“Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine.”

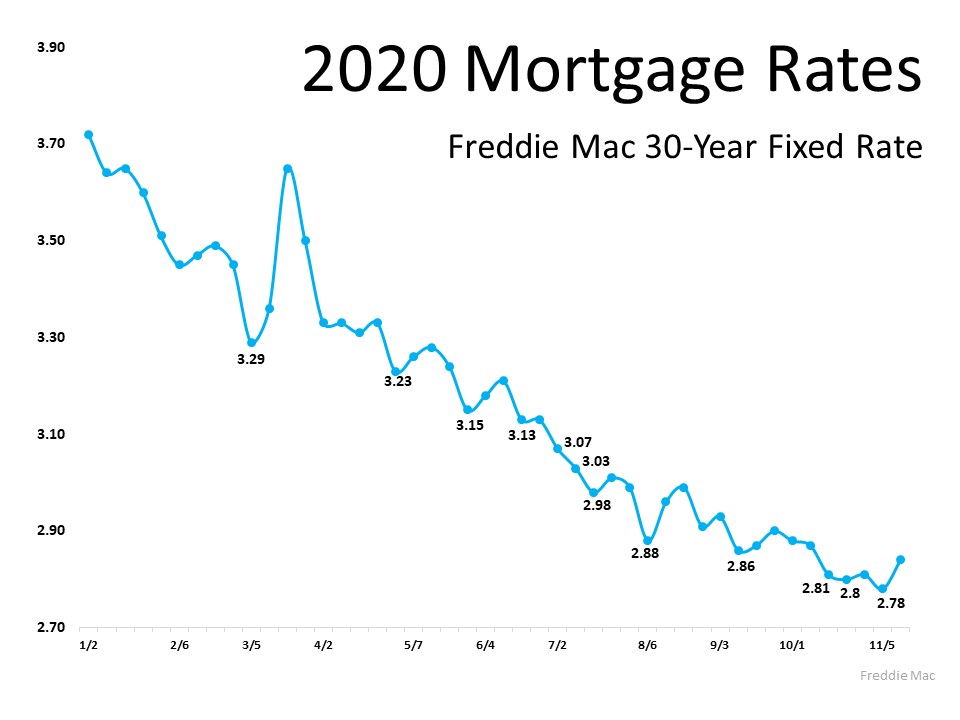

In 2020, buyers got a big boost in the housing market as mortgage rates dropped throughout the year. According to Freddie Mac, rates hit all-time lows 12 times this year, dipping below 3% for the first time ever while making buying a home more and more attractive as the year progressed (See graph below): When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

The Challenge with Waiting

The challenge with waiting is that you can easily miss this optimal window of time and then end up paying more in the long run. Last week, mortgage rates ticked up slightly. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine. Despite this rise, mortgage rates remain about a percentage point below a year ago.”

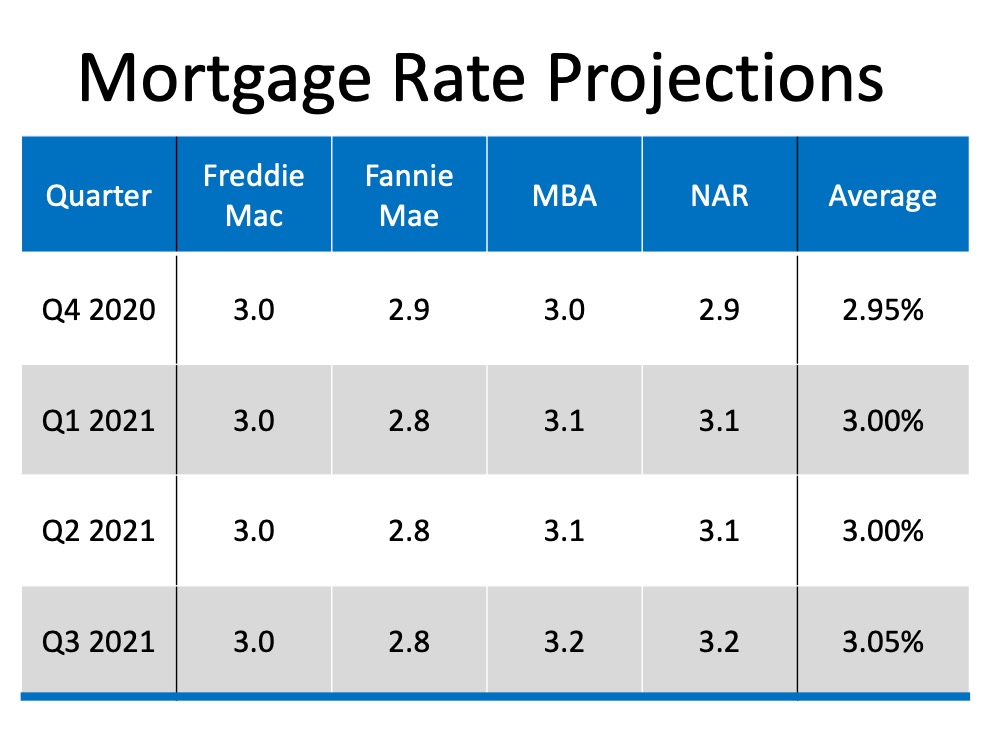

While rates are still lower today than they were one year ago, as the economy continues to get stronger and the pandemic is resolved, there’s a very good chance interest rates will rise again. Several top institutions in the real estate industry are projecting an increase in mortgage rates over the next four quarters (See chart below): If you’re planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise:

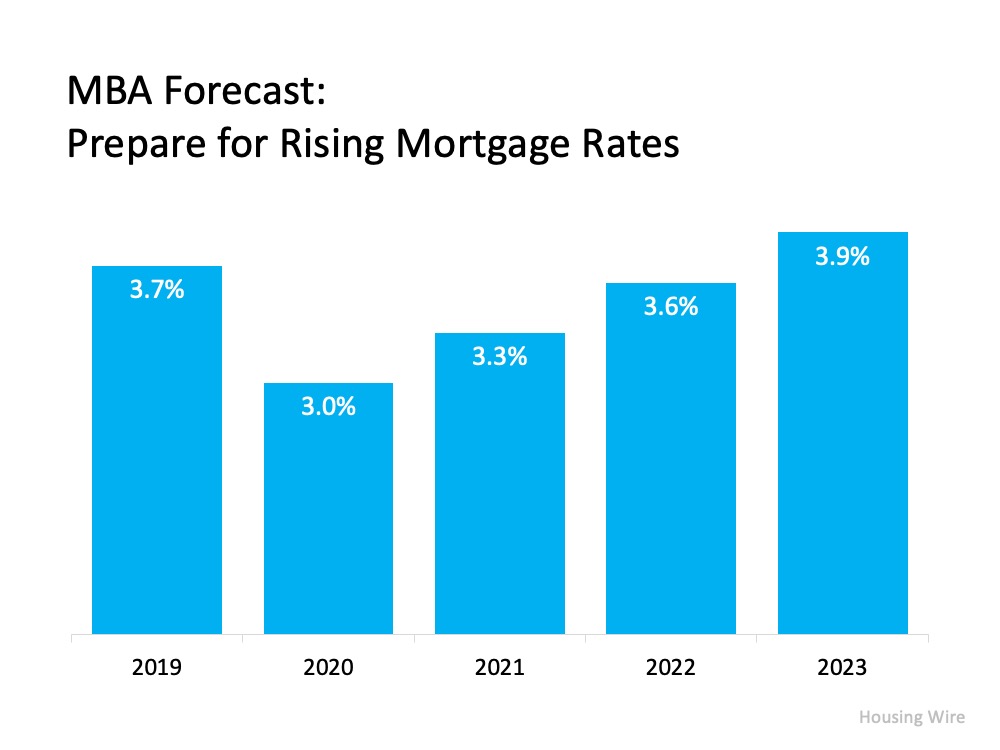

If you’re planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise: As a buyer, you need to decide if waiting makes financial sense for you.

As a buyer, you need to decide if waiting makes financial sense for you.

Bottom Line

If you’re planning to buy a home and want to take advantage of today’s low rates, now is the time to do so. Don’t assume they’re going to stay this low forever.

To view original article, visit Keeping Current Matters.

Why Today’s Housing Supply Is a Sweet Spot for Sellers

The number of homes for sale and new listing activity continues to improve compared to last year.

The Truth About Down Payments

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

Expert Home Price Forecasts for 2024 Revised Up

Now that rates have come down from their peak, and with further declines expected this year, buyer demand has picked up.

Strategic Tips for Buying Your First Home

If you’re ready, willing, and able to buy your first home, here are some tips to help you turn your dream into a reality.

It’s Time To Prepare Your House for a Spring Listing

With the market gearing up for its busiest time of year, it’s important to make sure your house shines bright among the competition.

Bridging the Gaps on the Road to Homeownership

Homeownership is an important part of building household wealth that can be passed down to future generations.