“One of the biggest questions right now is whether this historic unemployment rate will initiate a new surge of foreclosures in the market.”

One of the biggest questions right now is whether this historic unemployment rate will initiate a new surge of foreclosures in the market. It’s a very real fear. Despite the staggering number of claims, there are actually many reasons why we won’t see a significant number of foreclosures like we did during the housing crash twelve years ago. The amount of equity homeowners have today is a leading differentiator in the current market.

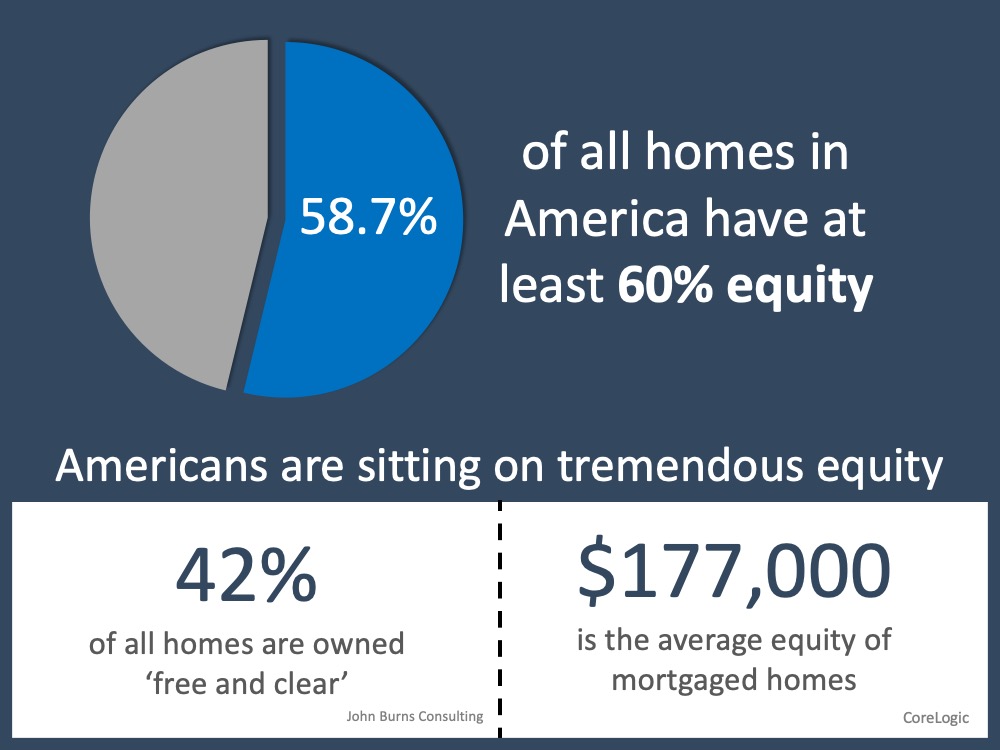

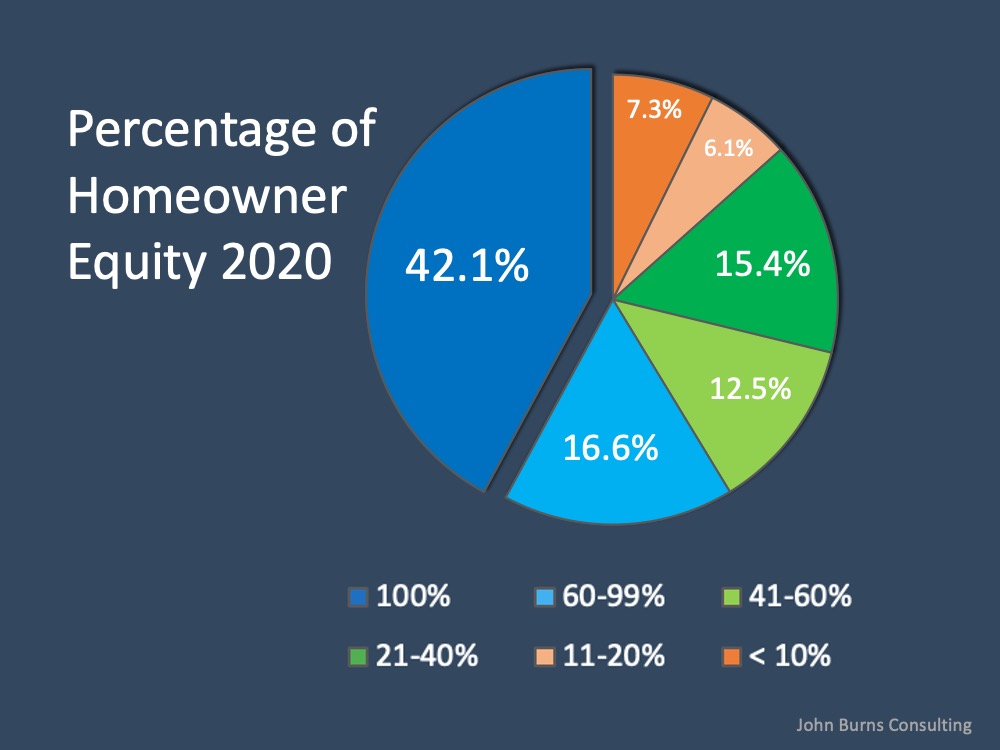

Today, according to John Burns Consulting, 58.7% of homes in the U.S. have at least 60% equity. That number is drastically different than it was in 2008 when the housing bubble burst. The last recession was painful, and when prices dipped, many found themselves owing more on their mortgage than what their homes were worth. Homeowners simply walked away at that point. Now, 42.1% of all homes in this country are mortgage-free, meaning they’re owned free and clear. Those homes are not at risk for foreclosure (see graph below):  In addition, CoreLogic notes the average equity mortgaged homes have today is $177,000. That’s a significant amount that homeowners won’t be stepping away from, even in today’s economy (see chart below):

In addition, CoreLogic notes the average equity mortgaged homes have today is $177,000. That’s a significant amount that homeowners won’t be stepping away from, even in today’s economy (see chart below): In essence, the amount of equity homeowners have today positions them to be in a much better place than they were in 2008.

In essence, the amount of equity homeowners have today positions them to be in a much better place than they were in 2008.

Bottom Line

The fear and uncertainty we feel right now are very real, and this is not going to be easy. We can, however, see strength in our current market through homeowner equity that has not been there in the past. That may be a bright spark to help us make it through.

To view original article, visit Keeping Current Matters.

What Every Homeowner Should Know About Their Equity

Understanding how much equity you have is the first step to unlocking what you can afford when you move.

Why the Sandwich Generation Is Buying Multi-Generational Homes

If you’re thinking about buying a multi-generational home, working with a local real estate agent is essential.

The Biggest Mistakes Sellers Are Making Right Now

If you aren’t working with an agent, you may not realize the mistakes you are making. And they may be costing you!

Are Home Prices Going to Come Down?

In the context of today’s housing market, it doesn’t mean home prices are going to fall dramatically. It only means prices are normalizing a bit.

How the Economy Impacts Mortgage Rates

Mortgage rates will continue to be volatile in the months ahead. There are signs the economy is headed in the better direction.

How Affordability and Remote Work Are Changing Where People Live

An experienced local agent can help you find the lifestyle you’re looking for in a home you can afford.