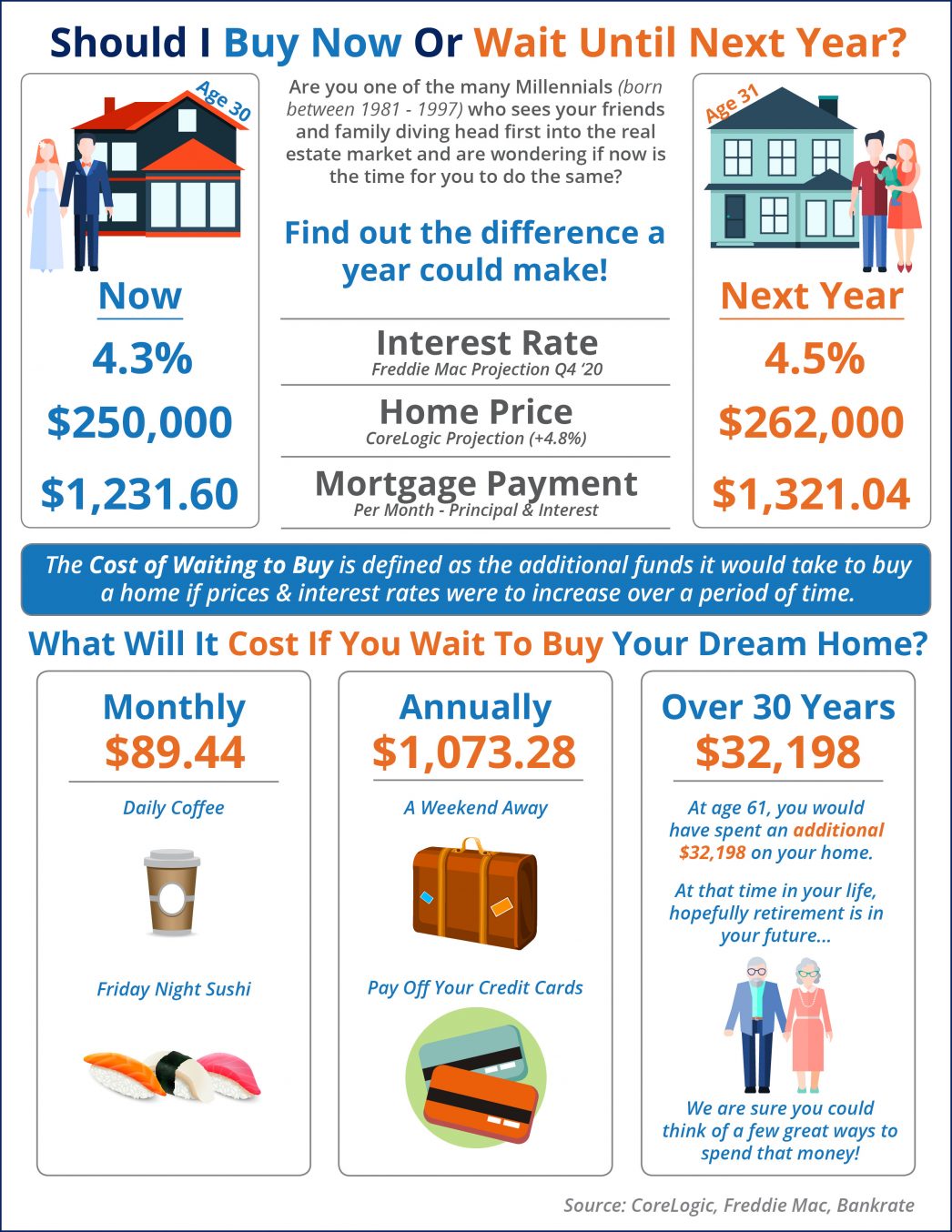

“What will it cost if you wait to buy your dream house?”

Some Highlights:

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

One Homebuying Step You Don’t Want To Skip: Pre-Approval

A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

The Truth About Credit Scores and Buying a Home

You don’t need perfect credit to buy a home, but your score can have an impact on your loan options and the terms you’re able to get.

What To Save for When Buying a Home

Planning ahead and understanding the costs you may encounter upfront can make buying a home less intimidating and allow you to take control of the process.

Expert Forecasts for the 2025 Housing Market

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends.

Time in the Market Beats Timing the Market

If you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it.

New Year, New Home: How to Make It Happen in 2025

Buying or selling is a big milestone and a great goal for this year. With the right expert, you’ll feel confident and ready to take on the market.