“Here’s what experts are saying about home prices next year.”

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward?

While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections so you have the best information possible today.

What the Experts Are Saying About Home Prices Next Year

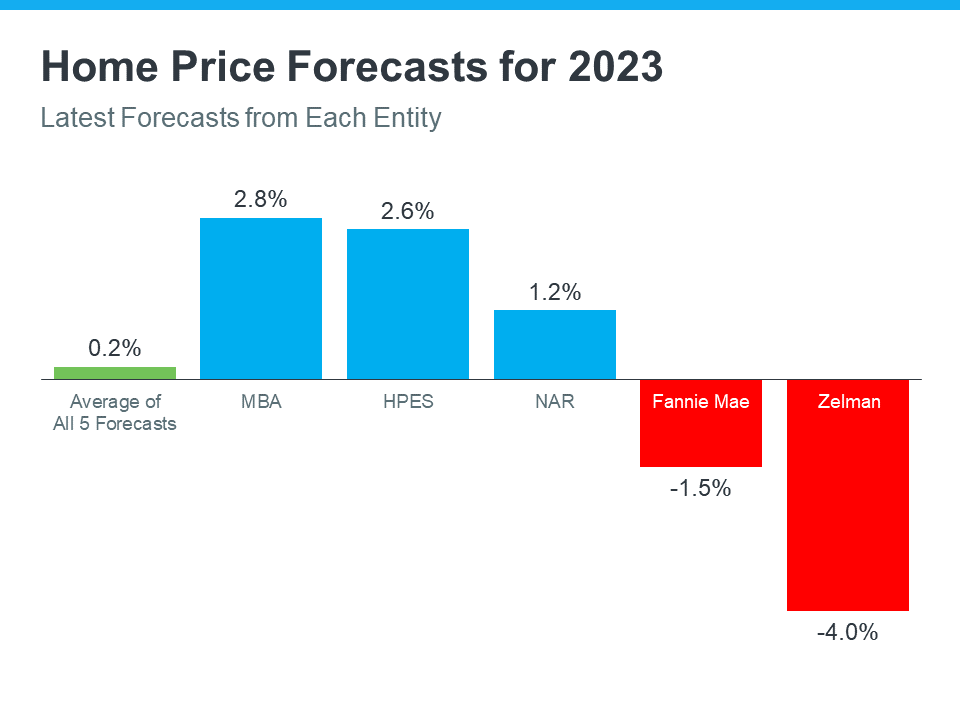

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

Don’t let fear or uncertainty change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, reach out to a local real estate professional for the guidance you need each step of the way.

Bottom Line

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted real estate professional to help you make confident and informed decisions about what’s happening in our market.

To view original article, visit Keeping Current Matters.

Why It Makes Sense to Move Before Spring

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

The 3 Factors That Affect Home Affordability

When you think about affordability, the full picture includes more than just mortgage rates and prices. Wages need to be factored in too.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.

Think Twice Before Waiting for 3% Mortgage Rates

It’s important to have a realistic vision for what you can expect this year; advice of expert real estate advisors is critical.

Today’s Housing Market Is Nothing Like 15 Years Ago

In the 2nd half of 2022, there was a dramatic shift in real estate causing many people to make comparisons to the 2008 housing crisis.