“What will it cost if you wait to buy your dream house?”

Some Highlights:

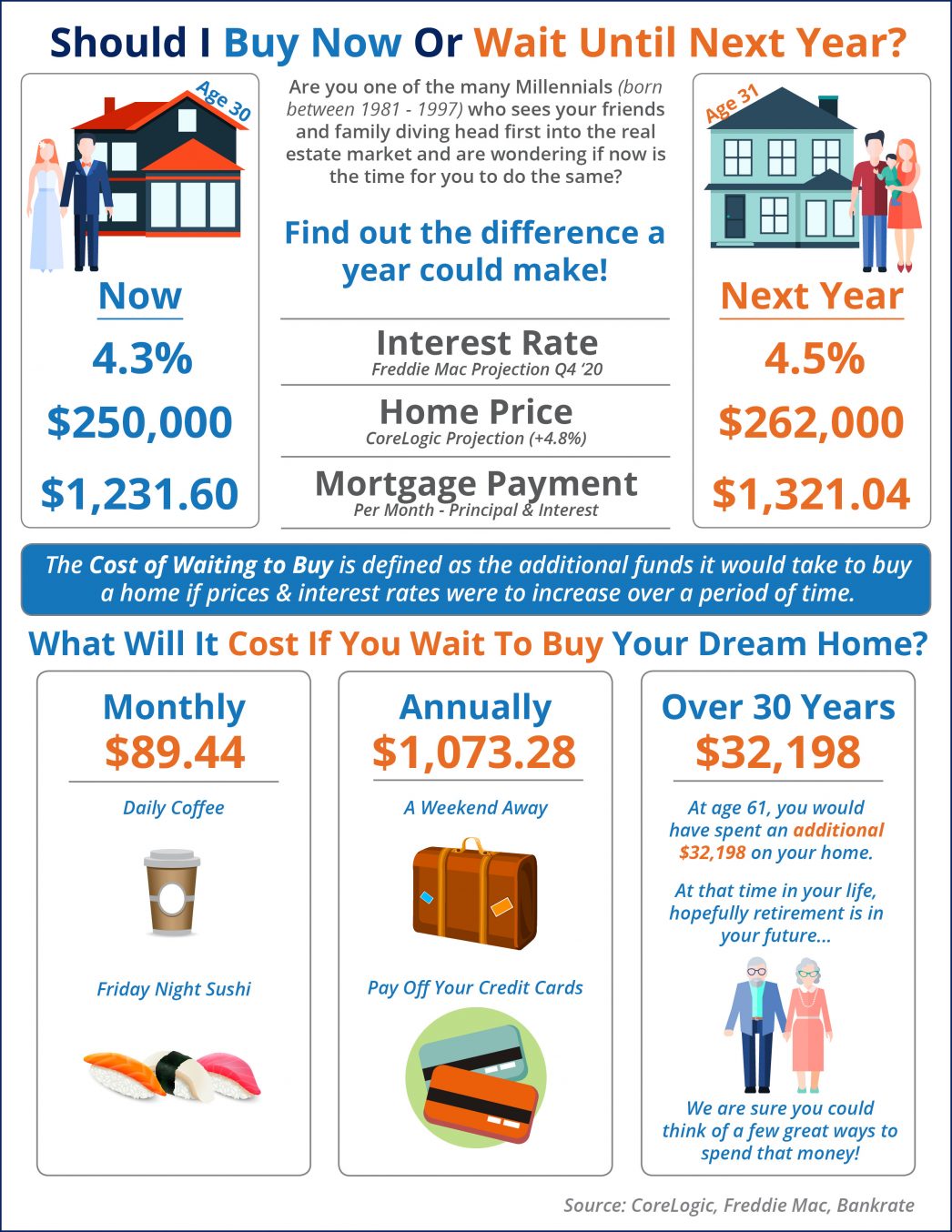

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates to rise to 4.5% by the Q4 2020.

- CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Bottom Line

The ‘cost of waiting to buy’ is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

To view original article, visit Keeping Current Matters.

Are We Heading into a Balanced Market?

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights.

What’s the Impact of Presidential Elections on the Housing Market?

Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.

What Mortgage Rate Are You Waiting For?

If you’ve been holding out and waiting for rates to come down, know that it’s already happening.

Today’s Biggest Housing Market Myths

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts and sort out the misconceptions.

How To Choose a Great Local Real Estate Agent

The right agent should be someone you trust to guide you through one of the most significant transactions of your life.

How Mortgage Rate Changes Impact Your Homebuying Power

Real estate agents have the expertise to help you understand what’s happening and what it means for you.