Why Home Prices Are Increasing

There are many unsubstantiated theories as to why home values are continuing to increase. From those who are worried that lending standards are again becoming too lenient (data shows this is untrue), to those who are concerned that prices are again approaching boom peaks because of “irrational exuberance” (this is also untrue as prices are not at peak levels when they are adjusted for inflation), there seems to be no shortage of opinion.

However, the increase in prices is easily explained by the theory of supply & demand. Whenever there is a limited supply of an item that is in high demand, prices increase.

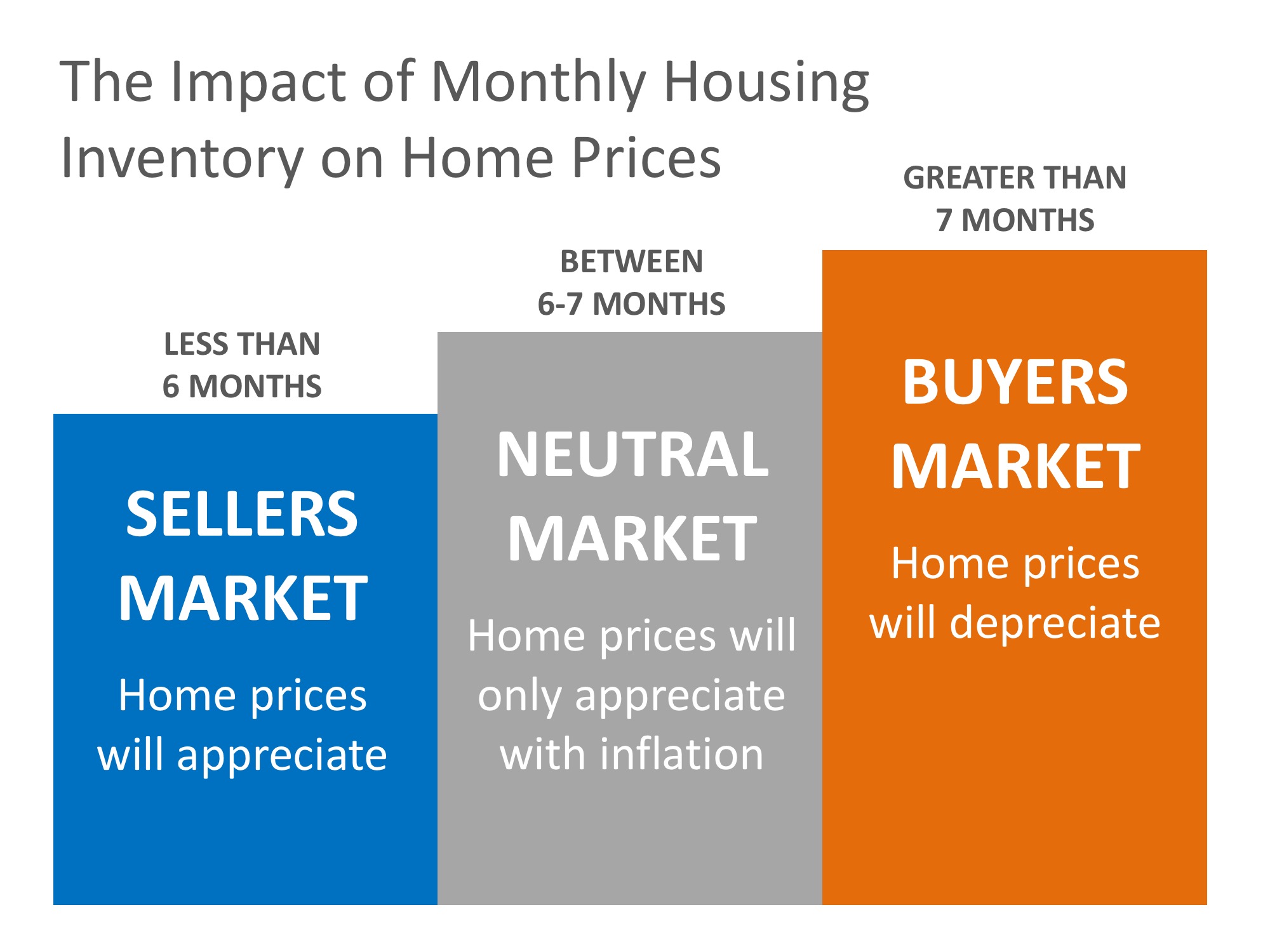

It is that simple. In real estate, it takes a six-month supply of existing salable inventory to maintain pricing stability. In most housing markets, anything less than six months will cause home values to appreciate and anything more than seven months will cause prices to depreciate (see chart below).

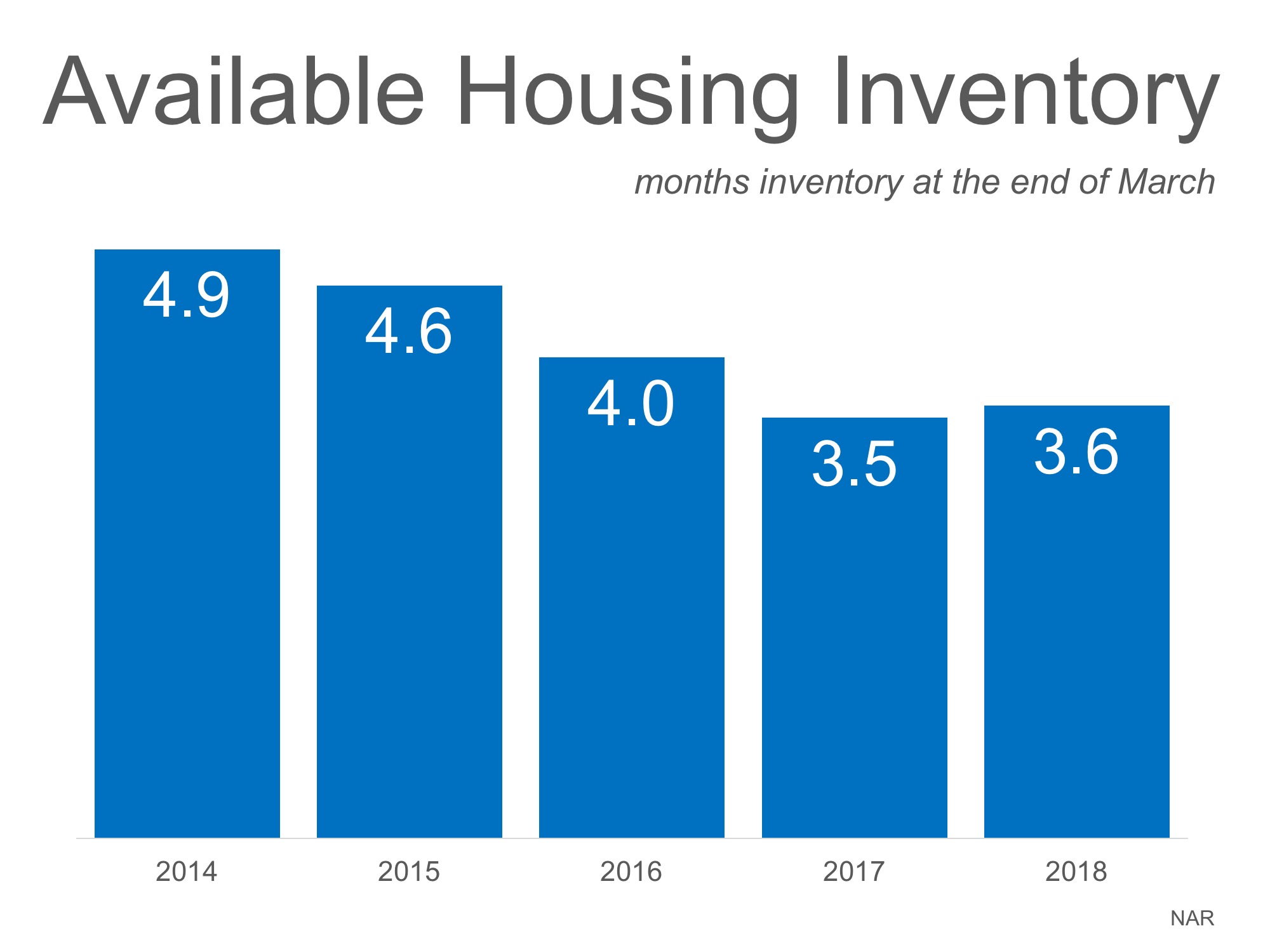

According to the Existing Home Sales Report from the National Association of Realtors (NAR), the monthly inventory of homes for sale has been below six months for the last five years (see chart below).

Bottom Line

If buyer demand continues to outpace the current supply of existing homes for sale, prices will continue to appreciate. Nothing nefarious is taking place. It is simply the theory of supply & demand working as it should.

Why Owning a Home Is a Powerful Financial Decision

In today’s housing market, there are clear financial benefits to owning a home including the chance to build your net worth.

Want to Build Wealth? Buy a Home This Year.

A financial advantage to owning a home is the wealth built through equity when you own a home.

Turn to an Expert for the Best Advice, Not Perfect Advice

An agent can give you the best advice possible based on the information and situation at hand.

What Record-Low Housing Inventory Means for You

The housing market will remain strong throughout 2021. Know what that means for you, whether you’re buying, selling, or doing both.

What Happens When Homeowners Leave Their Forbearance Plans?

If we do experience a higher foreclosure rate, most experts believe the current housing market will easily absorb the excess inventory.

What’s the Difference between an Appraisal and a Home Inspection?

Here’s the breakdown of each one and why they’re both important when buying a home.

Why Moving May Be Just the Boost You Need

There’s logic behind the idea that making a move could improve someone’s quality of life

Owning a Home Is Still More Affordable Than Renting One

In 2020, mortgage rates reached all-time lows 16 times, and so far, they’re continuing to hover in low territory this year.

Should I Wait for Lower Mortgage Interest Rates?

Borrowers are smart to take advantage of these low rates now and will certainly benefit as a result.

How to Make the Dream of Homeownership a Reality This Year

If you’re dreaming of buying a home this year, start by connecting with a local real estate professional.