“What will it cost if you wait to buy your dream house?”

Some Highlights:

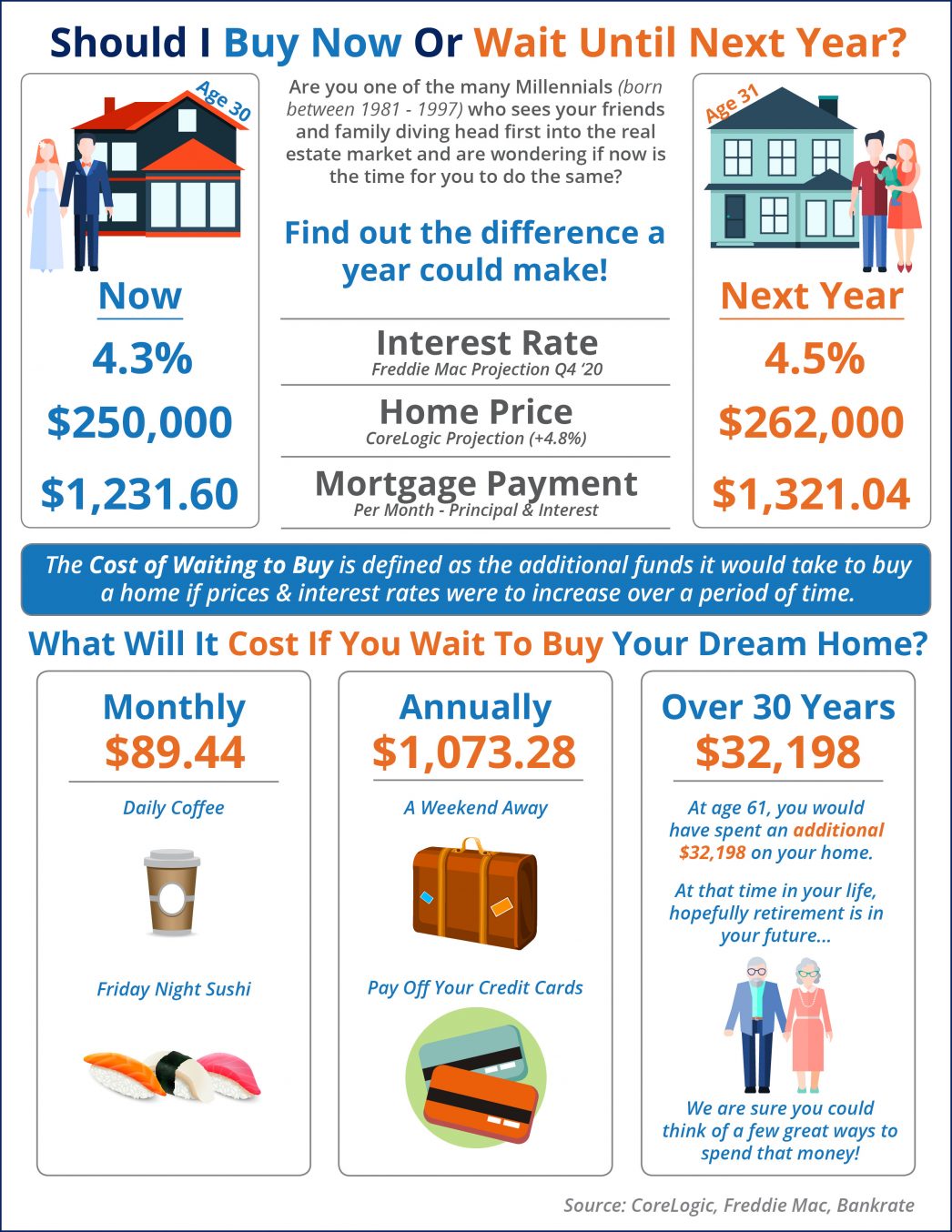

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

Beginning with Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.

Your Home Equity Can Offset Affordability Challenges

Some homeowners are reluctant to sell and take on a higher mortgage rate on their next home, but what about home equity?

Are More Homes Coming onto the Market?

If you’ve been putting off selling your house, now may be the sweet spot to make your move. The longer you wait, the more competition you’ll have.

Why Is Housing Inventory So Low?

The shortage of inventory isn’t just a today problem. It’s been a challenge for years. Let’s take a look what contributed this limited supply

What Experts Project for Home Prices Over the Next 5 Years

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth.

Planning to Retire? Your Equity Can Help You Make a Move

Whether you’re looking to downsize, relocate to a dream destination, or move closer to friends or loved ones, equity in your home may help.