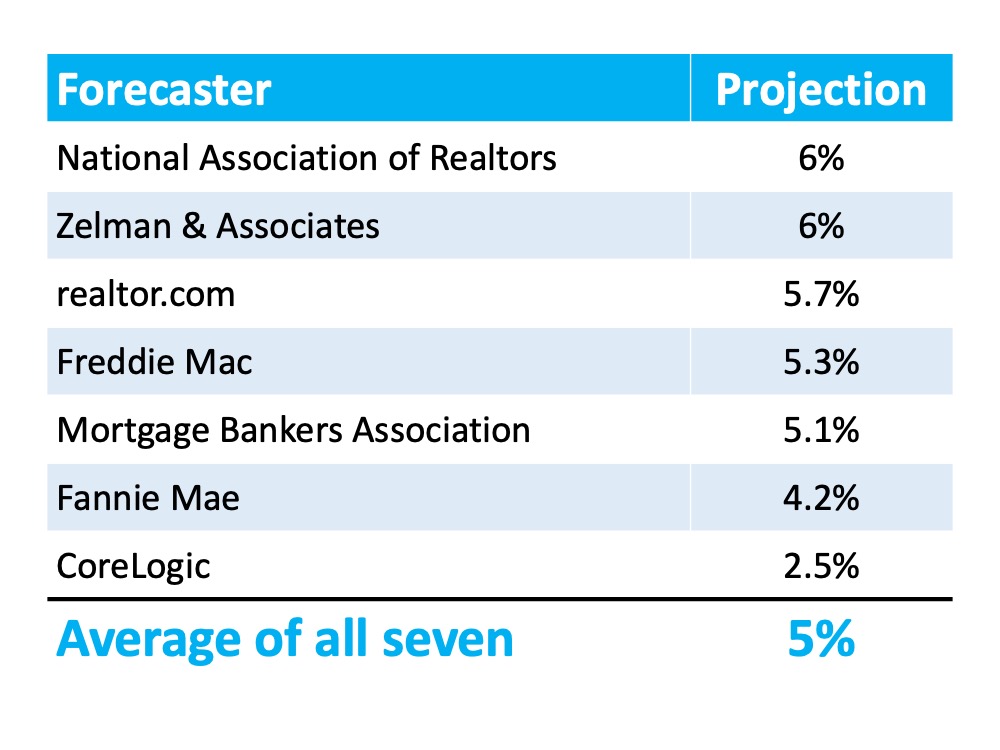

Here are the seven major home price appreciation forecasts for 2021: The National Association of Realtors (NAR) just reported that today, the median-priced home in the country sells for $309,800. If homes appreciate by 5% this year (the average of the forecasts), the homeowner will increase their wealth by $15,490 in 2021 through increased equity.

The National Association of Realtors (NAR) just reported that today, the median-priced home in the country sells for $309,800. If homes appreciate by 5% this year (the average of the forecasts), the homeowner will increase their wealth by $15,490 in 2021 through increased equity.

Bottom Line

As you make your plans for the coming year, be sure to consider the equity benefits of home price appreciation as you weigh the financial advantages of buying over renting. When you do, you may find this is the perfect time to jump into homeownership.

To view original article, visit Keeping Current Matters.

The Best Time to Buy a Home This Year

Mortgage rates just hit their lowest point in 19 months, and that goes a long way to help with your purchasing power and affordability. Are you ready to buy?

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

While home affordability is finally starting to show signs of improving, it’s still tight. Your lender can help you.

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it’s important to know what experts are projecting for the housing market.

Could a 55+ Community Be Right for You?

the number of listings tailored for homebuyers in this age group has increased by over 50% compared to last year.

Are We Heading into a Balanced Market?

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights.

What’s the Impact of Presidential Elections on the Housing Market?

Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.