“Remarkably, the residential real estate market (including existing homes and new construction) has flourished over the last twelve months.”

Last year started off with a bang. Unemployment was under 4%, forecasters were giddy with their projections for the economy, and the residential housing market had the strongest January and February activity in over a decade.

Then came the announcement on March 11, 2020, from the World Health Organization declaring COVID-19 a worldwide pandemic. Two days later, the White House declared it a national emergency. Businesses and schools were forced to close, shelter-in-place mandates were enacted, and the economy came to a screeching halt. As a result, unemployment in this country skyrocketed to 14.9%.

A year later, the economy is recovering, and the U.S. has regained more than half of the jobs that were originally lost. However, some businesses are still closed, and many schools are still struggling to reopen. Despite the past and current challenges, there is one industry that’s proven to be a tailwind helping to counter all of these headwinds to our economy. That industry is housing. Remarkably, the residential real estate market (including existing homes and new construction) has flourished over the last twelve months. Sales are up, prices are appreciating, and more new homes are being built. The housing market has been a pillar of strength in an otherwise slowly recovering economy.

How does the real estate market help the economy?

At the beginning of the pandemic, the National Association of Realtors (NAR) released a report that explained:

“Real estate has been, and remains, the foundation of wealth building for the middle class and a critical link in the flow of goods, services, and income for millions of Americans. Accounting for nearly 18% of the GDP, real estate is clearly a major driver of the U.S. economy.”

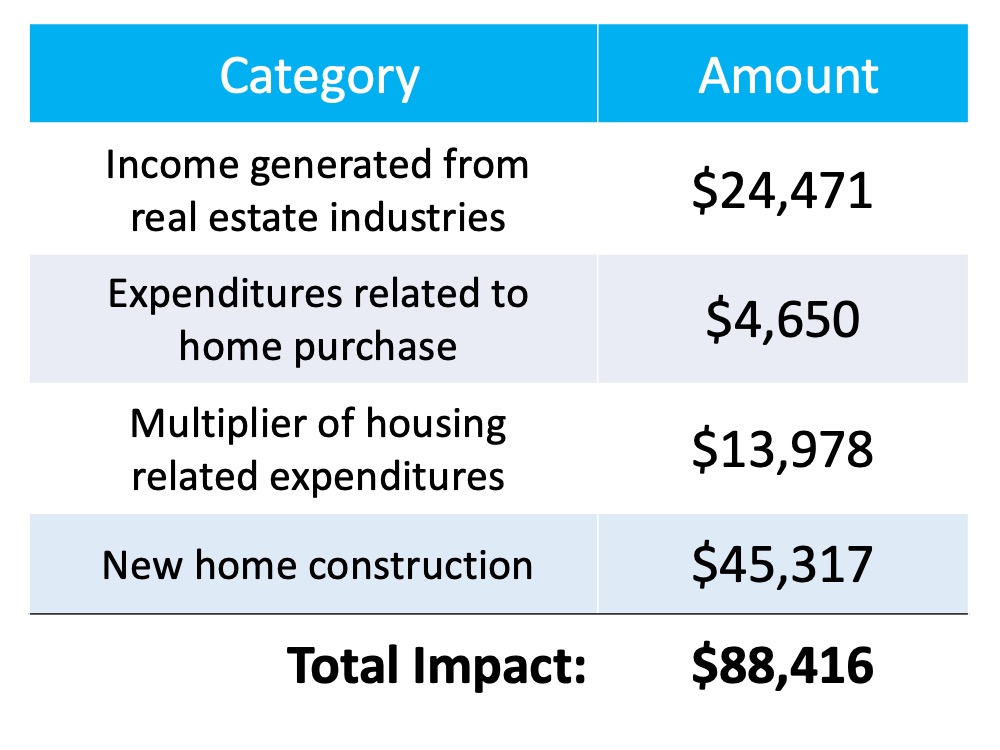

The report calculated the total economic impact of real estate-related industries on the economy as well as the expenditures that resulted from a single home sale. At a national level, their research revealed that a single newly constructed home had an economic impact of $88,416.

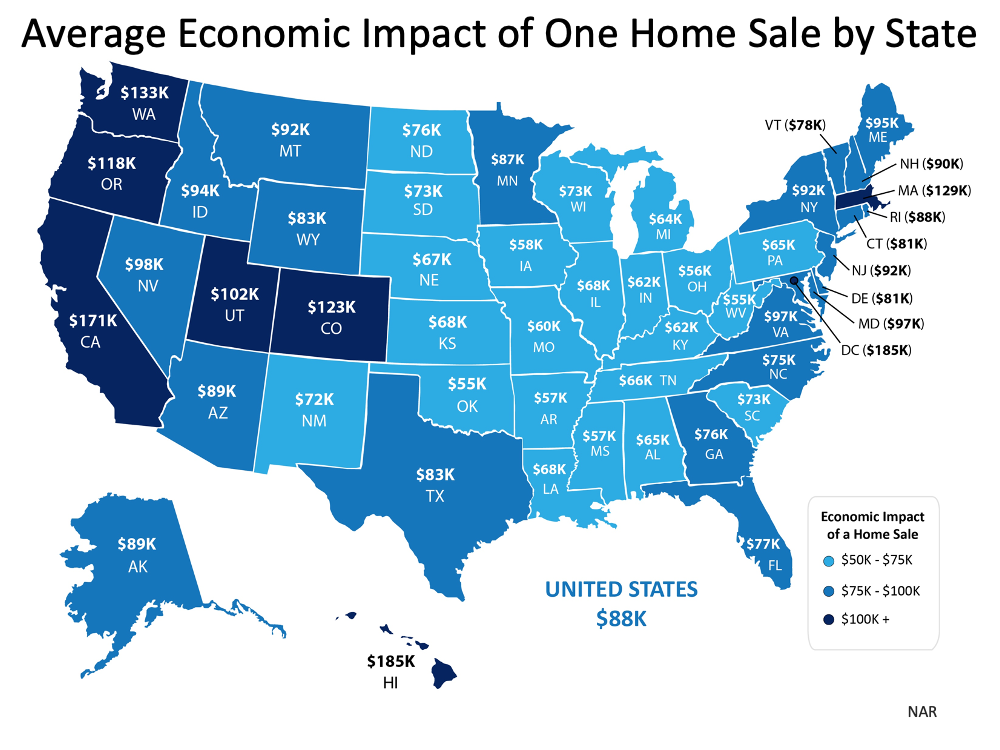

Here’s how it breaks down: The map below shows the impact by state:

The map below shows the impact by state: The impact of an existing home sale is approximately $40,000.

The impact of an existing home sale is approximately $40,000.

Real estate has done more for our economic wellbeing than virtually any other industry over the last year. It’s been a beacon of light during a very challenging time in our nation’s history.

Bottom Line

Whether you’re buying a newly constructed home or one that already exists, you’re making a positive economic impact in your local community – and it’s a step toward your homeownership goals as well.

To view original article, visit Keeping Current Matters.

The Truth About Negative Home Equity Headlines

News headlines focus on short-term equity numbers and fail to convey the long-term view.

What Experts Are Saying About the 2023 Housing Market

2023 likely will become a year of long-lost normalcy returning to the market with mortgage rates stabilizing.

3 Best Practices for Selling Your House This Year

A real estate professional can help you with tips to get your house ready to sell.

Wondering How Much You Need To Save for a Down Payment?

A real estate professional and trusted lender can show you options that could help you get closer to your down payment goal.

Homeowners Still Have Positive Equity Gains over the Past 12 Months

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home.

Mortgage Rates Are Dropping. What Does That Mean for You?

It’s important to work with a trusted real estate professional who follows what experts are projecting for the months, and year ahead.