“Home values have increased by 18.1% compared to this time last year.”

Many people have questions about home prices right now. How much have prices risen over the past 12 months? What’s happening with home values right now? What’s projected for next year? Here’s a look at the answers to all three of these questions.

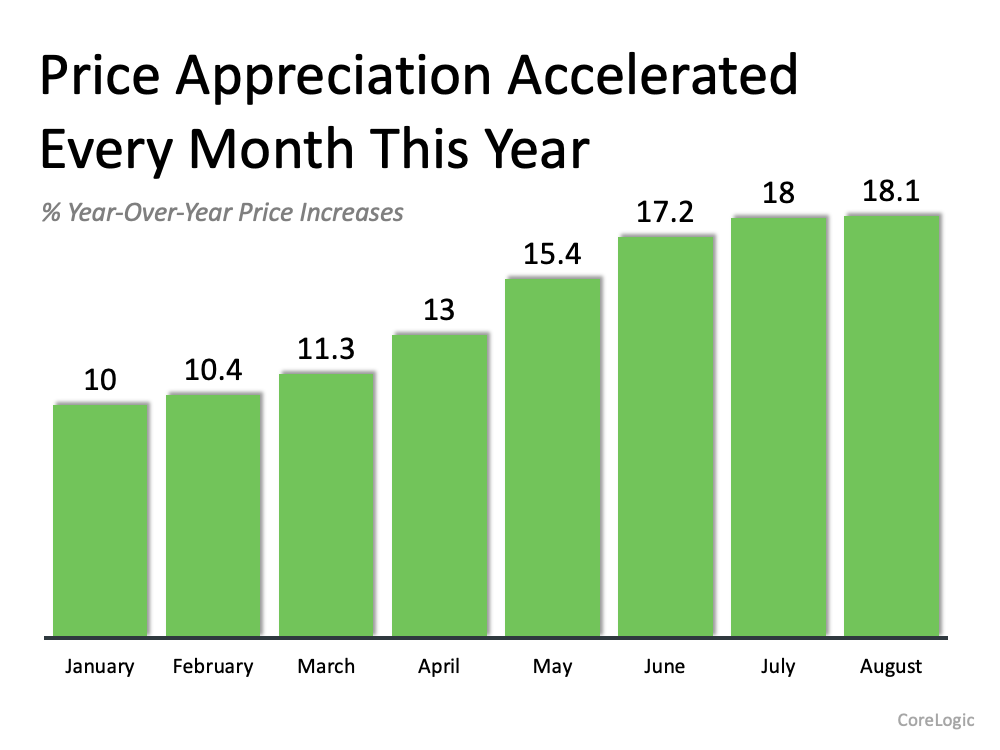

How much have home values appreciated over the last 12 months?

According to the latest Home Price Index from CoreLogic, home values have increased by 18.1% compared to this time last year. Additionally, prices have gone up at an accelerated pace for each of the last eight months (see graph below): The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The last year has shown tremendous home price appreciation, which is resulting in a major gain in wealth for homeowners through rising equity.

What’s happening with home prices right now?

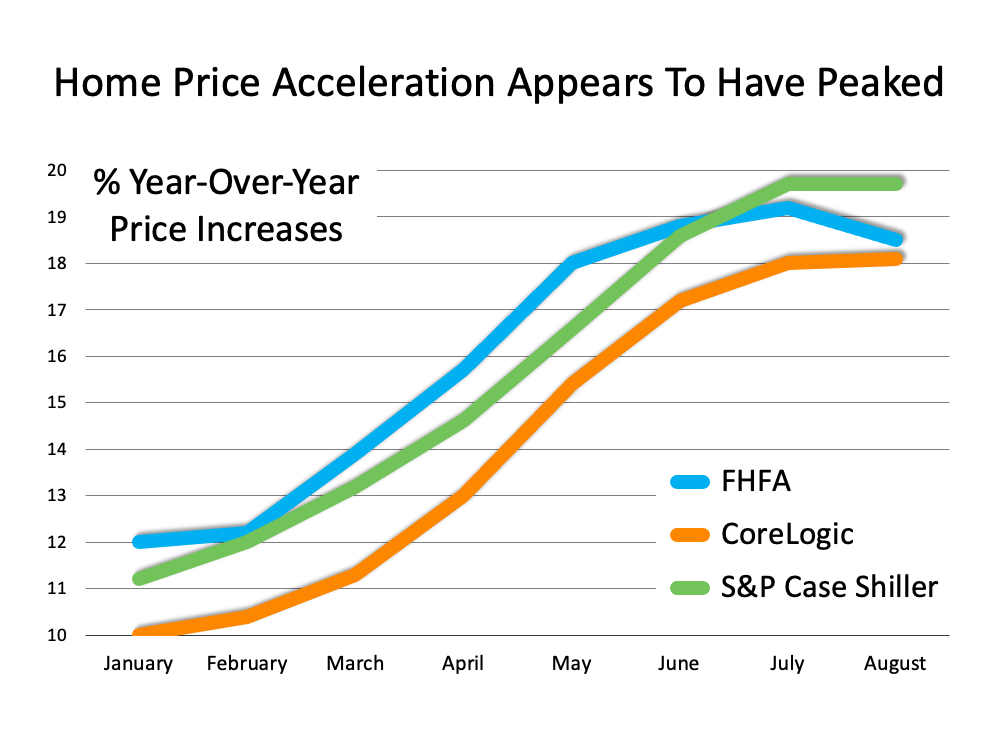

All three indices mentioned above also show that while appreciation is in the high double digits right now, that price acceleration is beginning to level off (see graph below): Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Keep in mind, that doesn’t mean home values will depreciate. It means the rate of appreciation will slow, yet stay well above the 25-year average of 5.1%.

What about next year?

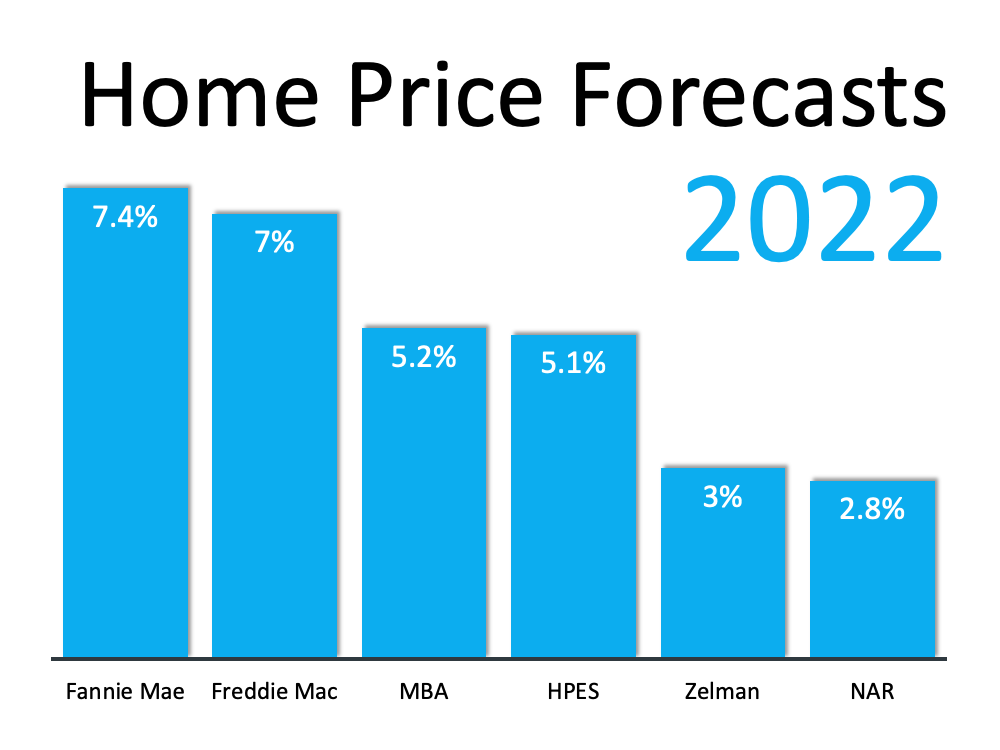

The recent surge in prices is the result of heavy buyer demand and a shortage of homes available for sale. Most experts believe that as more housing inventory comes to market (both new construction and existing homes), the supply and demand for housing will come more into balance. That balance will bring a lower rate of appreciation in 2022. Here’s a look at home price forecasts from six major entities, and they all project future appreciation:

- Fannie Mae

- Freddie Mac

- Mortgage Bankers Association

- Home Price Expectation Survey

- Zelman & Associates

- National Association of Realtors

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

Bottom Line

There have been historic levels of home price appreciation over the last year. That pace will slow as we finish 2021 and enter into 2022. Prices will still rise in value, just at a much more moderate pace, which is good news for the housing market.

To view original article, visit Keeping Current Matters.

2021 Real Estate Myth Buster

Here’s a little clarity when it comes to 5 common myths about the 2021 housing market. Let’s connect to discuss your needs and so you can decipher facts from fiction in our local market.

How a Change in Mortgage Rate Impacts Your Homebuying Budget

Anytime there’s a change in the mortgage rate, it affects what buyers can afford to borrow when buying a home.

What It Means To Be in a Sellers’ Market

Low mortgage rates and a year filled with unique changes have prompted buyers to think differently about where they live – and they’re taking action.

Buyer & Seller Perks in Today’s Housing Market

Buyers are clearly eager to purchase so homeowners who are in a position to sell shouldn’t wait to make their move!

Why You Should Think About Listing Prices Like an Auction’s Reserve Price

Frequent and competitive bidding wars are creating an auction-like atmosphere in many real estate transactions.

Should We Fear the Surge in Cash-Out Refinances?

Today’s cash-out refinance situation bears no resemblance to the situation that preceded the housing crash.