“One of the biggest questions right now is whether this historic unemployment rate will initiate a new surge of foreclosures in the market.”

One of the biggest questions right now is whether this historic unemployment rate will initiate a new surge of foreclosures in the market. It’s a very real fear. Despite the staggering number of claims, there are actually many reasons why we won’t see a significant number of foreclosures like we did during the housing crash twelve years ago. The amount of equity homeowners have today is a leading differentiator in the current market.

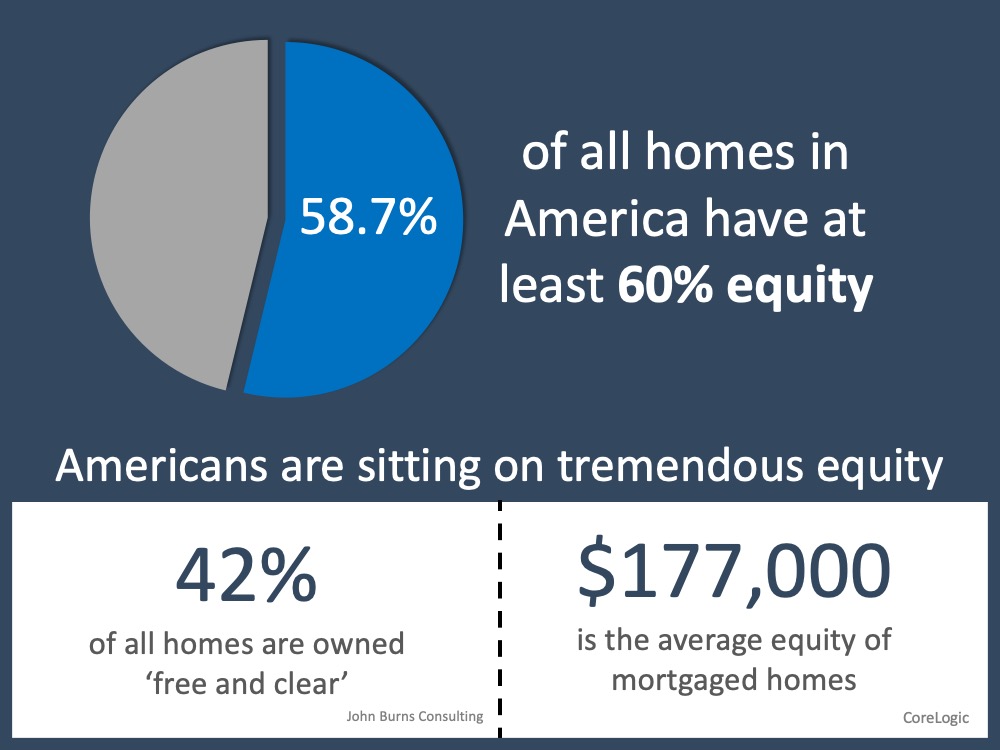

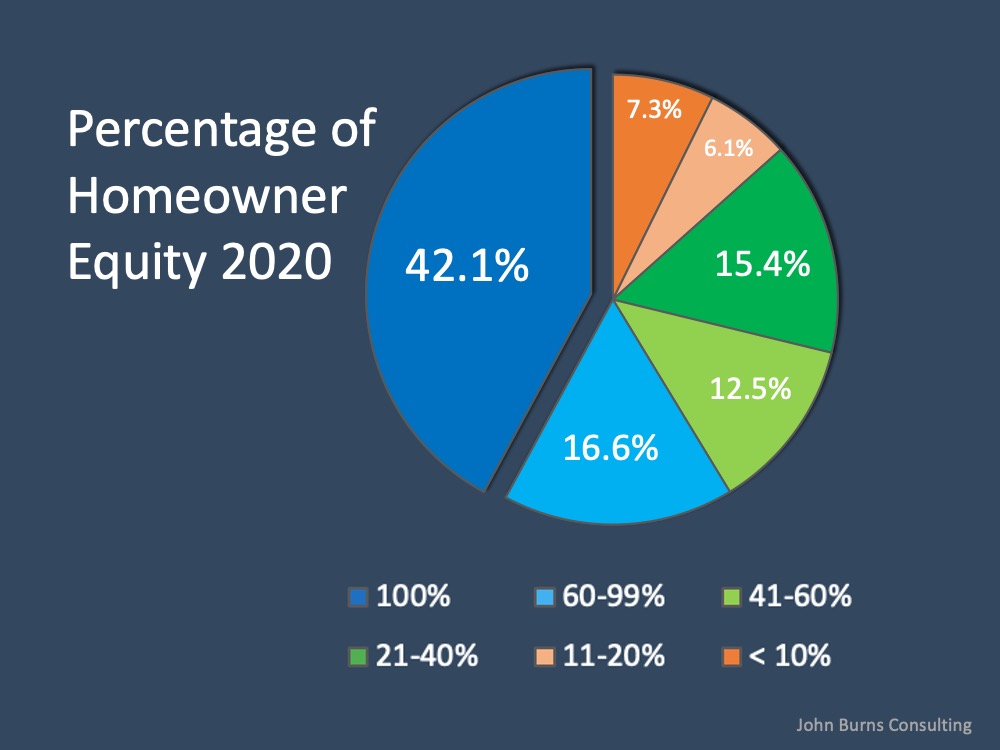

Today, according to John Burns Consulting, 58.7% of homes in the U.S. have at least 60% equity. That number is drastically different than it was in 2008 when the housing bubble burst. The last recession was painful, and when prices dipped, many found themselves owing more on their mortgage than what their homes were worth. Homeowners simply walked away at that point. Now, 42.1% of all homes in this country are mortgage-free, meaning they’re owned free and clear. Those homes are not at risk for foreclosure (see graph below):  In addition, CoreLogic notes the average equity mortgaged homes have today is $177,000. That’s a significant amount that homeowners won’t be stepping away from, even in today’s economy (see chart below):

In addition, CoreLogic notes the average equity mortgaged homes have today is $177,000. That’s a significant amount that homeowners won’t be stepping away from, even in today’s economy (see chart below): In essence, the amount of equity homeowners have today positions them to be in a much better place than they were in 2008.

In essence, the amount of equity homeowners have today positions them to be in a much better place than they were in 2008.

Bottom Line

The fear and uncertainty we feel right now are very real, and this is not going to be easy. We can, however, see strength in our current market through homeowner equity that has not been there in the past. That may be a bright spark to help us make it through.

To view original article, visit Keeping Current Matters.

Why Your House Will Shine in Today’s Market

If you’re thinking about selling, the shortage of homes for sale means your house is likely to get some serious attention from buyers.

How Long Will It Take to Sell Your House?

If you’re looking for ways to make your move happen as quickly as possible, partnering with a great local agent is the key.

Planning To Sell Your House in 2025? Start Prepping Now

By starting your prep work early, you’ll give yourself plenty of time to get your house market-ready by the end of the year.

What To Expect from Mortgage Rates and Home Prices in 2025

With home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

Why Did More People Decide To Sell Their Homes Recently?

As rates came down at the end of the summer, more people jumped into the market and decided to make their move.

Why an Agent Is Essential When Buying a Newly Built Home

By working with a knowledgeable real estate agent, you can feel confident when buying a newly built home today.