“The typical gain in the sale of the home (equity) has increased significantly over the last five years.”

Every year, households across the country make the decision to rent for another year or take the leap into homeownership. They look at their earnings and savings and then decide what makes the most financial sense. That equation will most likely take into consideration monthly housing costs, tax advantages, and other incremental expenses. Using these measurements, recent studies show that it’s still more affordable to own than rent in most of the country.

There is, however, another financial advantage to owning a home that’s often forgotten in the analysis – the wealth built through equity when you own a home.

Odeta Kushi, Deputy Chief Economist for First American, discusses this point in a recent blog post. She explains:

“Once you include the equity benefit of price appreciation, owning made more financial sense than renting in 48 out of the 50 top markets, with the only exceptions being San Francisco and San Jose, Calif.”

What has this equity piece meant to homeowners in the past?

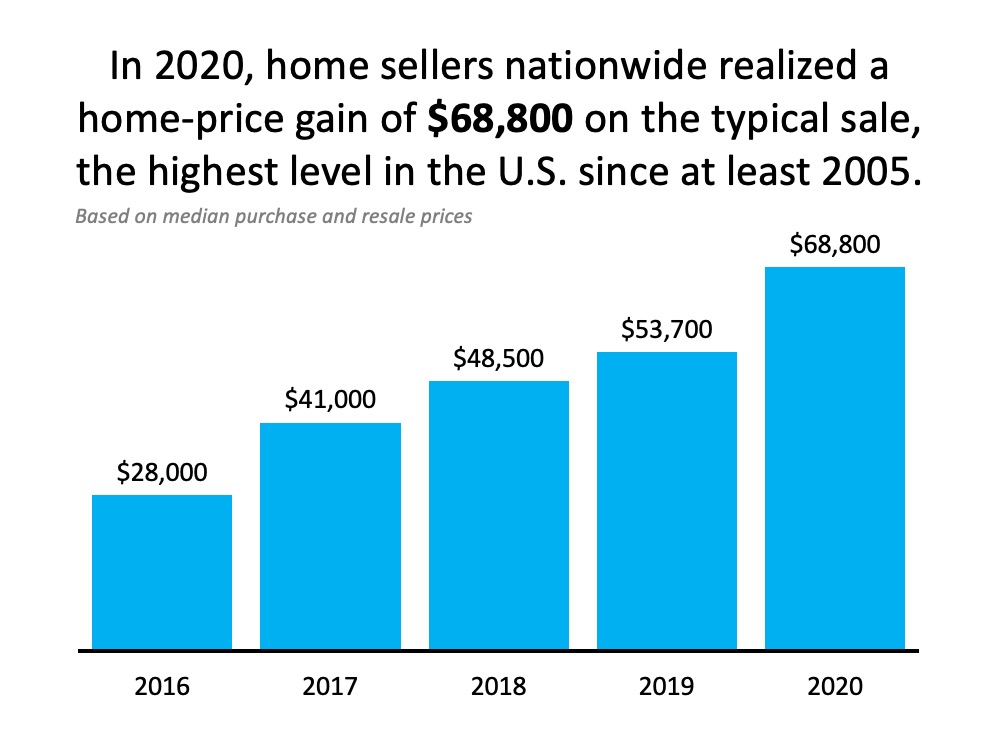

ATTOM Data Solutions, the curator of one of the nation’s premier property databases, just analyzed the typical home-price gain owners nationwide enjoyed when they sold their homes. Here’s a breakdown of their findings: The typical gain in the sale of the home (equity) has increased significantly over the last five years.

The typical gain in the sale of the home (equity) has increased significantly over the last five years.

CoreLogic, another property data curator, also weighed in on the subject. According to their latest Homeowner Equity Insights Report, the average homeowner gained $17,000 in equity in just the last year alone.

What does the future look like for homeowners when it comes to equity?

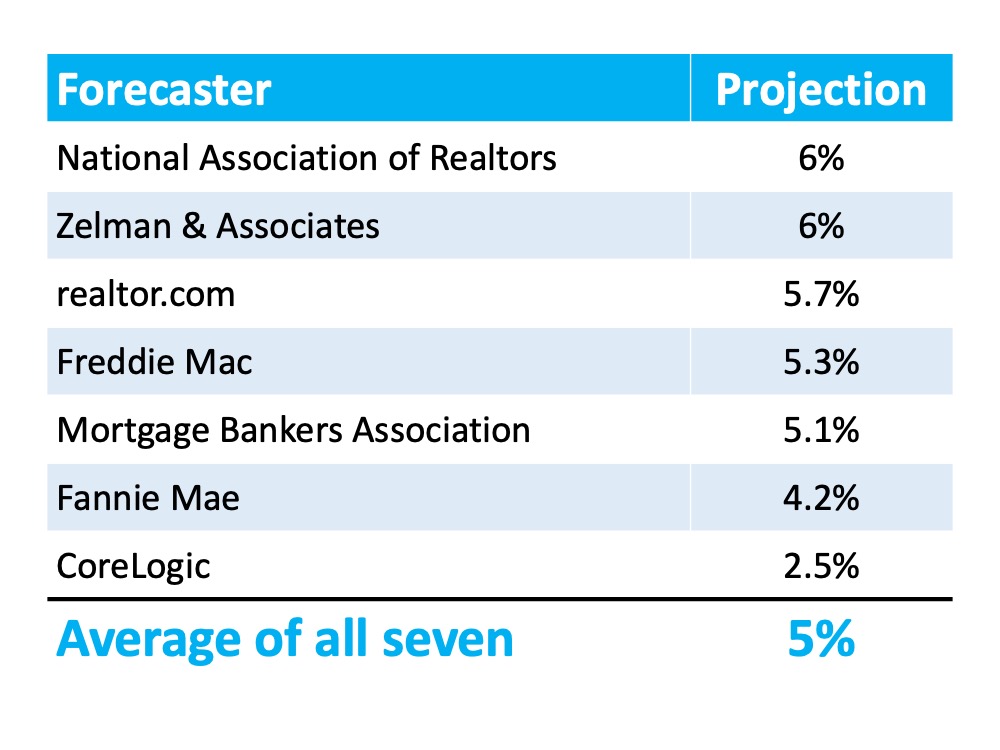

Here are the seven major home price appreciation forecasts for 2021: The National Association of Realtors (NAR) just reported that today, the median-priced home in the country sells for $309,800. If homes appreciate by 5% this year (the average of the forecasts), the homeowner will increase their wealth by $15,490 in 2021 through increased equity.

The National Association of Realtors (NAR) just reported that today, the median-priced home in the country sells for $309,800. If homes appreciate by 5% this year (the average of the forecasts), the homeowner will increase their wealth by $15,490 in 2021 through increased equity.

Bottom Line

As you make your plans for the coming year, be sure to consider the equity benefits of home price appreciation as you weigh the financial advantages of buying over renting. When you do, you may find this is the perfect time to jump into homeownership.

To view original article, visit Keeping Current Matters.

2021 Housing Forecast – Infographic

With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.

Homeowner Equity Increases an Astonishing $1 Trillion

Over the past year, strong home price growth has created a record level of home equity for homeowners.

The Holidays Aren’t Stopping Homebuyers This Year

There are first-time, move-up, and move-down buyers actively looking for the home of their dreams this winter.

5 Steps to Follow When Applying for Forbearance

Help is out there for homeowners in need, but it’s important to apply now while this benefit is still available.

Winning as a Buyer in a Sellers’ Market

Buying a home in today’s sellers’ market doesn’t have to feel like an uphill battle. Make your life easier by working with one of our trusted agents!

Why It Makes Sense to Sell Your House This Holiday Season

The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house.