“What will it cost if you wait to buy your dream house?”

Some Highlights:

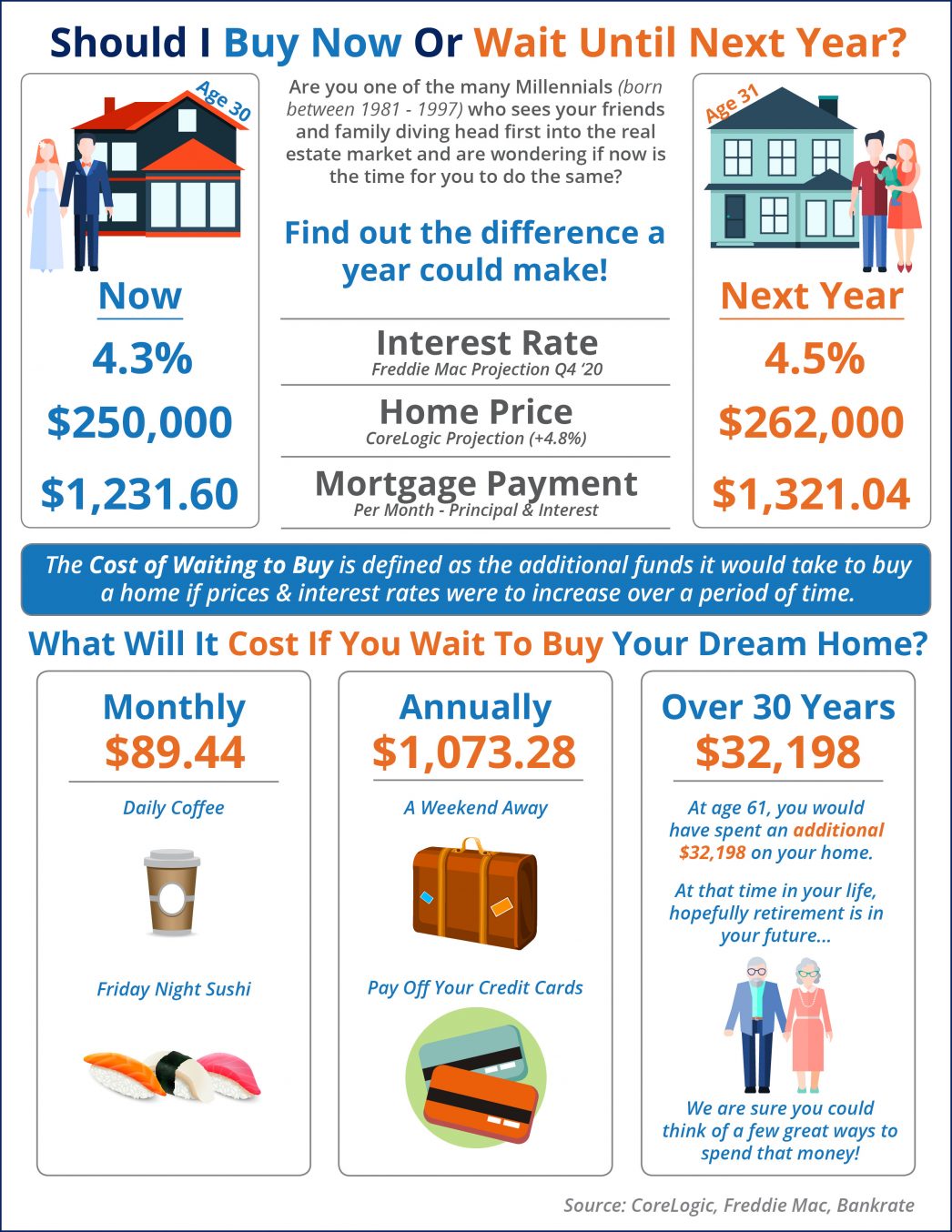

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Ever wonder why they change?

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.