“What will it cost if you wait to buy your dream house?”

Some Highlights:

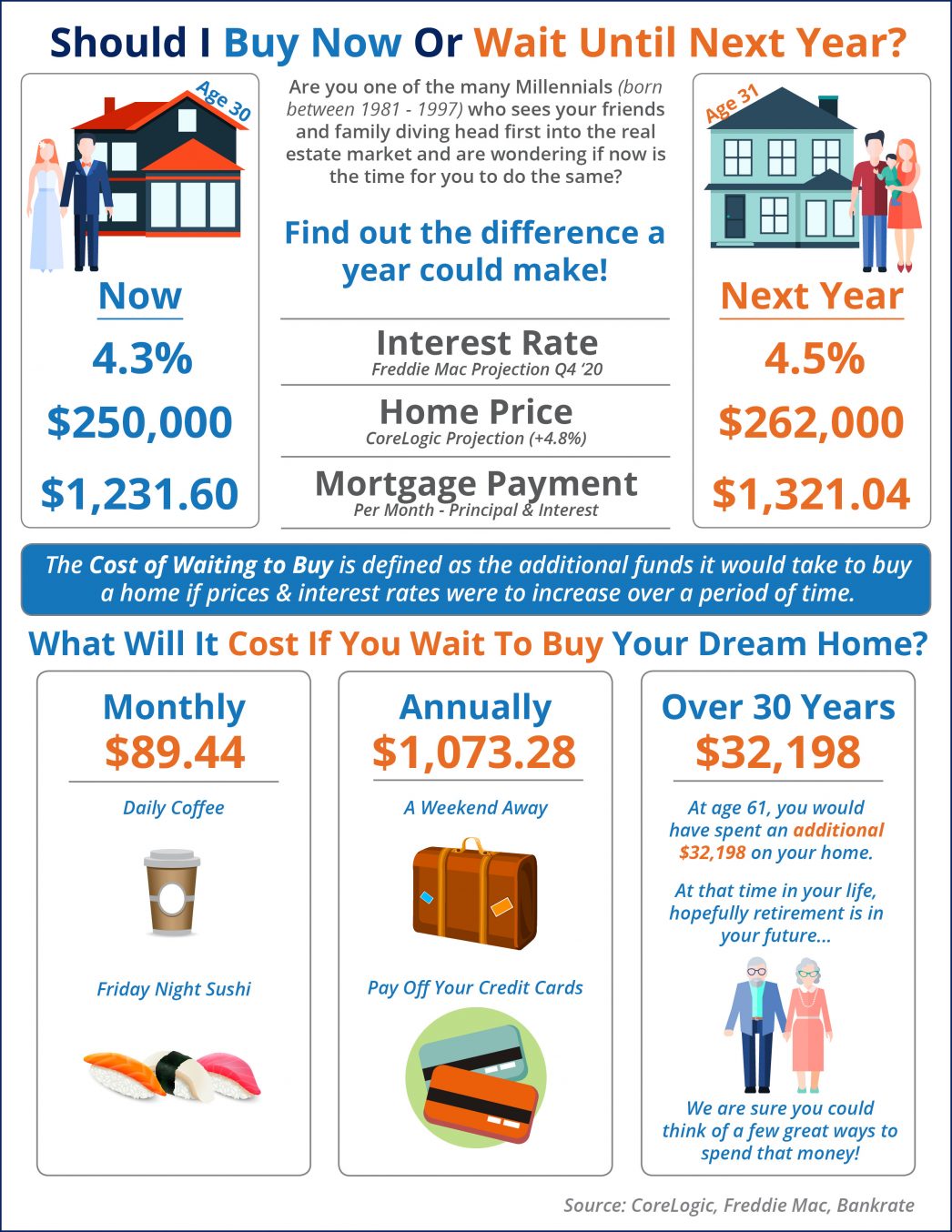

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

Pricing Your House Right Still Matters Today

Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it.

Homebuyers Are Still More Active Than Usual

Buyer demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.

Don’t Fall for the Next Shocking Headlines About Home Prices

In the coming months, you’re going to see even more headlines that either get what’s happening with home prices wrong or are misleading.

Foreclosure Numbers Today Aren’t Like 2008

Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

Explaining Today’s Mortgage Rates

Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve are all influencing mortgage rates today.

Homebuyers Are Getting Used to the New Normal

One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal.