“What will it cost if you wait to buy your dream house?”

Some Highlights:

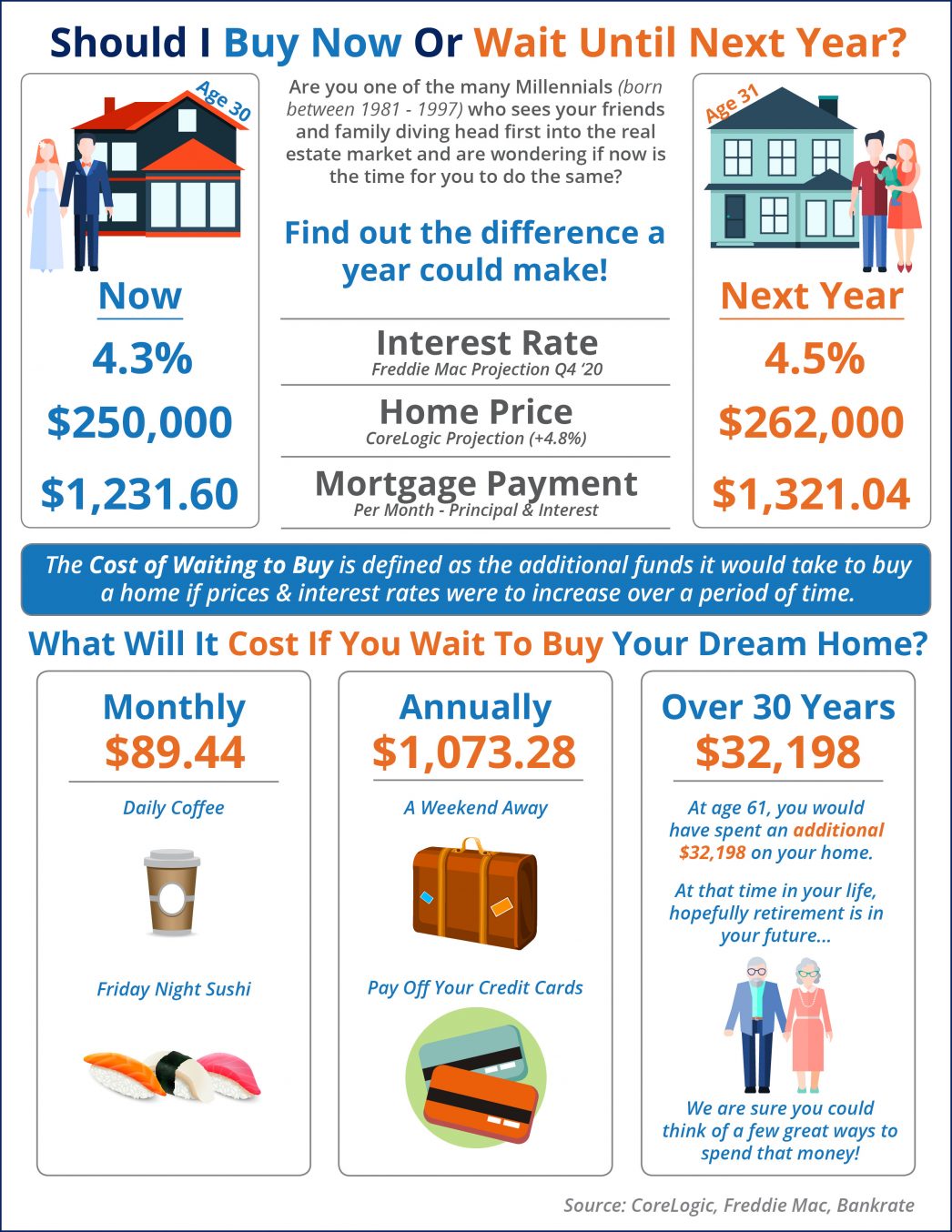

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

Are You a Homebuyer Worried About Climate Risks?

Homebuyers are interested in finding out if the house they want will be exposed to things like floods, extreme heat, and wildfires.

Home Prices Are Not Falling

Don’t fall for the negative headlines and become part of this statistic. Remember, data from a number of sources shows home prices aren’t falling anymore.

Unpacking the Long-Term Benefits of Homeownership

Higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if you should buy a home right now.

Why Your House Didn’t Sell

For insight on why your home didn’t sell, rely on a trusted real estate agent. A great agent will offer expert advice on relisting your house with effective strategies to get it sold.

The Return of Normal Seasonality for Home Price Appreciation

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear.

Beginning with Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.