“What will it cost if you wait to buy your dream house?”

Some Highlights:

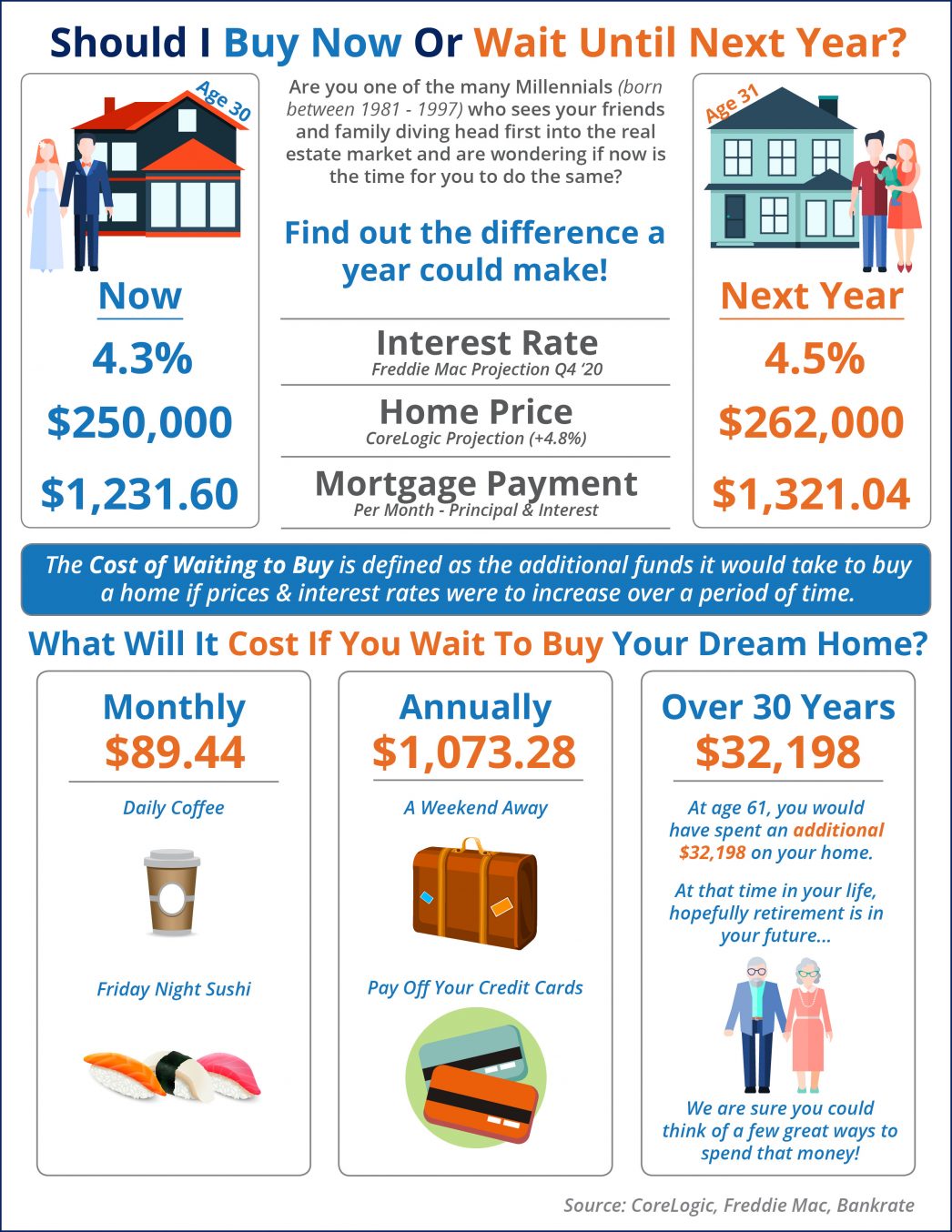

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

Why There Won’t Be a Recession That Tanks the Housing Market

The fundamentals of the economy, despite some hiccups, are doing pretty good.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.

Why You Want an Agent’s Advice for Your Move

A real estate advisor can anticipate what could happen next and work with you to put together a solid plan.

Why Today’s Housing Supply Is a Sweet Spot for Sellers

The number of homes for sale and new listing activity continues to improve compared to last year.

The Truth About Down Payments

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

Expert Home Price Forecasts for 2024 Revised Up

Now that rates have come down from their peak, and with further declines expected this year, buyer demand has picked up.