“You may be wondering if now’s the right time to buy or if you should hold off on your search until rates come back down.”

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may be wondering if now’s the right time to buy or if you should hold off on your search until rates come back down.

The recent uptick in rates has been driven by what’s happening with inflation. Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Mortgage rates increased across the board last week, pushed higher by market expectations that inflation will persist, thus requiring the Federal Reserve to keep monetary policy restrictive for a longer time.”

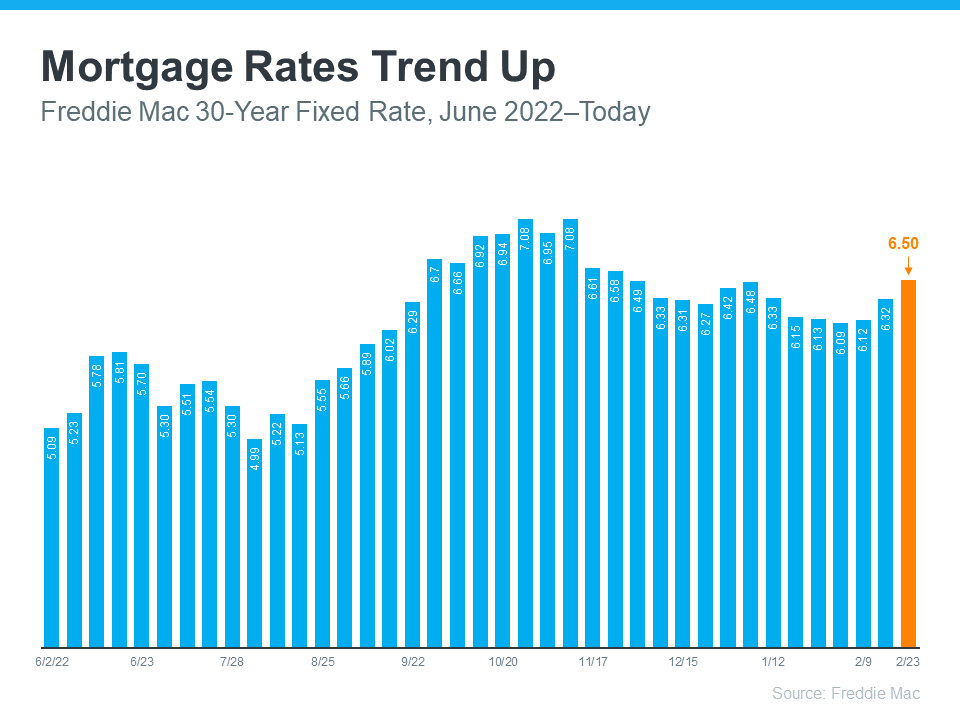

The most recent weekly average 30-year fixed mortgage rate reported by Freddie Mac is 6.5%. It’s the third week in a row that rates have increased and puts them at the highest point they’ve been this year (see graph below):

Advice for Home Shoppers

If you’re thinking about pausing your home search because rates have started to go up again, you may want to reconsider. This could actually be an opportunity to buy the home you’ve been searching for. According to the MBA, mortgage applications declined by 13.3% in just one week, so it appears the rise in mortgage rates is leading some potential homebuyers to pull back on their search for a new home.

So, what does that mean for you? If you stay the course, you’ll likely face less competition among other buyers when you’re looking for a home. This is welcome relief in a market that has so few homes for sale.

Bottom Line

Over the last few weeks, mortgage rates have risen. But that doesn’t mean you should delay your plans to buy a home. In fact, it could mean the opposite if you want to take advantage of less buyer competition. Let’s connect today to explore the options in our local market.

To view original article, visit Keeping Current Matters.

Why Today’s Seller’s Market Is Good for Your Bottom Line

The market is still working in favor of sellers. If you house is ready and priced competitively, it should get a lot of attention.

What Mortgage Rate Do You Need To Move?

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead.

Finding Your Perfect Home in a Fixer Upper

Your agent can also offer advice on which upgrades and renovations will set you up to get the greatest return on your investment.

The Benefits of Downsizing When You Retire

When you downsize your house, you often end up downsizing the bills that come with it, like energy costs, and maintenance requirements.

Why There Won’t Be a Recession That Tanks the Housing Market

The fundamentals of the economy, despite some hiccups, are doing pretty good.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.