“Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising.”

Last week’s Existing Home Sales Report from the National Association of Realtors (NAR) shows sales have dropped by 3.7% compared to the month before. This is the second consecutive month that sales have slumped. Some see this as evidence that the red-hot real estate market may be cooling. However, there could also be a simple explanation as to why existing home sales have slowed – there aren’t enough homes to buy. There are currently 410,000 fewer single-family homes available for sale than there were at this time last year.

Lawrence Yun, Chief Economist at NAR, explains in the report:

“The sales for March would have been measurably higher, had there been more inventory. Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising.”

Yun’s insight was supported the next day when the Census Bureau released its Monthly New Residential Sales Report. It shows that newly constructed home sales are up 20.7% over the previous month.

Buyer demand remains strong. With more of the adult population becoming vaccinated and job creation data showing encouraging signs, existing-home inventory is expected to grow in the coming months.

What will this mean for home sales going forward?

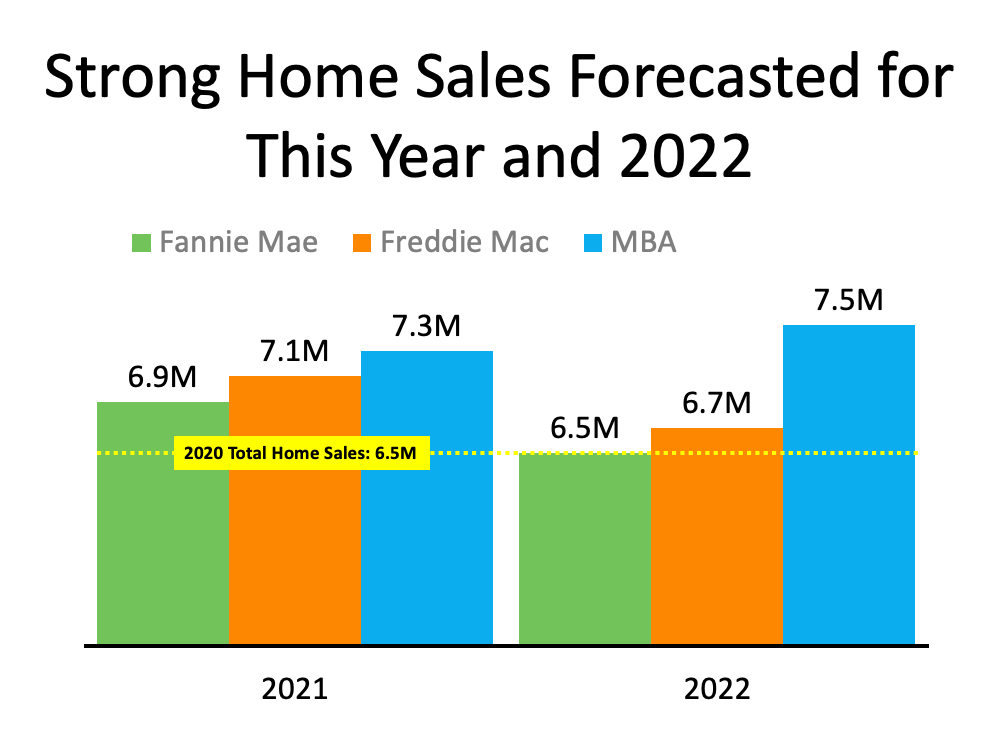

Fannie Mae, Freddie Mac, and the Mortgage Bankers Association (MBA) have all forecasted that total home sales (existing homes and new construction) will continue their momentum both this year and next. Here’s a graph showing those projections:

Bottom Line

Living through a pandemic has caused many to re-evaluate the importance of a home and the value of homeownership. The residential real estate market will benefit from both as we move forward.

To view original article, visit Keeping Current Matters.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.

The Best Week To List Your House Is Almost Here

The third week of April brings the best combination of housing market factors for sellers.