“What’s really happening with home prices?”

If you’re trying to decide whether or not to sell your house, recent headlines about home prices may be top of mind. And if those stories have you wondering what that means for your home’s value, here’s what you really need to know.

What’s Really Happening with Home Prices?

It’s possible you’ve seen news stories mentioning a drop in home values or home price depreciation, but it’s important to remember those headlines are designed to make a big impression in just a few words. But what headlines aren’t always great at is painting the full picture.

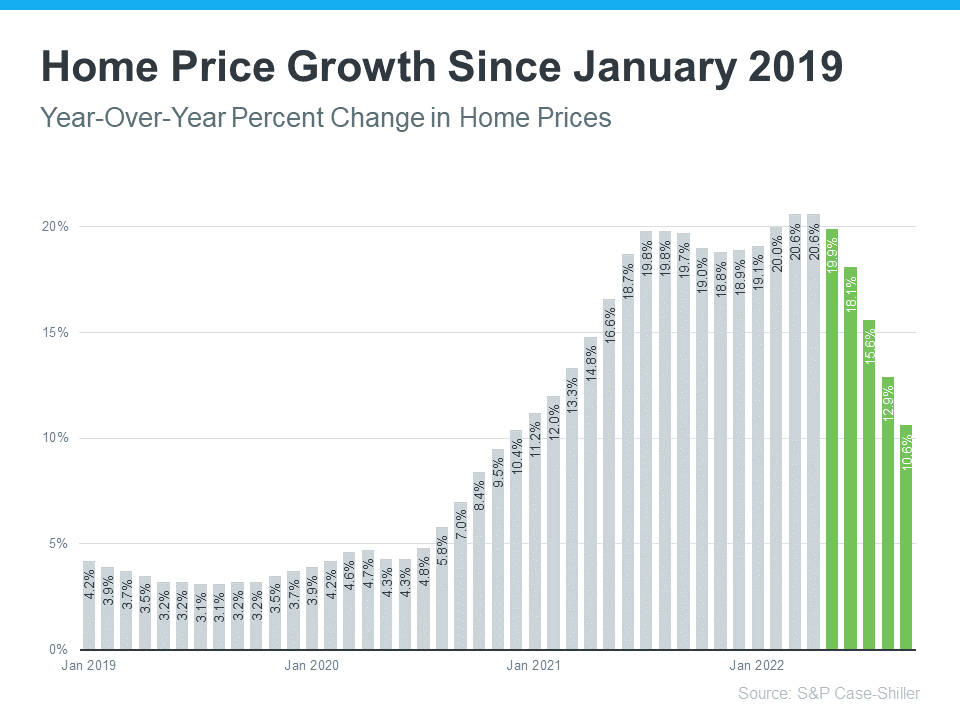

While home prices are down slightly month-over-month in some markets, it’s also true that home values are up nationally on a year-over-year basis. The graph below uses the latest data from S&P Case-Shiller to help tell the story of what’s actually happening in the housing market today:

As the graph shows, it’s true home price growth has moderated in recent months (shown in green) as buyer demand has pulled back in response to higher mortgage rates. This is what the headlines are drawing attention to today.

But what’s important to notice is the bigger, longer-term picture. While home price growth is moderating month-over-month, the percent of appreciation year-over-year is still well above the home price change we saw during more normal years in the market.

The bars for January 2019 through mid-2020 show home price appreciation around 3-4% a year was more typical (see bars for January 2019 through mid-2020). But even the latest data for this year shows prices have still climbed by roughly 10% over last year.

What Does This Mean for Your Home’s Equity?

While you may not be able to capitalize on the 20% appreciation we saw in early 2022, in most markets your home’s value, on average, is up 10% over last year – and a 10% gain is still dramatic compared to a more normal level of appreciation (3-4%).

The big takeaway? Don’t let the headlines get in the way of your plans to sell. Over the past two years alone, you’ve likely gained a substantial amount of equity in your home as home prices climbed. Even though home price moderation will vary by market moving forward, you can still use the boost your equity got to help power your move.

As Mark Fleming, Chief Economist at First American, says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

Bottom Line

If you have questions about home prices or how much equity you have in your current home, let’s connect so you have an expert’s advice.

To view original article, visit Keeping Current Matters.

3 Graphs To Show This Isn’t a Housing Bubble

It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. Today’s market is nothing like that.

Why Are People Moving Today?

While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors.

A Window of Opportunity for Homebuyers

The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic.

What’s Causing Ongoing Home Price Appreciation?

Experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand.

Think Home Prices Are Going To Fall? Think Again

If you’re planning to buy a home, you shouldn’t wait for home prices to drop to make your purchase.

Why Pre-Approval Is a Game Changer for Homebuyers

Pre-approval from a lender helps you understand your true price range and how much money you can borrow for your loan.