“What will it cost if you wait to buy your dream house?”

Some Highlights:

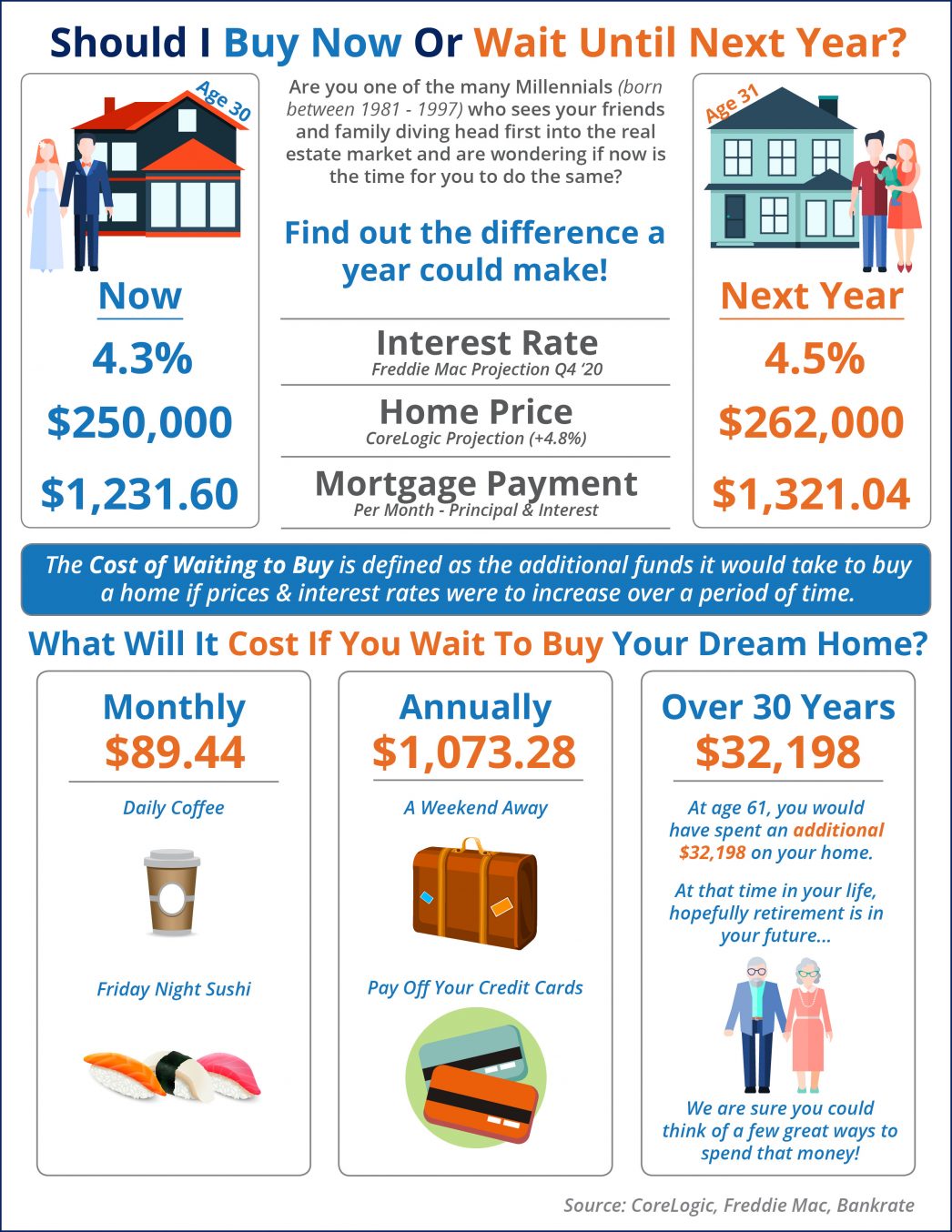

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

Expert Home Price Forecasts Revised Up for 2023

As activity slows again at the end of the year, home price growth will slow too. This doesn’t mean prices are falling.

Buyer Traffic Is Still Stronger than the Norm

Buyers will always need to buy, and those who can afford to move at today’s rates are going to do so.

Why You May Still Want To Sell Your House After All

If you need to sell now because something in your own life has changed, don’t let mortgage rates hold you back from what you want.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.