“Homes priced right are still selling in today’s market.”

Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you’re thinking of selling your house soon, that means you’ll want to adjust your expectations accordingly. As realtor.com explains:

“. . . some of the more prominent pandemic trends have changed, so sellers might wish to adjust accordingly to get the best deal possible.”

In a more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell. And the reality is, homes priced right are still selling in today’s market.

Why Pricing Your House Appropriately Matters

Especially today, your asking price sends a message to potential buyers.

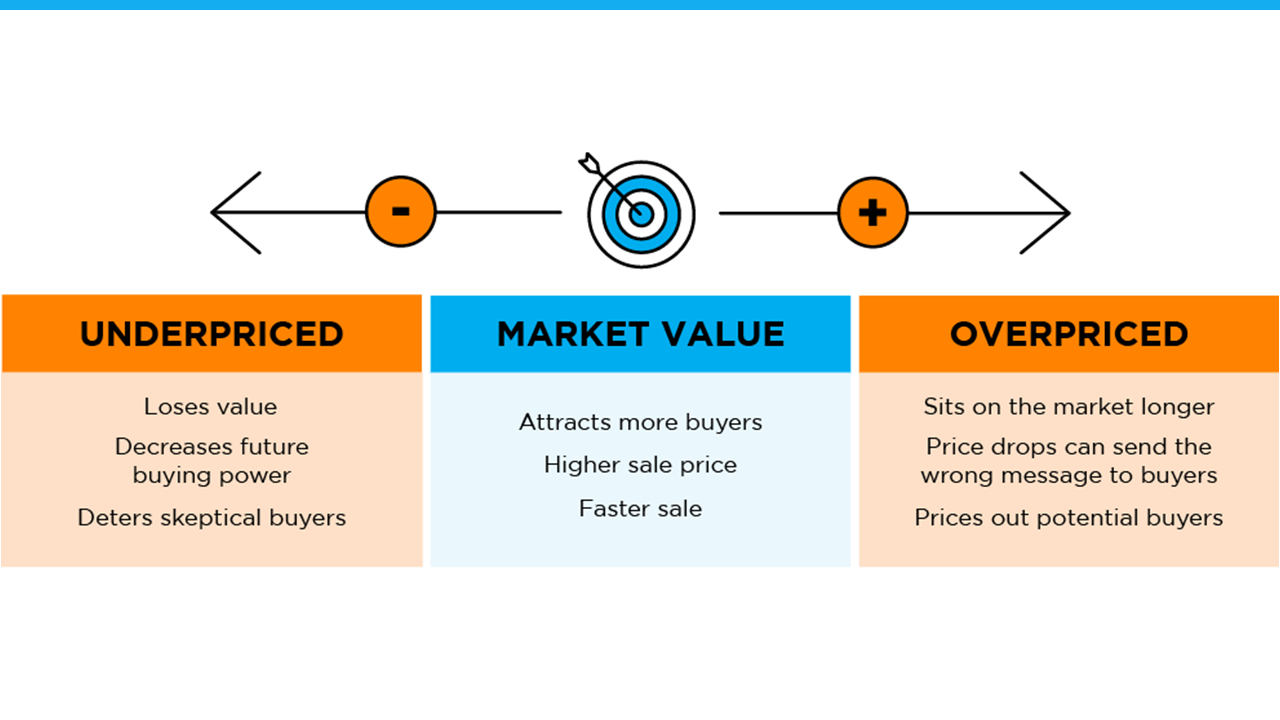

If it’s priced too low, you may leave money on the table or discourage buyers who may see a lower-than-expected price tag and wonder if that means something is wrong with the home.

If it’s priced too high, you run the risk of deterring buyers. When that happens, you may have to lower the price to try to reignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag by some buyers who will wonder what that means about the home.

To avoid either headache, price it right from the start. A real estate professional knows how to determine that ideal asking price. They balance the value of homes in your neighborhood, current market trends, buyer demand, the condition of your house, and more to find the right price. This helps lead to stronger offers and a greater likelihood your house will sell quickly.

The visual below helps summarize the impact your asking price can have:

Bottom Line

Homes that are priced at current market value are still selling. To make sure you price your house appropriately, maximize your sales potential, and minimize your hassle, let’s connect.

To view original article, visit Keeping Current Matters.

One Homebuying Step You Don’t Want To Skip: Pre-Approval

A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

The Truth About Credit Scores and Buying a Home

You don’t need perfect credit to buy a home, but your score can have an impact on your loan options and the terms you’re able to get.

What To Save for When Buying a Home

Planning ahead and understanding the costs you may encounter upfront can make buying a home less intimidating and allow you to take control of the process.

Expert Forecasts for the 2025 Housing Market

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends.

Time in the Market Beats Timing the Market

If you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it.

New Year, New Home: How to Make It Happen in 2025

Buying or selling is a big milestone and a great goal for this year. With the right expert, you’ll feel confident and ready to take on the market.